Pound / Australian Dollar Rate Could Struggle to Get Back Above 1.86

- Written by: James Skinner, Additional Editing by Gary Howes

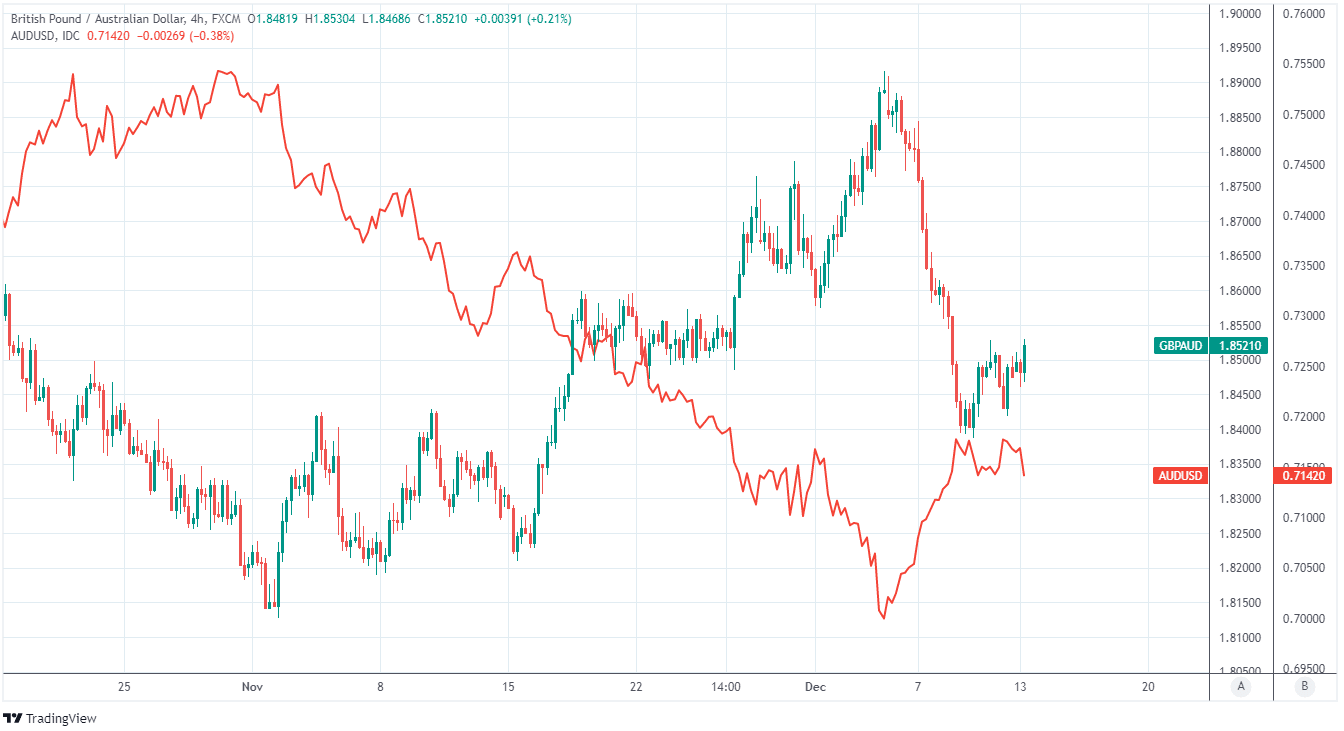

- GBP/AUD supported at 1.84, struggling near 1.86

- With AUD/USD momentum seen ebbing near 0.72

- Aiding GBP/AUD as UK virus risks constrain upside

- BoE decision in focus for GBP as AUD eyes job data

Image © Adobe Stock

The Pound to Australian Dollar rate fell heavily last week but could stabilise above 1.84 over the coming days as international factors lead the recently outperforming Aussie to cool its heels, although coronavirus-related risks in the UK may be likely to prevent Sterling making it back above 1.86.

Australia’s Dollar remained the best performing major currency of the last week on Monday and had pushed the Pound-Aussie rate more than two percent lower to 1.84 before the Sterling exchange rate attempted to stabilise ahead of the weekend.

The Pound-Australian Dollar rate edged back above 1.85 on Monday as the main Aussie exchange rate AUD/USD retreated further from last week’s highs around 0.7185, although the Sterling pair could potentially struggle this week to get back above even the nearby 1.86 handle.

This is in light of recent signs that the UK government could be about to reverse ferret on its earlier commitment to a supposedly irreversible roadmap toward a reopened economy, citing the perceived risks of the latest mutated strain of coronavirus; Omicron.

"Talk of a 'Plan B+' or 'Plan C' are already in the works. And it's very possible, in our view, that conversations around a light touch lockdown after Christmas will certainly gain traction. We will be watching this very closely," says Sanjay Raja, an economist at Deutsche Bank.

Above: Pound-Australian Dollar rate shown at 4-hour intervals alongside AUD/USD.

- GBP/AUD reference rates at publication:

Spot: 1.8560 - High street bank rates (indicative band): 1.7910-1.8040

- Payment specialist rates (indicative band): 1.8393-1.8467

- Find out about specialist rates, here

- Set up an exchange rate alert, here

- Book your ideal rate, here

Omicron was cited by Downing Street on Sunday for an accelerated rollout that aims to make a third vaccine shot available to all adults by year-end.

“Get boosted now to protect our NHS, our freedoms and our way of life,” said Prime Minister Boris Johnson.

The latest vaccine rollout has gotten off to almost as robust a start as the first highly successful campaign during the early stages of 2021 - UK government dashboard figures suggest - and at point when it’s not yet known whether the newest strain of the virus has the same troublesome credentials as the others in circulation.

Sunday’s announcement comes after last week’s resort to ‘Plan B’ containment measures and suggestions of even a so-called 'Plan C' being in the pipeline and may mean the government’s roadmap is falling by the wayside and that restrictions are likely to be ramped up over the coming weeks.

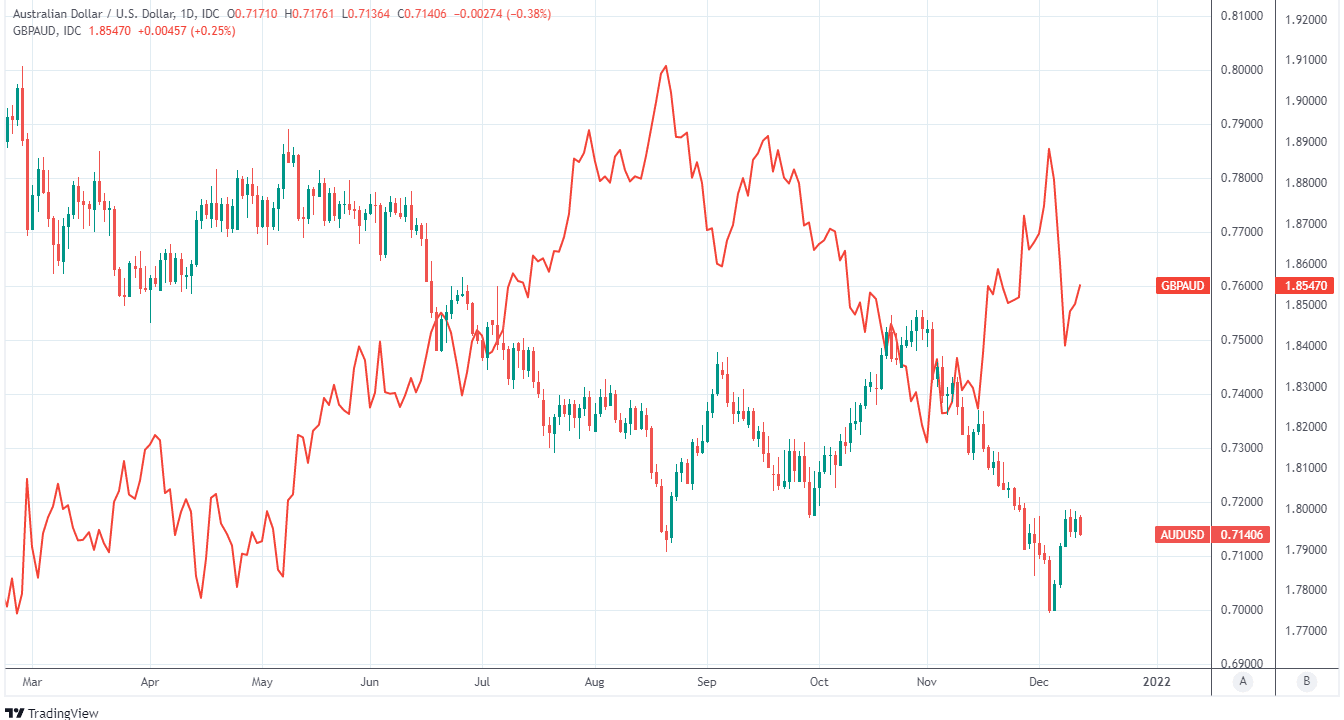

Some analysts were already looking for the main Sterling exchange rate GBP/USD to slip toward 1.30 in the days ahead and that would likely ensure that Monday’s Pound-Australian Dollar recovery loses steam around 1.86 even if AUD/USD remains in retreat also this week.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

“GDP grew just 0.1%mth in October and the UK government has reacted more aggressively than most to the Omicron threat, bringing in ‘Plan B’ restrictions. This may see the BoE hold steady again but sterling should be on edge into the meeting,” says Sean Callow, a Sydney based senior FX strategist at Westpac

“The Aussie dollar handily outperformed most major currencies last week. In order to extend its recovery to above 0.7200, it will need to negotiate a very crowded local and global calendar, including the Fed, ECB and BoE monetary policy decisions and Australia’s November post-lockdown jobs report,” Callow and colleagues wrote in a Monday briefing.

GBP/AUD would be at risk of a further setback this week if AUD/USD’s recovery takes it above 0.72, given that GBP/AUD always closely reflects the relative performances of AUD/USD and GBP/USD.

AUD/USD will be sensitive to the outcome of Wednesday’s Federal Reserve policy decision, a subsequent speech from Reserve Bank of Australia Governor Philip Lowe and Thursday’s Australian employment data for November.

The danger is that the U.S. Dollar garners further support from a possible indication by the Fed that its interest rate could be likely to rise as soon as the second quarter of next year and on as many as three occasions in 2022.

Above: AUD/USD shown at daily intervals with Pound-Australian Dollar rate.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

A ‘hawkish’ Fed decision would likely weigh on AUD/USD and support GBP/AUD, although the reverse could be true of the later speech by RBA Governor Lowe and the subsequent employment figures from Australia.

The latter could see the Aussie spurred on to further gains if Governor Lowe confirms the apparent message of last week’s RBA policy decision, which appeared to offer a subtle but meaningful change in the bank’s guidance.

The RBA appeared to suggest there could be scope for its quantitative easing programme to be ended completely following its next review in February and also seemed to create room in its guidance to allow for an initial increase in the cash rate sooner than the year 2024 previously billed as most likely.

“The Australian labour report for November is the last major data for the year. The report provides the first read on the labour market after lockdowns and stay at home orders were lifted in NSW, Victoria and the ACT. We expect the survey to show a massive 250,000 gain in employment. We estimate the unemployment rate eased to 4.7%,” says Kim Mundy, a senior economist and currency strategist at Commonwealth Bank of Australia.

“AUD/USD will be driven by reactions to the FOMC policy meeting as well as Omicron news. A hawkish FOMC policy meeting can weigh on AUD. We still see a risk, albeit fading, that AUD again dips below 0.70 if news about Omicron is negative. We expect AUD will end the year in a 0.70‑0.73 range. Currencies are generally tracking close to our forecasts,” Mundy said in a Sunday research briefing.

Once all is said and done in the U.S. as well as Australia the Bank of England is set to announce its final policy decision of the year on Thursday at 12:00 London time and the market has effectively written off the earlier prospect of an increase in Bank Rate from 0.10% to 0.25%.

In the absence of any surprise change in Bank Rate, which would be almost sure to provide a sharp uplift to Sterling, the Pound may be likely to its cues from any commentary on the outlook for borrowing costs in 2022.