GBP/AUD Week Ahead Forecast: Painting a High Water Mark Might

- Written by: Gary Howes

Image © Adobe Images

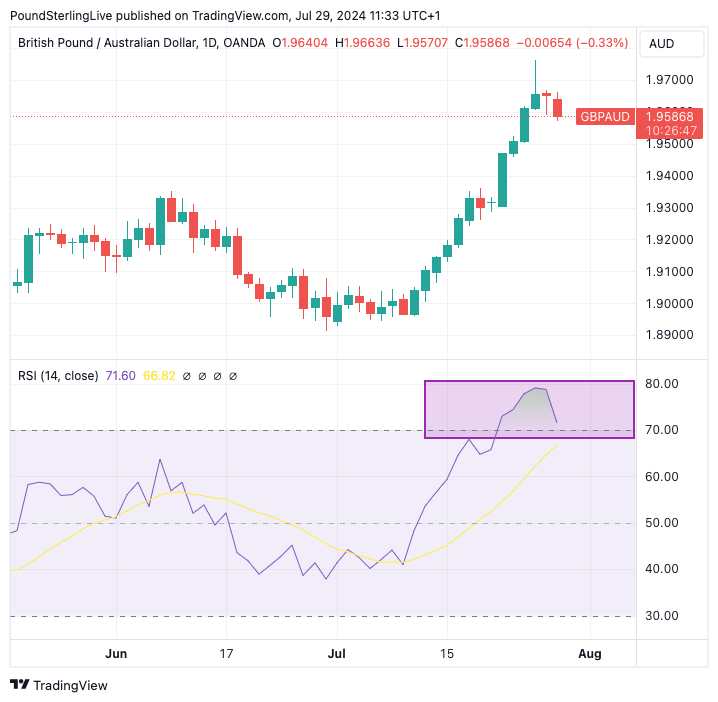

The Pound to Australian Dollar exchange rate can undergo a decent pullback in the coming days as it corrects from heavily overbought conditions.

GBP/AUD is significantly overbought: the Relative Strength Index on the daily chart shot higher to 80 at one stage last week.

It is rare to see any exchange rate reach such extreme conditions (the RSI rarely hits 70, which signals overbought, let alone surpasses it significantly). It is particularly rare to see GBP/AUD reach such conditions.

This leaves us looking for a washout of these unusual conditions via a pullback of the rally that peaked and left a high water mark at 1.9762 last week.

Above: GBP/AUD at daily intervals. The RSI in the lower panel is overbought. A pullback and consolidation is advocated. Track GBP/AUD with your custom alerts; find out more here

"While AUD momentum remains bearish, oversold RSI and inverted hammer pattern cautions for the risk of near-term corrective rebound," says Christopher Wong, an analyst at OCBC.

Already on Monday, we see some weakness as the pair retraces to 1.9587, but there is ample space for this weakness to extend in the coming days, particularly if the Japanese Yen weakens.

We wrote last week that the surge in Yen was the primary culprit behind Australian Dollar weakness. This is because the AUD is a prime component in the 'carry trade,' which saw billions borrowed in cheap Yen invested in higher-interest-rate Aussie assets.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Investors are reassessing the carry trade in light of expectations for lower interest rates at the Federal Reserve, convincing currency market intervention by Japanese authorities to weaken the Yen and a potential Bank of Japan interest rate hike on Tuesday.

Market expectations for another hike have risen of late, meaning if the Bank fails to hike the Yen can falter. It will experience a relatively deep selloff if the Bank fails to hike while also appearing non-committal to raising rates in the future.

Such an outcome can boost the Aussie and weigh on GBP/AUD. If the opposite happens and the Bank proceeds with a hike, there is also probably a limited chance of another surge in JPY.

This is because much of this expectation is already in the price of the currency, so risks are not symmetrical, we believe.

🎯 GBP/AUD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

Aus Inflation

Interest in Australia is also high this week, with an important inflation report covering the second quarter due. The report's outcome could potentially seal the deal on another Reserve Bank of Australia (RBA) interest rate hike, extending the Aussie's recovery.

"This week’s focus is on AU inflation. In particular trimmed mean staying above or around 4% would mean that inflation has well exceeded RBA’s inflation target range for around 10 quarters. A re-acceleration in CPI should put pressure on RBA to tighten at its upcoming MPC (6 Aug)," says OCBC's Wong.

UK Rate Cut

The Pound is coming off the boil against a number of currencies as investors become increasingly wary that the Bank of England will cut interest rates on Thursday.

The odds of such a move have been rising over recent days, with economists saying the Bank could proceed with a cut by saying it can begin to start adjusting Bank Rate without risking stoking inflation.

Much will also depend on the tone of the guidance and the state of the new economic forecasts: anything that points to further rate cuts will likely weigh on the Pound.

That said, the Pound is 2024's best-performing major currency and it is unlikely the Bank will deliver any kind of guidance that would terminally kill the rally.

The UK economy is growing, the labour market remains healthy and capable of generating inflation, meaning we are likely looking at a shallow interest rate cutting cycle.

If so, then the Pound can continue to benefit from one of the higher interest rates in the G10 world over the coming months.