The Australian Dollar Knocked by Inflation Shock

Pound Sterling has recorded a three-week high against the Australian Dollar on the back of some worse-than-expected inflation data.

Inflation data remains a key focus for the Australian Dollar, and the latest figures in from the Australian Bureau of Statistics has shown up some surprises.

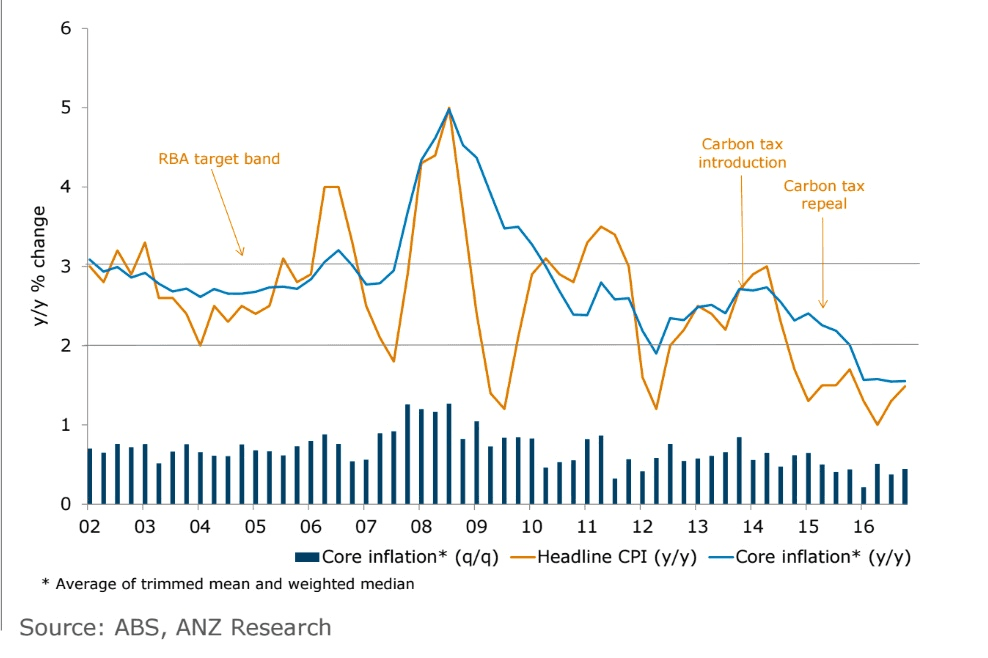

The ABS reported the country’s Core Rate of Inflation slowed to an annualised 1.6% - this being the slowest pace since the series began in 1983.

The Pound to Australian Dollar exchange rate is 0.84% higher having reached 1.6656 on the news.

The Australian to US Dollar exchange rate is at 0.7523, down by 0.78%.

Headline CPI came in at 1.5% y/y (consensus forecasts were for 1.6%), with the average of the RBA’s core measures at 1.6% y/y (close to consensus).

“The data are close to the RBA’s expectation, although our economists note that the detail continues to point to benign inflation and the RBA is likely to maintain a mild easing bias in the February SOMP,” says Adam Cole, Head of G10 FX Strategy at RBC Capital Markets.

Were the RBA to cut rates again this would certainly be negative for the Aussie Dollar, particularly as the USA is seeing its interest rate profile rise, while even the UK is expected to sit on current settings, at most.

However, Senior Economist at ANZ, Jo Masters, is more constructive on the data.

“Today’s inflation data suggest that the sharp disinflationary forces that have been weighing on prices are abating and that inflation is stabilising,” says Masters.

Masters notes this data is consistent with the RBA’s forecast profile and has no immediate policy implication.

But, while the stabilisation in inflation would be welcome, ANZ continue to see inflation running below the policy target band until H2 2017.