Australian Dollar Boosted by Strong Jobs Report, CNH Boost

- Written by: Gary Howes

Image © Adobe Images

A strong Australian jobs report and a boost to the Chinese Yuan have conspired to propel the Australian Dollar to the top of the leaderboard on July 20.

The Australian Dollar rose after it was reported Australia added 32.6K jobs in June which was more than the 15K expected by markets, although less than May's upwardly revised 76.6K.

In addition, the People's Bank of China set a significantly stronger reference rate for the Yuan, a currency with which the Australian dollar is positively correlated.

"The PBOC's CNY supportive measures and Australia's stronger-than-expected employment data unleashed a one-two punch to the US dollar in Asia trading," says Alvin Tan, Asia FX Strategist at RBC Capital Markets.

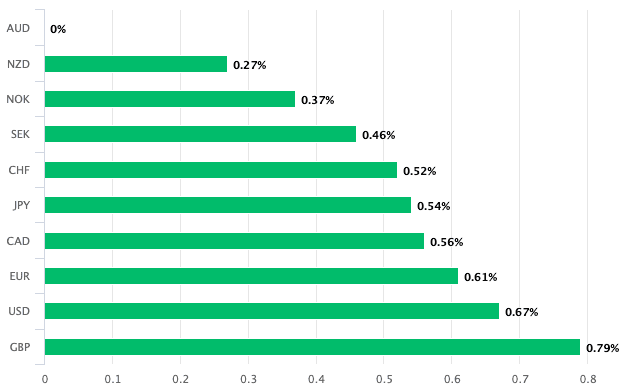

Above: The AUD has advanced against all its G10 peers on July 20.

"The USD/CNY reference rate today was set 680 pips below market expectations, which is the single largest deviation since November last year. The PBOC also loosened its macro-prudential rule capping foreign borrowing by domestic firms, thereby encouraging more foreign capital inflows," says Tan.

The move is seen as a stimulatory one for the Chinese economy which has been struggling to live up to hyped-up expectations since Covid restrictions were ended in China at the start of the year.

China is Australia's most important trading partner and a boost to the world's second-larget economy is therefore a boost for the Aussies and their currency.

"AUD/USD climbed about 1% to trade near 0.6830. AUD was underpinned by a stronger CNH and the better than expected Australian labour force report," says Carol Kong, a strategist at Commonwealth Bank of Australia.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

In fact, an appreciating Yuan would be the single most important driving force behind any Australian Dollar recovery over the coming months; therefore if the boost to the Chinese unit proves shortlived, so too will Aussie upside.

"Various economic-boosting messages and rhetoric have still not been followed up by concrete and decisive measures," says Tan.

"With a weakening global economic outlook, we doubt AUD/USD will sustain its gains for long," says Kong.

Australia's stronger-than-expected jobs report meanwhile holds some significance in that it signals the Australian jobs market remains tight and capable of generating the wage increases that can keep inflation elevated.

The Labour Force report also revealed the unemployment rate remained at 3.5%, defying a market consensus for a rise in unemployment to 3.6%.

The Australian to U.S. Dollar exchange rate is 0.67% higher at 0.6815.

The Pound to Australian Dollar exchange rate is down 0.80% on the day at 1.8955 at the time of writing, the Euro to Aussie Dollar rate is down 0.60% at 1.6447.

The June labour market report will have boosted expectations for further rate hikes out of the RBA, something that can support the Aussie in a currency world where interest rate differentials matter.

"The strong Australia labour force report in June followed on what was already a stellar May with no sign of any of the payback we had expected," says Tan.

CBA economists maintain a base case for one final 25bp hike at the RBA’s August meeting which is around 40% priced.

But much will depend on next week's second-quarter inflation reading for Australia.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes