Australian Dollar Bids Goodbye and Offers Salute in Changeover of Guard at RBA

- Written by: James Skinner and Gary Howes

"We are confident that Ms Bullock will provide the strong leadership and stability necessary for the RBA to navigate an increasingly complex and rapidly changing economic environment" - Treasurer Jim Chalmers.

Image © ArchivesACT, Reproduced under CC Licensing, Editorial, Non-Commercial

The Australian Dollar appeared to bid goodbye to one while offering a salute to another in the final session of the week after the Treasurer announced the appointment of a new Governor at the Reserve Bank of Australia (RBA).

Australian Dollar exchange rates were little changed on Friday after the Treasurer said Governor Philip Lowe would not be reappointed when his current term expires in September and would instead be succeeded by Deputy Governor Michele Bullock.

"Her appointment strikes the optimal balance between providing exceptional experience and expertise and offering a fresh leadership perspective," Treasurer Jim Chalmers said in a statement announcing the decision.

"We sincerely thank Dr Philip Lowe for his leadership since his appointment in September 2016 and acknowledge the outstanding commitment he has given to the RBA over his 43 years there," he added.

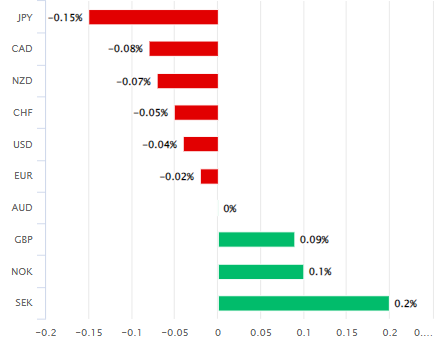

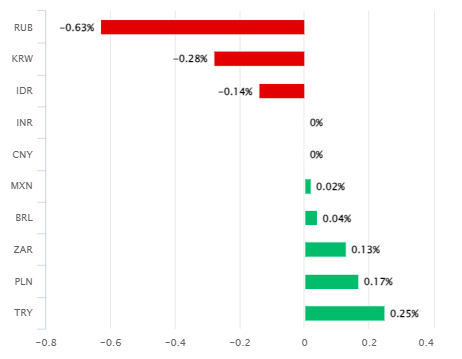

Above: Australian Dollar relative to G10 and G20 currencies on Friday. Source: Pound Sterling Live.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

The announcement heralds the departure of the most tenured central banker from among the advanced economies and the appointment of another who boasts a similarly formidable level of experience and expertise to her predecessor.

"The lack of AUD reaction likely reflects the market’s view Bullock’s appointment supports policy continuity as she is an insider," says Carol Kong, a strategist at Commonwealth Bank of Australia.

Michele Bullock has been Governor Lowe's deputy since April 2022 and a short time before the RBA began raising its cash rate but is promoted with more than 40 years of experience at the bank after joining as an analyst in 1985.

"The government has made a first rate choice for the new Governor. In the short time she has been in the role of Deputy Governor Michele Bullock has demonstrated a skill to choose and address key issues. She will be a worthy successor to Phillip Lowe," says Bill Evans, Chief Economist at Westpac.

Above: AUD/USD shown at 15-minute intervals alongside EUR/AUD and GBP/AUD.

With regards to the future of Australian monetary policy - a key driver of Australian Dollar value - "it remains to be seen whether the new Governor is more or less “hawkish” than Dr Lowe," says Evans.

The appointment follows a review of RBA policy announced last year and comes as the bank grapples with some of the highest inflation rates seen in Australia since the early 1990s after the quarterly measure of price growth reached 7.8% late in 2022.

Inflation has since moderated over the first half of 2023 but remained far above the 2.5% target when the monthly indicator for May was announced last month, while the reserve bank has raised its cash rate to 4.1% since the second quarter of last year, from its pandemic period low of 0.1%.

"Dr Lowe has overseen the Bank through a period of exceptional economic disruption and uncertainty, including the impacts of the COVID‑19 pandemic and Russia’s invasion of Ukraine," said Chalmers. "We respect and appreciate the remarkable dedication and contribution he has made to our country and our economy, and the way he has conducted himself in a difficult role at a challenging time."

Above: AUD/USD shown at daily intervals alongside EUR/AUD and GBP/AUD.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes