GBP/AUD Rate Week Ahead Forecast: Braced at Resistance, RBA Key

- Written by: Gary Howes

- GBP/AUD in strong start to Dec.

- But now at key resistance area

- Break could follow Tues. RBA decision

- China reopening provides AUD with support

Image © ArchivesACT, Reproduced under CC Licensing, Editorial, Non-Commercial.

The Pound to Australian Dollar exchange rate (GBP/AUD) sits poised at a key area of resistance that, if broken, could usher in new highs, but failure to breach could ultimately result in a pullback over the course of the coming week.

Although the Pound has risen 1.66% already in December, the Australian Dollar will resist further gains amidst supportive headlines out of China and the potential for a more hawkish-than-expected Reserve Bank of Australia (RBA) on Tuesday.

The RBA is expected to raise interest rates by 25 basis points as it continues to raise the cost of borrowing, albeit at a reduced pace, in order to combat inflation which it believes remains too high.

For the Australian Dollar, it is this slowdown in the intensity of RBA rate hikes that are proving unsupportive.

"We remain surprised by the underperformance of the Australian Dollar in the last few days," says strategist Damien McColough at Westpac.

"With the rates market now pricing in sub 20bps of rate hikes from the RBA Tuesday following Lowe’s comments last Monday and the ‘weak’ monthly CPI last Wednesday, we clearly need to get through that key risk event," he adds.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

It is however worth noting that market pricing has edged up to 25bp again in the wake of Monday's news China continues to ease Covid restrictions.

The RBA is nevertheless expected to be amongst the first major central banks that would end its hiking cycle, primarily over concerns higher rates will deliver a significant blow to the country's housing market.

This dynamic is, on balance, unsupportive of the Australian Dollar, particularly against currencies that can depend on their own central banks to continue hiking such as the Pound, U.S. Dollar and Euro.

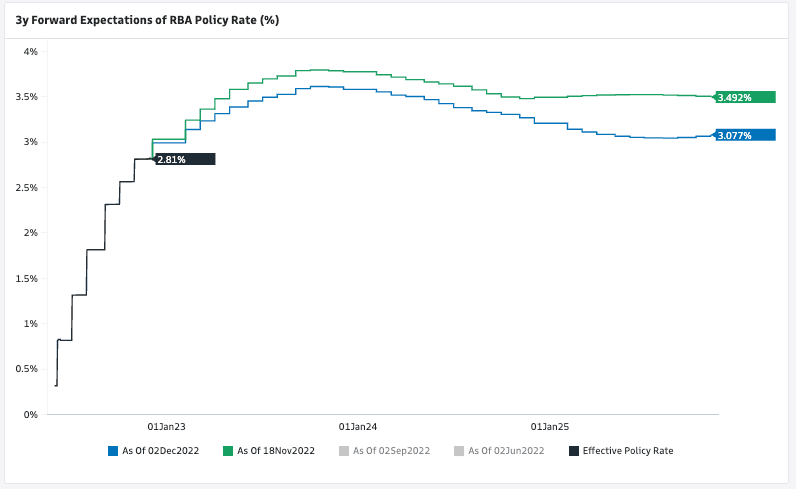

Above: Market implied expectations for RBA hikes has come down of late, weighing on AUD. Image source: Goldman Sachs.

But the RBA might have to concede there is more work to be done, particularly amidst headlines China continues to ease Covid controls, raising expectations Australia's main trading partner will be set to experience a stronger economic recovery.

"News that Shanghai and Hangzhou are joining other major cities such as Beijing in further easing Covid restrictions was good news for the AUD," says Valentin Marinov, Head of FX Strategy at Crédit Agricole.

"China's move to re-open will encourage the central bank to continue raising rates," he adds.

Authorities in China's commercial hub Shanghai said PCR testing requirements to enter outdoor public venues, such as parks or use public transportation, would be scrapped.

The developments are a continuation of a trend in easing controls, despite rising Covid cases.

"Shanghai has eased some of its Covid restrictions following the lead of Beijing, Shenzhen and Guangzhou, all of which have relaxed curbs in recent days in response to recent protests. The news has provided support to risky appetite," says Jane Foley, Head of FX Strategy at Rabobank.

In recognition of the developments out of China GBP/AUD trades slightly weaker at 1.8050 at the start of the new week. AUD/USD is up a quarter of a percent on the day at 0.6809.

A look at the daily GBP/AUD chart shows an area of thick technical resistance is being tested:

Above: GBP/AUD at daily intervals, showing key resistance bands. If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.

The market appears to have discounted fully the notion the RBA is nearing the end of its hiking cycle, therefore any developments that lead investors to bet on an extension to the cycle could boost the Aussie.

"A 25bp rate hike by the RBA would give the AUD an immediate boost given market pricing," says Marinov.

The initial impact on the Aussie Dollar from the rate decision could prove short-lived and it will be the guidance offered by the RBA that provides the more enduring impact.

"Investors should also pay attention to Governor Philip Lowe’s rhetoric, which should remain relatively neutral and point to further rate adjustments being data-dependent," says Marinov.

"Lowe could give some hope to mortgage holders by saying there have been encouraging signs of cooling inflation, which would restrict AUD upside on the back of a 25bp rate hike," he adds.

On the eve of the RBA decision, it was reported the value of new housing finance declined 2.7% in October marking the ninth consecutive monthly fall. New lending was 17.1% lower than a year ago.

"The housing market is one of the first areas in the economy to feel the impact from rising interest rates. Reduced housing turnover and softer prices are a double negative for new lending and have driven the recent decline in the value of new housing finance," says Jarek Kowcza, Senior Economist at St. George Bank.

However, the RBA will likely see through current developments and proceed with another rate hike, given the housing market decline remains relatively contained.

"New housing finance activity is echoing the sentiment across the broader housing market. That is, a material slowdown is underway, but we are not staring down the face of a crash," says Kowcza.

Economists at ANZ are meanwhile on the lookout for the RBA's statement to hint at the potential for a pause in the rate hiking cycle.

"We are, however, alert to the prospect of substantive changes in the post-meeting statement. In particular, any reference to a possible pause being brought explicitly into the statement (at present such a reference is in the minutes and not the post-meeting statement). This would be a dovish development," says David Plank, economist at ANZ.

Such a dovish outcome would be consistent with a weaker Australian Dollar, potentially allowing GBP/AUD a test of the upper bounds of the aforementioned resistance bands.

The decision is due 00:30 GMT.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes