GBP to Push Higher Against Australian Dollar

Research conducted by Westpac Institutional Bank in Sydney have confirmed the pound v Australian dollar exchange rate remains in a powerful uptrend.

GBP is closing in on its long term average rate versus AUD - data from Westpac shows the 1.90-2.05 range accounts for 9% of daily closes since the 1983 AUD float but 2.05-2.20 captures a hefty 19.5% of trade confirming we are approaching historically comfortable levels.

Can the move higher continue? We hear from one of Australia's leading institutional analysts as to whether these levels above 2.0 are sustainable and if even stronger rates of exchange can be achieved.

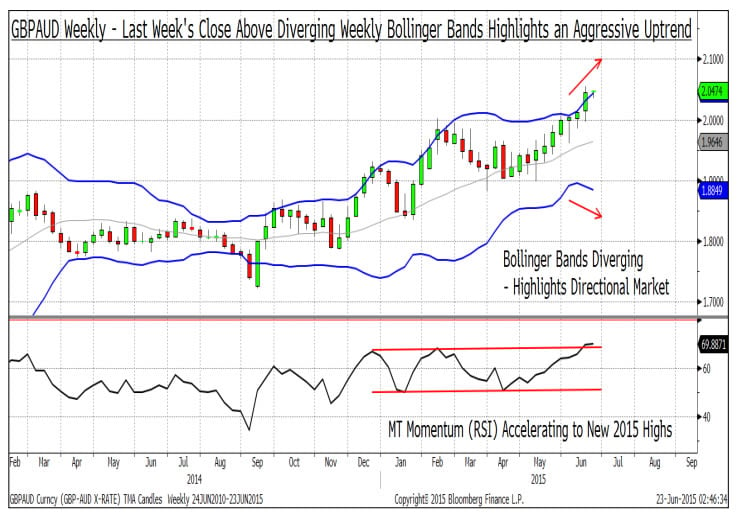

In a new note to clients analyst David Coloretti notes GBPAUD closed last week above the upper weekly Bollinger band which gives us some educated clues regarding the outlook:

“This is a common confirmation of a powerful uptrend. Note that the weekly Bollinger bands are diverging, highlighting the return of a directional multi-week market.”

Since the May election results cleared the air over the UK’s economic outlook from a political standpoint a new phase of sterling outperformance has emerged.

Indeed, Westpac point out that the pound sterling is easily the strongest G10 currency since 7 May.

This has helped drive GBP/AUD to its best rate of exchange since 2009.

From an Australian perspective Westpac’s Coloretti expects GBP-AUD to advance as the Australian dollar trades softer against a range of crosses in coming weeks as a sluggish economy keeps markets pondering whether the RBA will cut rates yet again.

“GBP/AUD should continue to grind higher multi-week, to 2.09/2.10. Further sterling outperformance could take some time longer however, with subdued UK inflation (partly due to GBP strength) likely to keep the BoE from tightening monetary policy until May 2016,” says Coloretti.

Looking at the chart once more, medium term momentum (RSI) has broken above multi-year highs in recent weeks. “This confirms that positive MT momentum has shifted to new levels that justify an ongoing MT uptrend,” says Coloretti.

While price remains above 2.0000 Westpac target the next key Fibonacci retracement target at 2.0700/50.

A weekly close above 2.0700/50 will target far greater heights at 2.2200/50 on a multi-month basis.