Australian Dollar Advances on Strong GDP Data, More Gains Against Pound Likely

The Pound to Australian Dollar exchange rate was seen under pressure at the start of the new month, ensuring the trend lower seen through the start of 2017 retains intact.

The Australian Dollar was the best-performing currency in the G10 complex on March 1 following the release of some better-than-forecast economic growth data.

That Australian Bureau of Statistics reports that GDP for the fourth quarter grew at an annualised 2.4%, well ahead of the 1.9% forecast by analysts. This puts to bed fears that the shock 0.5% drop seen in the third quarter was something more than a blip.

"Growth bounced broadly across the economy. Even consumer spending rebounded, in spite of persistently low wages growth," says Felicity Emmett, Senior Economist at ANZ Research.

The news is clearly good, but Emmett is not rushing into calling a pro-AUD interest rate hike at the Reserve Bank of Australia on the back of the data:

"Weak wages growth is, however, dampening unit labour costs, which suggest that inflation is likely to stay low. This confirms our view that the RBA is on hold for some time."

Emmett questions whether the growth is sustainable raising doubts over whether consumer spending can continue to outpace household income growth.

Wages are the largest component of household income and the overall wages bill fell 0.5% in the quarter, while overall household income grew just 0.2% (compared with 1.2% growth in nominal consumer spending).

"Moreover, high and rising household debt in an environment of persistently low wages growth is likely to eventually crimp consumer spending in our view," says Emmett.

Outlook for GBP vs AUD

Pound Sterling has been moving sideways against the Australian Dollar for several weeks now and although it seemed to want to break out to the upside on Friday, the spike was only temporary before the exchange rate retracted and ended the week back down inside the range.

On Monday, there was a similar break but this time below the lower boundary of the sideways range at 1.6120, which saw the exchange rate fall to lows of 1.6101 before also retracting back up, and also ending the day back inside the range.

These false breakouts in both directions show continued indecision.

However, given the overall longer-term trend is down, the probabilities continue to slightly favour a break lower, which would be confirmed by a move below the hammer lows at 1.6101 on Monday.

Such a move would lead to an extension to a downside target at 1.6000 where the January 16 lows and the S1 monthly pivot are situated.

Current Account Deficit Shrinks as Australian Trade Improves

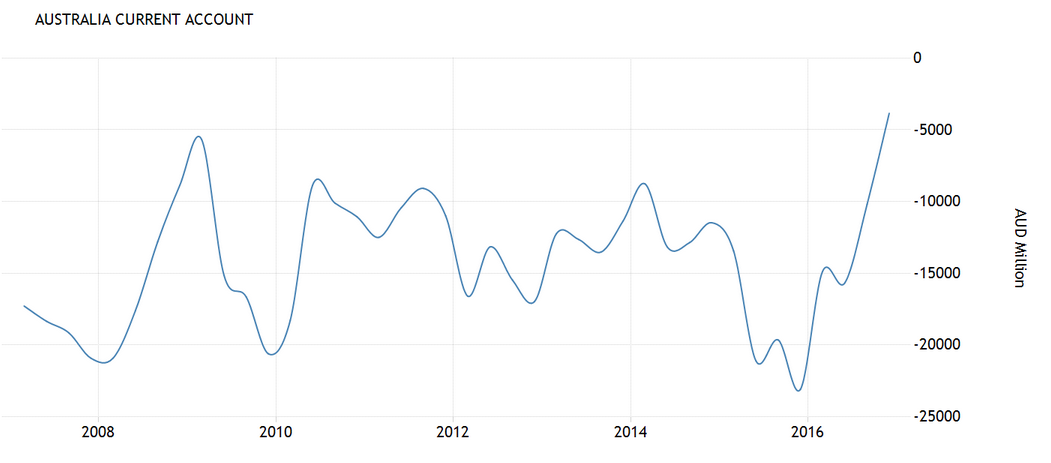

The Aussie retained a slight bid into month-end on news that Australia's Current Account deficit shrunk to its lowest level in 15 years as the deficit fell by two-thirds to AUD $3.9 billion in Q4.

The improvement was driven by higher commodity prices especially iron ore and coal. Iron ore prices rose from $56 per tonne at the start of Q4 to $92 today suggesting the improvement should continue through Q1 at least.

The Current Account is the total balance of money coming in and out of country as well as the trade balance, it, therefore represents demand and supply dynamics for a currency.

A shrinking deficit indicates increased demand for a currency - in this case the Aussie, which will rise as a result.

An interesting point to note is that many analysts are now considering the Aussie Dollar to be in overvalued territory.

"AUDUSD is now appearing very overvalued against 2-year rates spreads (see chart) suggesting a vulnerability as with other USD pairs. Despite the strong data, AUDUSD has failed to appreciate which is likely the result of extended long positioning," says a note from BNP Paribas, the global financial services and investment bank.

AUD longs have reached the highest level since 2012 and now stand at +31 according to BNP Paribas FX Positioning Analysis (scale +/- 50).

"We view the current level as opportune selling levels targeting a move to 0.74," say BNP Paribas.

We reckon that any weakness in the Aussie could well lead to support for the under-pressure GBP/AUD which suggests downside should be limited to recent values.