Pound-to-Australian Dollar Eyes 1.80 in Wake of RBA Surprise

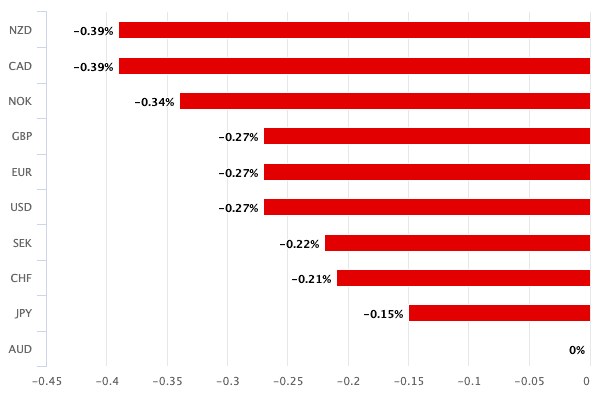

- AUD in the red

- RBA boost quantitative easing by A$100BN

- AUD strength also now a focus at RBA

Above: Governor Philip Lowe. Photo Source: RBA on Flickr, reproduced with permission from the RBA press office.

- GBP/AUD spot at publication: 1.7980

- Bank transfer rates (indicative guide): 1.7350-1.7475

- FX transfer specialist rates (indicative): 1.7554-1.7852

- More information on how to access specialist rates, here

The Reserve Bank of Australia (RBA) has surprised markets by expanding its bond buying quantitative easing programme while sending a clear message to markets that interest rates will not rise for three more years.

The developments sent the Australian Dollar lower against key rivals, with the Pound-to-Australian Dollar exchange rate (GBP/AUD) rising to a high of 1.7970 in response.

The rally in GBP/AUD keeps alive a multi-day trend of appreciation and the developments at the RBA open the door to a potential test of the psychologically significant 1.80 level in the near future.

Above: GBP/AUD jumps on RBA surprise.

The RBA held its cash rate at 0.10% as expected but surprised by expanding its current bond buying programme by another A$100BN.

The present programme is set to end in April and analysts had thought the RBA would wait another month or so before deciding whether to extend it.

"With regard to the QE extension, the RBA obviously thought there was little to be gained by waiting before it revealed its intensions. We agree, especially since last week’s ongoing commitment to bond purchases by the Fed left the RBA with little option but to extend its own programme," says economist David Plank at ANZ Bank.

The timing of the next interest rate hike represents another significant shift at the RBA picked up by foreign exchange markets.

In previous monetary policy statements Governor Philip Lowe and his team committed to keeping interest rates unchanged for at least three years, but the February 02 announcement saw the RBA cement this message by saying they did not expect the conditions for a hike to be in place until 2024 at the earliest.

"The Board will not increase the cash rate until actual inflation is sustainably within the 2 to 3 per cent target range. For this to occur, wages growth will have to be materially higher than it is currently. This will require significant gains in employment and a return to a tight labour market. The Board does not expect these conditions to be met until 2024 at the earliest," said Lowe in a statement.

"The forward guidance on the cash rate has evolved into a calendar commitment," says Plank.

The rule of thumb is that the Australian Dollar benefits when the cash rate at the RBA is higher than that at other central banks. Currently the 0.10% on offer gives little interest rate advantage to the Aussie Dollar, but were markets to expect a rate rise was on the horizon the currency would be expected to move higher.

But, the RBA killed this assumption by sending a clear message that rates will be lower for longer, hence the AUD underperformance:

As expected, the RBA revised its growth forecasts up, but the strengthening of the Australian Dollar prompted authorities to add a new line to the statement, saying that the exchange rate has appreciated and "is in the upper end of the range of recent years".

The focus on the value of the Australian Dollar by the RBA confirms that the rally seen through 2020 and into 2021 is starting to become a concern, with the RBA fearing it could act as a headwind to economic growth and inflation were the trend to continue.

However, declines in the value of the Aussie Dollar since mid-January will likely be welcomed by the RBA. But should the trend of appreciation resume - as many foreign exchange analysts expect - the RBA might become more vocal and start taking policy decisions they believe might dent that appreciation.

{wbamp-hide start} {wbamp-hide end}{wbamp-show start}{wbamp-show end}

"The encouraging global economic outlook, favourable AUD valuation and Australia’s solid balance of payments backdrop relative to the US will continue to support the fundamental AUD/USD uptrend," says Elias Haddad, Senior Currency Strategist at Commonwealth Bank of Australia (CBA).

CBA told clients last week that they are looking to buy the Australian Dollar on any weakness saying they expect commodity prices - iron ore in particular - to continue experiencing strong demand. Australia is the world's premier iron ore exporter, therefore higher prices will likely aid the Aussie Dollar.

"Bottom line," says Haddad, "look to accumulate AUD/USD on weakness closer to 0.7500."

The Australian Dollar-to-U.S. Dollar exchange rate is at 0.7610, the Pound-to-Australian Dollar exchange rate is at 1.7965, the Euro-to-Australian Dollar exchange rate is at 1.5854.