Australian Dollar Boosted by Chinese GDP and Industrial Production Surprises

- Written by: Gary Howes

Image © Adobe Images

The Australian Dollar played its role as a China proxy by rising across the board after the world's second-largest economy posted a set of stronger-than-forecast economic growth figures.

China said GDP expanded by 4.9% in the year to the third quarter, exceeding estimates of 4.4%.

This represents a slowdown on Q2's 6.3%, but as always, when it comes to currencies, it is how the incoming data matches up against expectations.

The Pound to Australian Dollar slid a quarter of a per cent to 1.09090 by the time of writing midweek, the Euro to Australian Dollar exchange rate was also down a quarter of a per cent at 1.6570, the Australian Dollar to U.S. Dollar exchange rate rising 0.34% to 0.6388.

"AUD/USD is currently trading near 0.6380. It received a boost from the stronger than expected Chinese economic data," says Kristina Clifton, an analyst at Commonwealth Bank of Australia. "July looks to have been the low point for the Chinese economy although the recovery so far is limited."

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

Chinese industrial production expanded 4.5% in the year to September, which was better than the 4.3% expected and in line with the previous month's release.

This is particularly cheering to the Australian Dollar, which derives much value from the export of raw materials that fuel China's industrial engine.

Retail sales also offered a positive surprise with a 5.5% y/y expansion in September against the 4.9% expected and the 4.6% recorded in August.

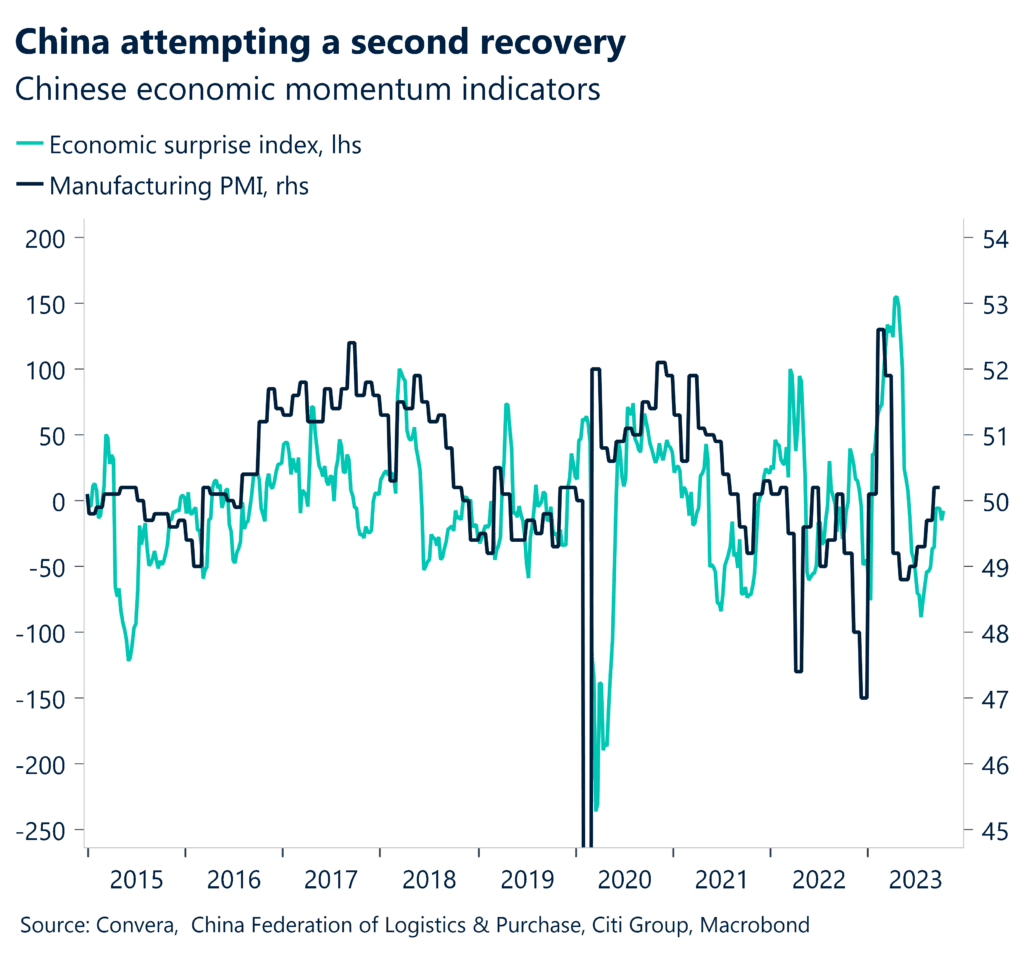

Above image is courtesy of Convera.

And to top it off, the Chinese unemployment rate unexpectedly dipped to 5.0% in September from 5.2% in August.

The Chinese economy might, therefore, be picking itself up from a period of underperformance, which can boost its own currency and proxies, such as the Australian Dollar.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes