Australian Dollar Tops the Charts on Retail Beat

- Written by: Sam Coventry

Food sales were a key driver of retail trade growth in May. Image © Adobe Images

The Australian Dollar is the top-performing G10 currency after Australian retail sales beat expectations and raised the odds of another interest rate rise at the country's central bank.

The Pound to Australian Dollar dipped to 1.90 after the ABS said retail trade rose 0.6% month-on-month in May from just 0.1% in April and tripling consensus estimates for a 0.2% outcome.

The numbers signal an ongoing demand in the Australian economy that might be boosted further by incoming tax cuts. The Reserve Bank of Australia (RBA) might raise interest rates further to ensure robust demand does not stimulate inflation.

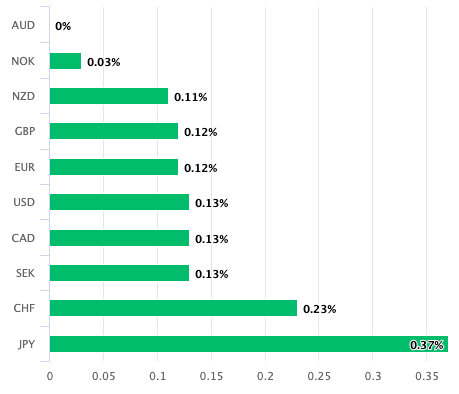

The Australian Dollar has been the best-performing G10 currency of the past month as investors anticipate Australia to command higher interest rates for longer than peer countries. Outperformance is also seen in the wake of the retail trade numbers, indicating the figures have had an impact on currency trade.

The Aussie Dollar is 0.22% higher against the U.S. Dollar (0.6681) and 0.17% higher against the Euro (1.66090).

We wrote on Tuesday that the RBA minutes from the June meeting came in more 'dovish' than expected. The RBA said it was mindful that households were coming under pressure, which weighed against the odds of further rate hikes.

However, evidence of robust demand would make a counterargument to the RBA's assessment.

Above: AUD gains against all peers on July 03.

The rise in retail trade marks the best gain since the start of the year, with annual sales growth lifting to 1.7% year-on-year, also the strongest pace for the year.

May saw strong demand in the basic food category (+0.7%), and gains in the clothing (+1.6%) and household goods brackets (+1.1%).

An August rate hike at the RBA is not guaranteed, and ANZ economist Madeline Dunk says the next set of Aussie economic releases will carry greater weight than usual.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

"The RBA Deputy Governor said the Board will be watching the activity data carefully, and today’s data is just one piece of information the RBA will receive before its August meeting," says Dunk.

"We’ll be looking at the next retail sales print (due 30 July) to gauge whether there is any meaningful upward momentum in today’s result. If the June retail data are strong, inflation comes in higher than the RBA’s forecasts (as we expect) and the labour market remains resilient, there is a chance the RBA could hike in August," she adds.