GBP/AUD Week Ahead Forecast: Big Technical Test

- Written by: Gary Howes

Image © Adobe Stock

The Pound to Australian Dollar exchange rate's recovery meets a key technical hurdle that could frustrate further advances in the coming week.

The Pound rose to its highest level in nearly a month against the Australian Dollar early on Monday when GBP/AUD touched 1.9166.

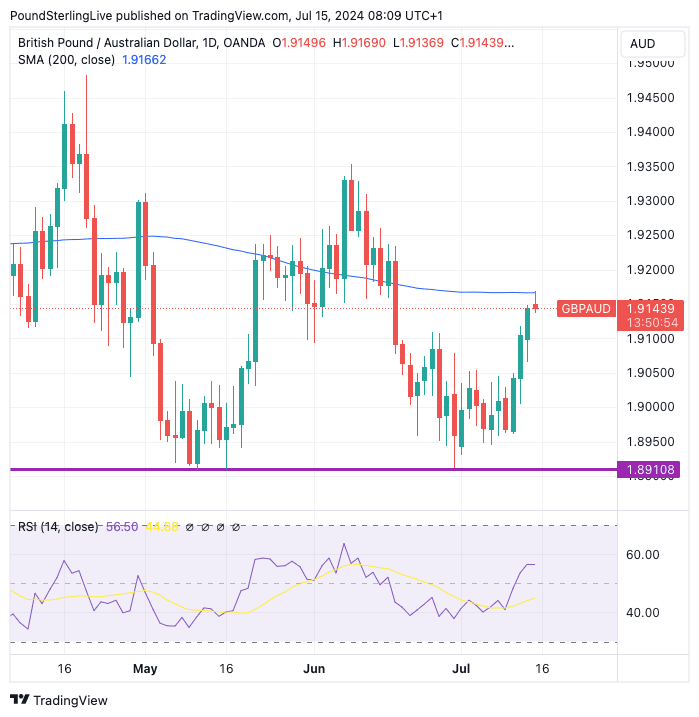

GBP/AUD has risen for two consecutive weeks, but the gains take it to the 200-day moving average, which is also located at 1.9166:

Above: GBP/AUD at daily intervals. Track GBP/AUD with your custom alerts; find out more here.

The exchange rate has since pulled back from this level. Is it a coincidence that the pullback happened just as GBP/AUD encountered the 200 DMA? The 200 DMA is a significant technical figure that is often considered a major level of support or resistance.

In this instance, the area forms a potential area of resistance that can frustrate the Pound's attempts to increase in value against the Aussie Dollar. For the coming week, we will be watching price action around here: a concerted break of the DMA would mean the exchange rate has evolved from recovery into a rally.

Should this happen, a rise to the June highs at 1.9350 becomes increasingly likely in the next two weeks to one month.

But, failure at the 200 DMA could mean the pair is entering a consolidative phase, with a retreat to support that comes in at 1.8910.

Expect a pullback to ensue if Wednesday's UK inflation numbers disappoint; this is a busy week for the Pound as these inflation data will be followed by wage numbers on Thursday and retail sales on Friday.

All of which should firm expectations for an August 01 interest rate cut at the Bank of England.

"We are still holding on to our call for an August rate cut, but another upside surprise for services inflation and/or wages would challenge our view and encourage a further strengthening of the GBP in the week ahead," says Lee Hardman, an analyst at MUFG Bank Ltd.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

Services inflation is expected to read at 5.6% and headline CPI inflation is forecast to read at 2.0%. Any undershoot would raise the odds of an August 01 rate cut and send an overbought Pound-Euro sharply lower.

Analysts at Oxford Economics reckon the headline CPI inflation print will land at 1.8%, an outcome that would represent a decent undershoot and prompt a selloff in the Pound.

"Considering the GBP has been the best performing G-10 currency QTD, we think it remains prone to a larger correction if CPI print comes in lower than expectations," says Daragh Maher, Head of FX Strategy at HSBC.

However, the sell-off in the Pound would be limited because the Bank of England will find it difficult to cut aggressively if the economy continues to perform robustly, something a number of economists said was likely following last week's GDP release.

Regarding the wage numbers on Thursday, the expectation is for average weekly earnings to have increased 5.8% over the year to June. Anything below here would result in GBP selling.

The Australian Dollar's new week didn't get off to the strongest of starts thanks to an undershoot in Chinese data. Chinese GDP read at 0.7% quarter-on-quarter in Q2, undershooting expectations for 1.1%.

The numbers suggest Australia's most important economic partner is still not seeing the kind of recovery needed to stimulate Chinese proxies, such as the Aussie Dollar.

The Australian weekly highlight comes in the form of Thursday's labour market figures, which will potentially add to growing bets that the Reserve Bank of Australia might raise interest rates again.

A reading above the anticipated 20K growth in jobs will boost the odds that the RBA will hike rates again. Australia's economy is proving to be more robust than the RBA had previously thought, which means it can continue to generate strong inflation prints.

Economists say the RBA might have to raise rates to cool activity and prevent inflation from becoming entrenched.

Expectations for higher RBA interest rates are meanwhile supporting Aussie bond yields, which are a key driver of AUD value.

In short, another strong labour market print will underpin AUD's ongoing bout of outperformance.