Pound / Australian Dollar Rate Finds Feet with RBA Minutes, Fed and BoE in Focus

- Written by: James Skinner

- GBP/AUD drawing line under steep sell-off

- May be set to hold above 1.7950 this week

- Could test 1.82 as AUD/USD reverses lower

- Amid market rebound & commodity unwind

- RBA minutes, Fed decision support GBP/AUD

- But AU job data & BoE decision posing risks

Image © Adobe Images

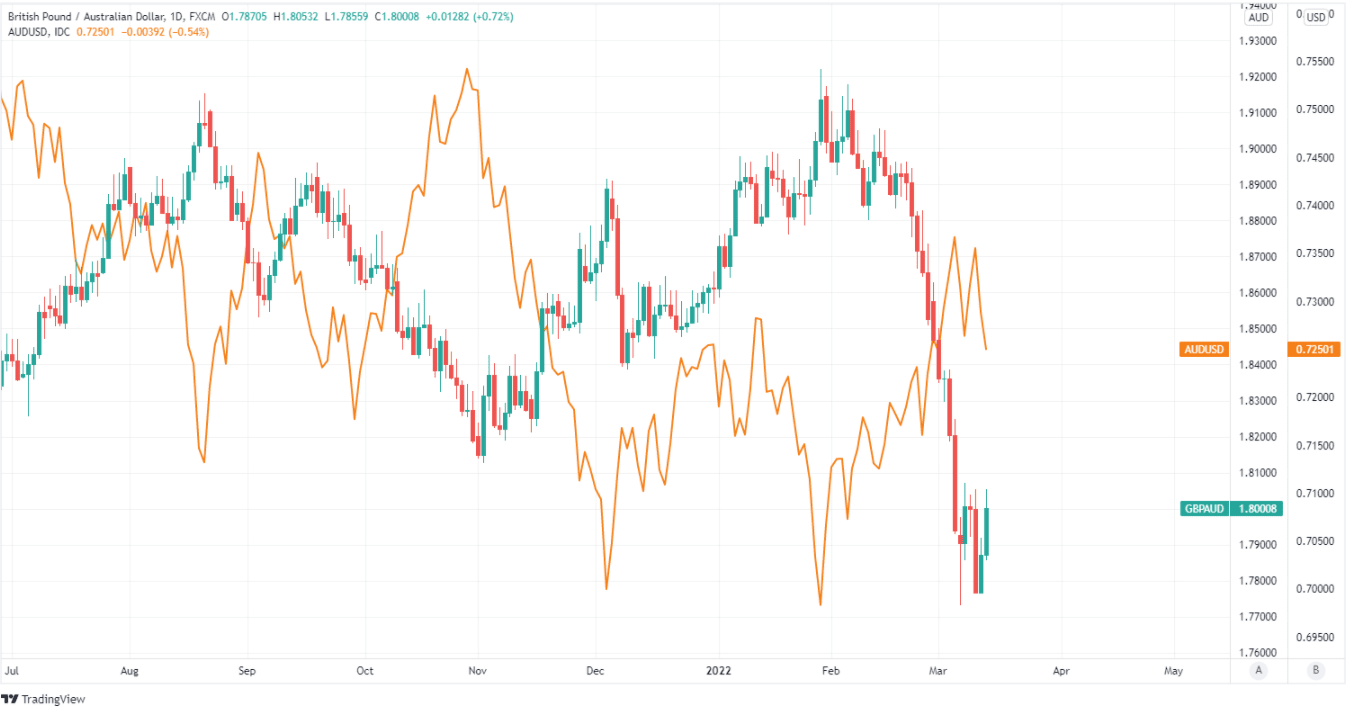

The Pound to Australian Dollar exchange rate is increasingly drawing a line under a fortnight-long run of losses and could be likely to hold above the 1.7950 level this week and may even have scope to probe above 1.8250 if the recent rally in the all-important AUD/USD rate continues to unwind.

Australia’s Dollar opened the week on its back foot alongside other commodity-linked currencies as it further reversed the recent rally in AUD/USD, which had been a significant driver of GBP/AUD’s almost seven percent fall over the two weeks since Russia began its invasion of Ukraine.

AUD/USD had reversed almost half of the 6.8% rally from 0.6967 to 0.7443 that took place between January 31 and March 07 by Monday, and if this earlier move continues to unwind over the coming days it would likely mark a conclusive end to the recent downturn in GBP/AUD.

That leaves much resting on Tuesday’s minutes from the Reserve Bank of Australia’s (RBA) February policy meeting as well as interest rate decisions from the Federal Reserve (Fed) on Wednesday and the Bank of England (BoE) this Thursday.

“Markets should reassess the 100bp of hikes priced in for the remainder of the year (including this week’s move), particularly in the light of a further squeeze on real incomes through higher utility prices later in the year,” says Adam Cole, chief FX strategist at RBC Capital Markets.

Above: Pound to Australian Dollar rate at daily intervals alongside AUD/USD.

- GBP to AUD reference rates at publication:

Spot: 1.8044 - High street bank rates (indicative band): 1.7412-1.7540

- Payment specialist rates (indicative band): 1.7882-1.7918

- Find out about specialist rates, here

- Set up an exchange rate alert, here

Cole and the RBC team said Monday that this week’s BoE decision is likely a downside risk for Sterling and advocated that clients bet on a Pound-Australian Dollar decline to 1.7650 over the coming days, while others too have warned that GBP/AUD could fall to similar levels this week.

“Tomorrow’s minutes from the RBA’s March policy meeting may support AUD if there is a long discussion on rising labour costs. We estimate a strong 40,000 increase in jobs in February,” says Joseph Capurso, head of international economics at Commonwealth Bank of Australia.

“AUD/GBP has traded in a tight range since 7 March. AUD/GBP can build on last week’s gains to approach the 2021 high of 0.5733 [GBP/AUD low of 1.7442] if the BoE is dovish,” Capurso and colleagues said on Monday.

Thursday’s BoE decision does pose a risk to Sterling, although GBP/AUD would be likely to hold above the round number of 1.78 if the main Aussie exchange rate AUD/USD continues this week to unwind the commodity-induced gains it made since Russia first launched its invasion of Ukraine.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

“We still see some further weakness developing in the near term but would use Q2 weakness as an opportunity to buy for strength later in the year. Dips into the low 0.72s are a buy opportunity,” says Richard Franulovich, head of FX strategy at Westpac, referring to AUD/USD.

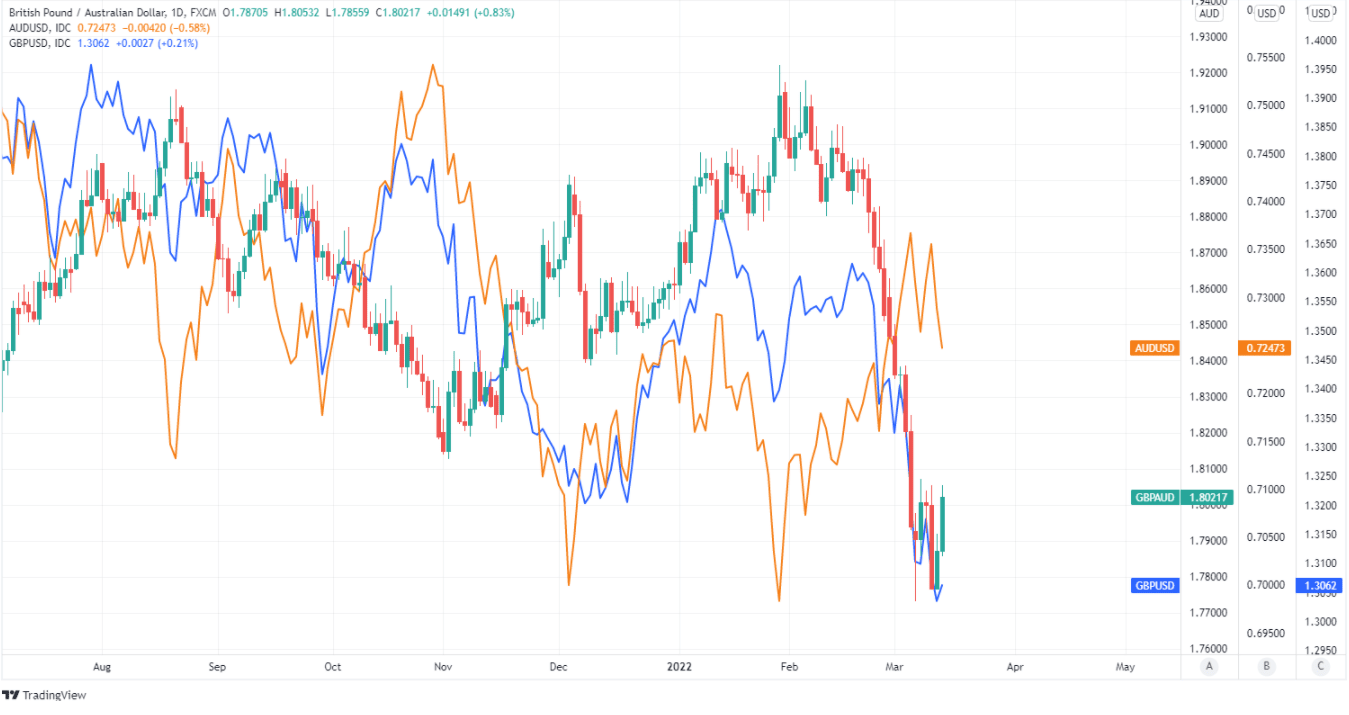

So long as AUD/USD continues its Monday descent toward 0.72 or below, GBP/AUD would hold above 1.78 even if the main Sterling exchange rate GBP/USD fell all the way to 1.2837 this week while GBP/AUD would actually rise to 1.82 or above if GBP/USD also partially recovers from recent losses.

GBP/AUD tends to closely reflect the relative performance of Sterling and the Aussie when each is measured against the U.S. greenback, and it would actually rise to 1.82 or above this week if along the way the GBP/USD pair rises for any reason from Monday’s levels.

“Aussie dollar price action became more two-way last week, after 5 straight weekly gains. Last Monday’s squeeze to 0.7441, a fresh high since November 2021, came amid nasty price action in many markets but was unwound within hours,” says Sean Callow, a Westpac colleague of Franulovich.

Above: AUD/USD shown at daily intervals alongside GBP/USD and GBP/AUD.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

While minutes of February’s RBA meeting and last month’s employment data are important highlights for the Australian Dollar this week, the trajectory of international energy prices and market response to Wednesday’s Fed policy decision might be the greater influence on AUD/USD.

“A fall below .7245/36 would turn the risk back lower again, with a break below the 55-day moving average at .7198 warning of a deeper setback within a potentially broader range,” says David Sneddon, head of technical analysis trading strategy at Credit Suisse, referring to AUD/USD.

Recent Australian Dollar gains were driven almost entirely by commodity price increases associated with the Russian invasion of Ukraine, and commodity prices have beat a steady retreat from early March highs over the recent week; taking AUD/USD along for the ride too.

Meanwhile, Wednesday’s Fed decision has drawn closer and is widely expected to see the bank take the first step toward withdrawing the monetary support provided by the significant interest rate cuts announced in support of the U.S. economy back in 2020.

It’s also likely that the latest dot-plot of forecasts will show Federal Open Market Committee (FOMC) members anticipating a larger number of rate rises for this year than were guided for back in December, which is a possible downside risk for AUD/USD and upside risk for GBP/AUD this week.