New Three-year Best for GBP/AUD Rate After Aussie Inflation Shortfall

- Written by: Gary Howes

- GBPAUD touches new three-year high

- After Aussie inflation undershoots expectations

- But core measures remain elevated

- Suggesting RBA can hike again next week

Image © Adobe Images

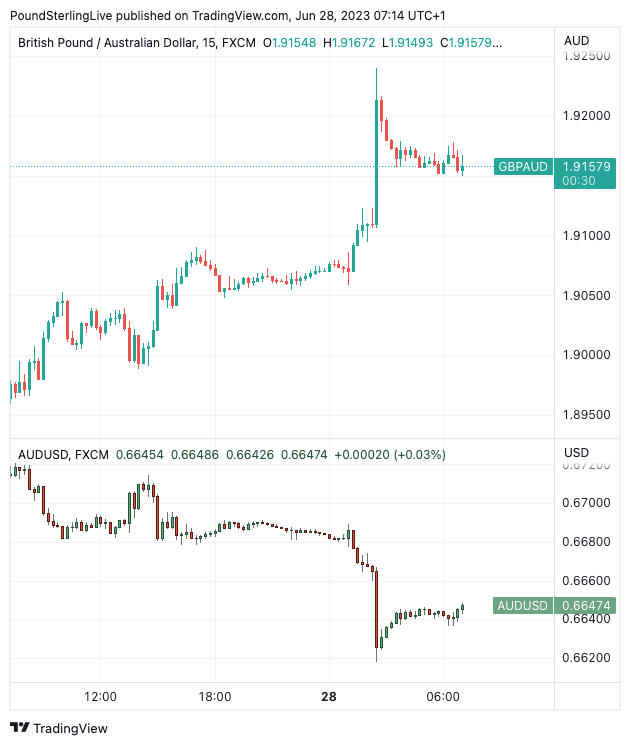

The Pound to Australian Dollar exchange rate (GBPAUD) briefly spiked to a new three-year high as investors lowered expectations for a July interest rate hike at the Reserve Bank of Australia (RBA) after the release of official data that confirmed inflation in Australia is decelerating.

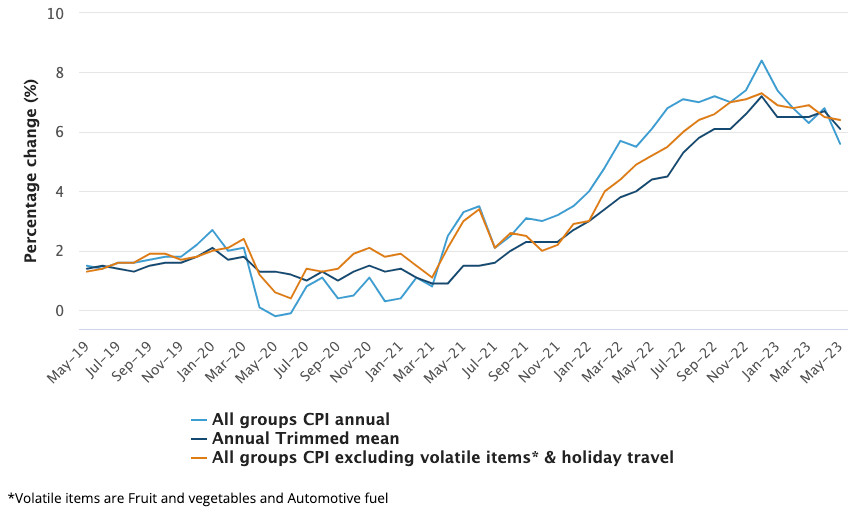

Interest rate expectations were pared after the ABS reported its monthly CPI indicator rose 5.6% in the twelve months to May, a shortfall on the 6.1% figure the market was expecting and the 6.8% reported the previous month.

The easing in prices was largely due to a 6.7% fall in fuel with a drop in holiday travel and accommodation prices in the month.

"AUDUSD dropped by 0.9% to 0.6619 after Australia’s CPI indicator for May was much weaker than expected," says Joseph Capurso, a strategist at Commonwealth Bank of Australia.

The Pound to Australian Dollar exchange rate (GBPAUD) is up by half a per cent at 1.9170 at the time of writing but had earlier spiked to a new three-year high (37 month) at 1.9239 following the data, before paring the advance back to 1.9154.

Above: GBPAUD (top) and AUDUSD showing CPI inflation release reaction.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

Money market pricing shows investors are now positioned for a less than 20% chance of a 25bp increase in the RBA's cash rate when it meets next week, following the release of the data.

"We agree there is a small chance of a rate hike in July. With little additional news about a Chinese government economic stimulus package, the path of least resistance for AUD/USD is down. AUDUSD can test 0.6547 this week," says Capurso.

However, a rate hike cannot be fully excluded given CPI ex-volatiles and holiday travel (which would equate to core inflation measures in the UK and elsewhere) was only marginally lower at 6.4% y/y in May from 6.5%.

This could offer the RBA the opportunity to raise interest rates again before the window to turn more 'hawkish' shuts, meaning there is still a chance the RBA surprises once again.

"The debate next week will likely be over 0 or 25bp as the RBA deliberates on just how restrictive rates need to be. The case for both can be made but at the margin, we think the prudent move is another 25bp hike," says Adam Cole, Chief Currency Strategist at RBC Capital Markets.

Given reduced expectations for a hike, any decision to raise interest rates would underscore how unpredictable the RBA has become and would potentially garner Australian Dollar volatility.

Recall, the RBA had paused its rate hiking cycle but in June surprised markets with a hike. In yet another surprise for currency markets, minutes for the meeting released later in the month revealed the call was a close one, and not the assured sign of intent initially assumed.

This is therefore by no means a 'hawkish' central bank and given its behaviour over recent months the odds of it erring to the side of caution and enacting another pause are therefore elevated.

The Australian Dollar would likely remain under pressure in the event the central bank foregoes a hike, potentially allowing GBPAUD to cement levels at or near the three-year highs.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes