Australian Dollar Outperforms on China Reopening News

- Written by: Gary Howes

Image © Adobe Stock

China is easing its Covid containment restrictions, boosting expectations for a recovery in the world's second largest economy and Australia's largest export market.

The Australian Dollar has risen on the news.

China said it will halve to seven days its Covid quarantine period for visitors from overseas, with a further three days spent at home, health authorities said on Tuesday.

Trinh Nguyen, Senior Economist for Emerging Asia at Natixis, says the move is part of a trend to normalisation in China and will "jolt" demand.

"China is employing a different kind of zero-Covid, as in no more Q2 strict lockdown, both internally & externally," she says.

Nguyen expects more easing of restrictions.

"AUD is a liquid way to play China reopening in the macro space," says Viraj Patel, Macro Strategist at Vanda Research.

The Australian Dollar outperformed on the news: the Pound to Australian Dollar exchange rate was quoted 0.40% lower at the time of writing at 1.7645. (Set your FX rate alert here).

The Australian Dollar to U.S. Dollar exchange rate was half a percent higher at 0.6954.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

The China news provides another boost to global investor sentiment which was expressed via higher equity markets in both Asia and Europe while U.S. futures pointed to a positive open.

This should aid 'high beta' currencies such as those belonging to Emerging Market economies and commodity producers, such as Australia.

Nguyen's reference to a Chinese demand "jolt" is observable in global commodity prices, with metals and oil prices moving higher.

Australia is a net exporter of iron ore, coal and natural gas, therefore China's reopening news would be expected to improve the country's terms of trade, offering a fundamental boost to the Aussie Dollar.

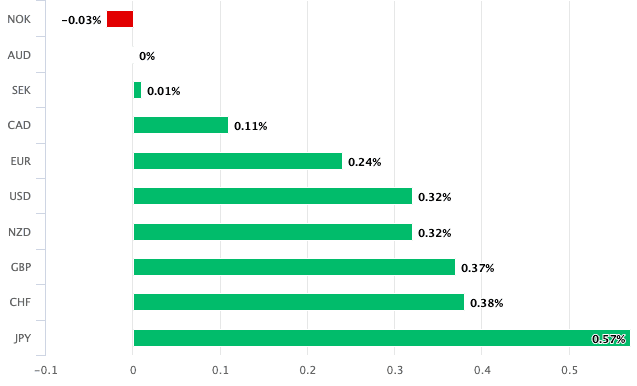

Above: AUD outperforms on June 28.

Rising commodity prices are however an inflationary development and markets could react negatively if the rally extends.

The developments come on the back of the previous week's stock market rally that analysts said was linked to falling commodity prices and declining inflation expectations.

Expectations for falling inflation prompted investors to cut back on the number of interest rate hikes they expected from global central banks, most notably the Federal Reserve.

Less rate hikes in the pipeline and easing inflationary pressures could be beneficial to global growth, according to current market dynamics.

But should the Chinese reopening reignite inflation expectations there is the prospect that central bank rate hike expectations start to rise again, which will in turn choke the rebound in risk.

This rally could therefore have its limits, be it for stocks, commodities and the Australian Dollar.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes