Australian Dollar: GBP/AUD: Bullish Long-Term; Resistance Short-Term

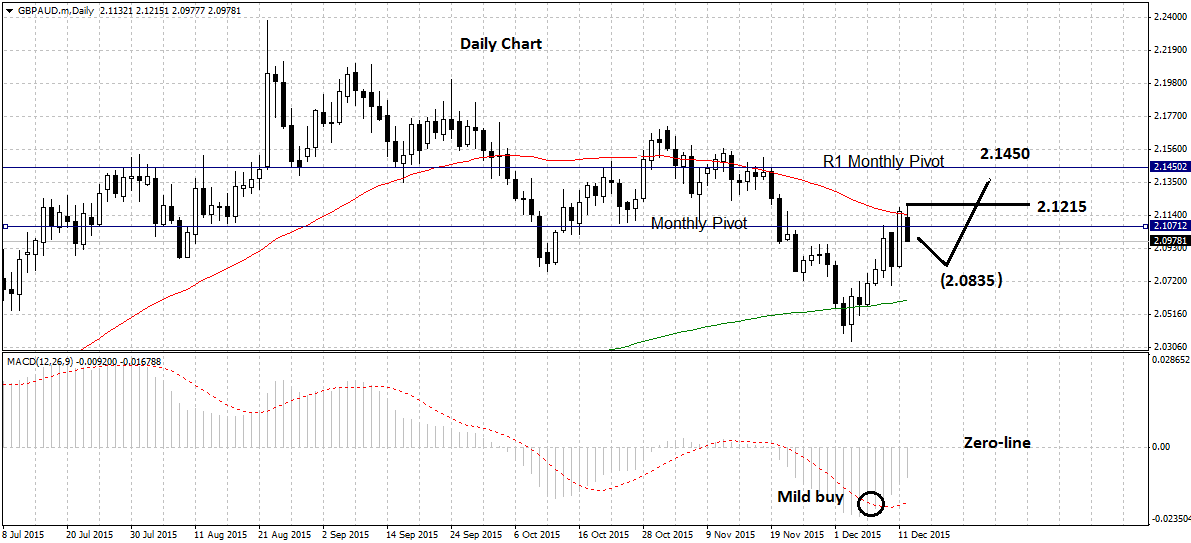

GBP/AUD has risen strongly in a possible renewal of the long-term up-trend, but now it has met stiff resistance from a cluster of levels, including the 50-day moving average and the monthly pivot.

The pound to Australian dollar exchange rate is currently trading at resistance and could pull-back to 2.0835 in the very short-term, however eventually the dominant long-term up-trend will probably revive, pushing the exchange rate higher again.

A mild buy signal from the MACD on the daily chart is supporting the possibilty of more upside, however, the indicator has still not risen above the zero-line indicating a change of trend.

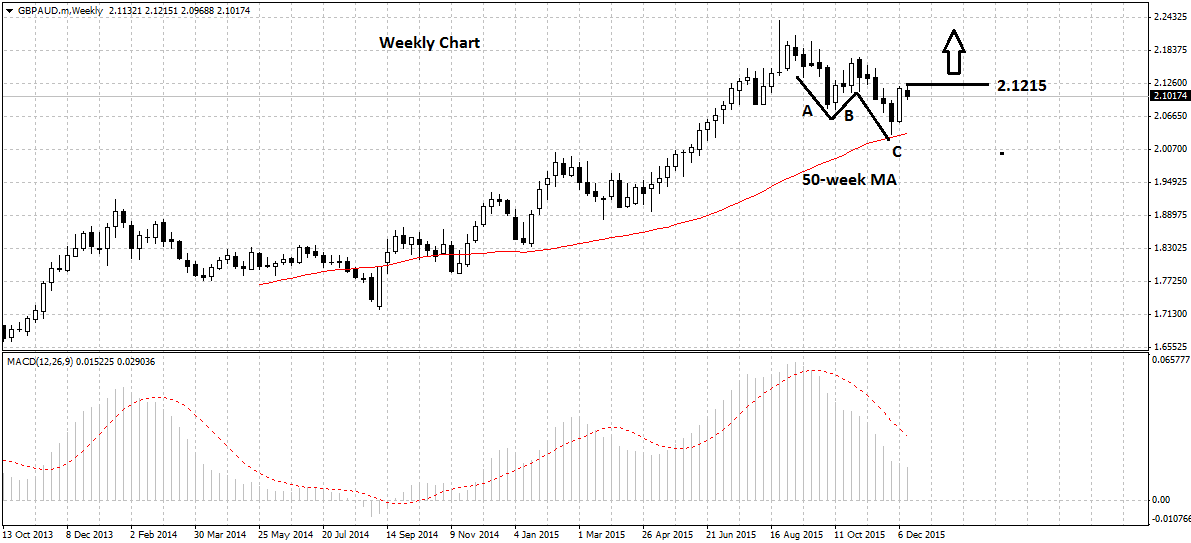

The strongest bullish indication comes from the structure of the market on the weekly chart which is showing a clear A-B-C corrective pattern and providing supportive evidence that a move higher could be beginning.

The high buying volume in the recovery move so far also indicates a bullish longer-term outlook.

A clear break above Friday's highs at 2.1215 would probably signal a bullish breakthrough, increasing the probabiliities of a continuation higher, to the next level at 2.1450, where the R1 monthly pivot is situated.