Pound / Australian Dollar Rate Eyeing 1.96 Multi-month, Westpac says

- Written by: James Skinner

- GBP/AUD set to extend & could top 1.9607

- With GBP set to outperform lethargic AUD

- On fragile risk appetite & policy divergence

- As RBA shows patience & BoE lifts further

Image © Adobe Stock

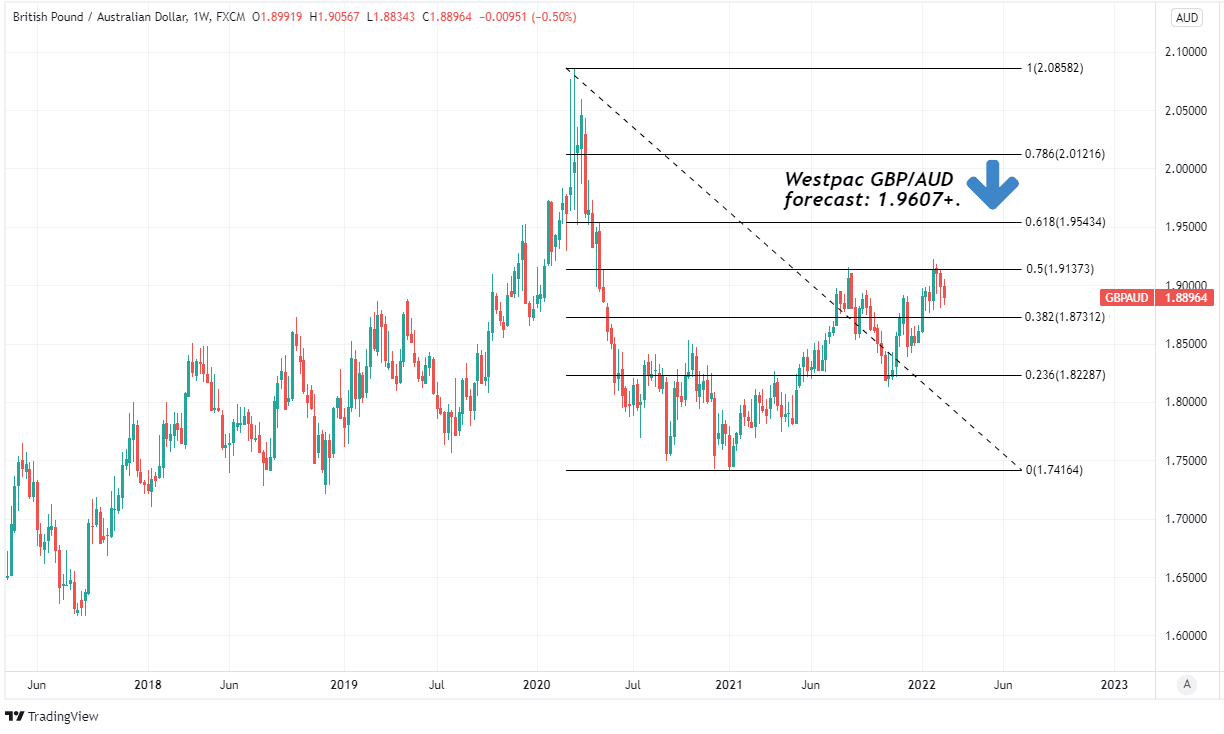

The Pound to Australian Dollar exchange rate rally has stalled in February but strategists at Westpac say it can extend further during the months ahead and are looking for Sterling to reach two-year highs above 1.96 in the first half of 2022.

Sterling sustained a hat-trick of intraday losses this week as its consolidation of January highs above 1.92 continued with the encouragement of an ongoing rebound in the influential AUD/USD exchange rate.

The Pound-Australian Dollar rate has been confined within a wide four-cent range spanning the gap between a tried and tested level of technical support at 1.8805 on the charts and late January’s peak this month, although strategists at Westpac are looking for the range to break in the weeks ahead.

“Sterling is the strongest G10 currency so far in 2022. As such, the Aussie down trend against the pound is to a substantial degree a reflection of sterling’s appeal,” says Sean Callow, a strategist at Westpac.

“The next few weeks into the March FOMC meeting should be unsettling for risk appetite and thus for A$. We see AUD/GBP spending considerable time with a 0.51 handle [GBP/AUD: 1.96] and probably struggling into mid-year,” Callow also said on Thursday.

Above: GBP/AUD shown at daily intervals with Fibonacci retracements of November rally indicating areas of technical support for Sterling.

- GBP to AUD reference rates at publication:

Spot: 1.8890 - High street bank rates (indicative band): 1.8230-1.8360

- Payment specialist rates (indicative band): 1.8720-1.8796

- Find out about specialist rates, here

- Set up an exchange rate alert, here

International markets have all been influenced this week by developments between Russia and Ukraine, but the growing gulf between policy stances of the Reserve Bank of Australia’s (RBA) and its international peers has been the foremost driver of the big trends in the Aussie Dollar over the last year.

“The BoE began to raise rates from 0.1% in December 2021 and this month’s 25bp hike to 0.5% was a 5- 4 vote, with the dissenters preferring 50bp. The RBA in contrast is keeping its 0.1% cash rate for now, likely until August in our view, a drag on A$” Callow and colleagues wrote in a Thursday research briefing.

RBA forecasts and guidance have repeatedly suggested that its interest rate could potentially remain at its coronavirus-inspired low of 0.1% until late in 2023 and for a lengthy period after other comparable central banks will have begun to lift theirs.

This policy results from the bank's scepticism about whether Australian inflation pressures are strong enough for the 2.5% annual target to be met beyond the very short-term and played a significant role in making the Australian Dollar the second biggest faller among G10 currencies for the 12 months to Thursday.

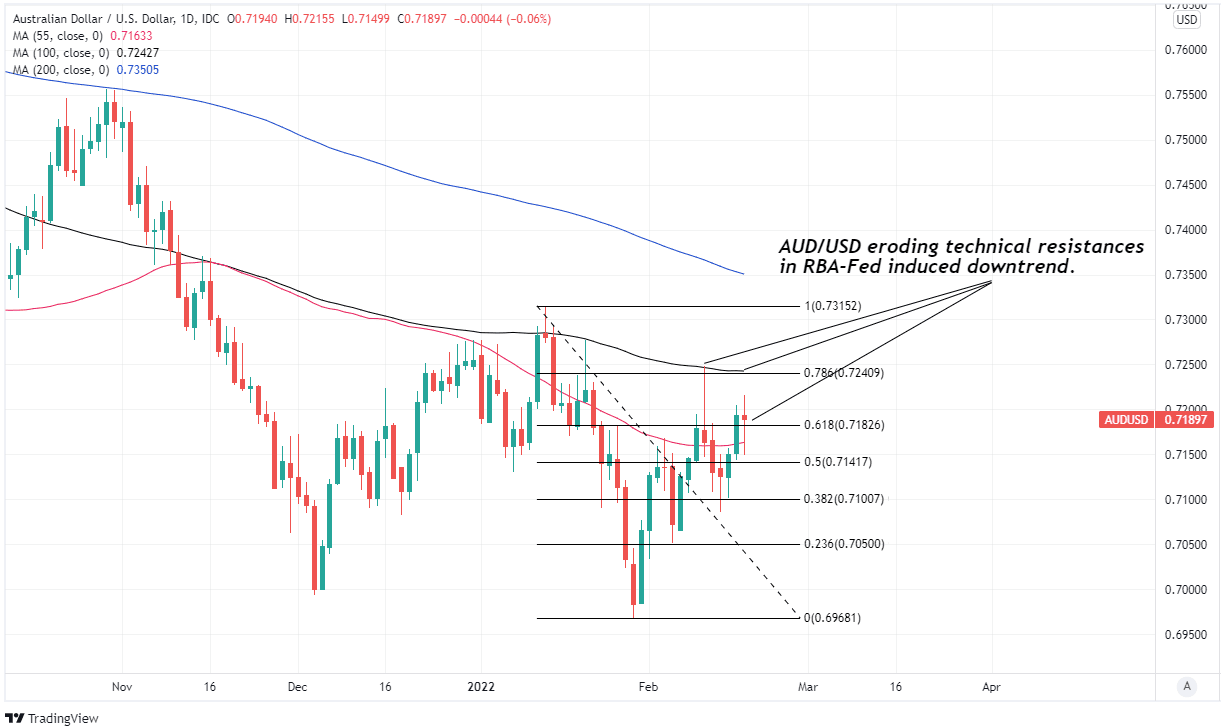

“The bottom line is that the RBA is very likely to hold steady in coming months as many other G10 central banks hike rates, a drag on A$,” Callow and colleagues say. “The 100 dma at 0.7245 should cap AUD/USD for now."

Above: AUD/USD shown at daily intervals with Fibonacci retracements of 2022 decline and selected moving-averages indicating areas of technical resistance to any Aussie Dollar recovery.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

The RBA's stance could potentially remain an Australian Dollar headwind for some months while the Bank of England (BoE) is widely expected to lift its benchmark interest rates on multiple occasions this year, and after already having raised it back to 0.50% between December and February.

This is a part of why the Pound was still one of the best performing major currencies of 2022 on Thursday and is also a major factor underpinning Westpac's strategy outlook and forecast for GBP/AUD to rise to 1.96 and above during the months ahead.

Meanwhile, the Pound to Australian Dollar rate would at the least be likely to remain buoyant above the 1.8805 level in the near future if the Westpac team is right to suspect that AUD/USD’s recovery will eventually peter out around 0.7245, given that GBP/AUD tends to closely reflect the relative performance of AUD/USD and its Sterling equivalent GBP/USD.

Meanwhile, the negative correlation often evident between GBP/AUD and AUD/USD frequently enables the Pound-Aussie rate to benefit from declines in AUD/USD and vice versa.

“We see AUD/USD weakness developing towards 0.70 through the end of the month into the March Fed lift-off. Bigger picture, we would look to use that weakness through 0.70 as an opportunity to buy for strength later in the year,” Callow said on Thursday.

Above: GBP/AUD shown at weekly intervals with Fibonacci retracements of 2020 decline indicating areas of technical resistance to a further recovery.