Rampant Australian Dollar Pushes GBP/AUD Down 1.40% Amidst Surging Iron Ore Prices and Brexit Jitters

Image © Adobe Stock

- GBP/AUD spot rate at time of writing: 1.7710

- Bank transfer rate (indicative guide): 1.7090-1.7214

- FX specialist providers (indicative guide): 1.7326-1.7586

- More information on FX specialist rates here

Surging iron ore prices have lit a fire under the Australian Dollar, allowing currency traders to ignore news that Chinese officials are looking to ban or raise tariffs on additional Australian exports.

The Australian Dollar is the best performing major currency at the time of writing as it has advanced against all its G10 peers.

The strength in the Australian Dollar comes as the British Pound drops in anticipation of a 'no deal' Brexit, prompting a sizeable 1.32% dip in the Pound-to-Australian Dollar exchange rate.

"AUD leads the way amongst G10 currencies over the last week, the currency continuing to shrug off trade tensions with China, instead focusing on some strong business and consumer confidence numbers and higher iron ore prices. AUD/USD has broken some important resistance levels this week, including 0.7414 and 0.7450. A pullback earlier to 0.7427 - within that range, before rebounding, speaks to the relevance of that band as support," says Patrick Bennett, analyst with CIBC Capital Markets.

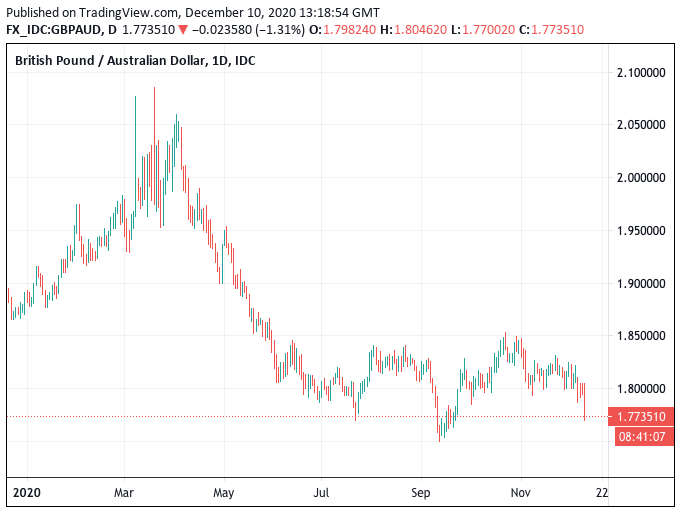

The GBP/AUD exchange rate now looks set to test the bottom of its June-December range at 1.7480, meaning fresh 2020 lows could be printed before the year is out.

Above: GBP/AUD looks to pressure the bottom of its 2020 range

"With the iron ore price on a bull run, AUD is largely ignoring the‘bad’news," says Joseph Capurso, Head of International Economics at CBA.

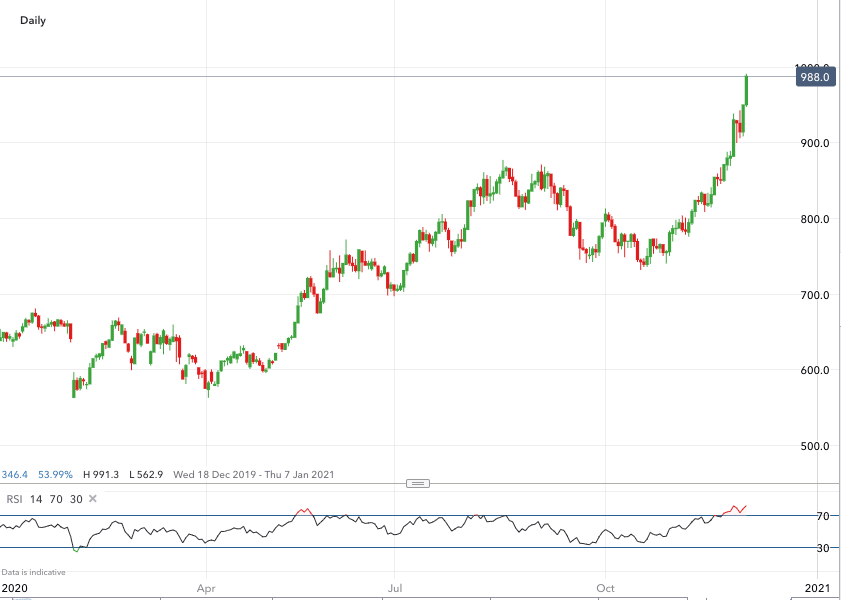

China's most actively traded Iron Ore futures contract, for May delivery, gains 4.5% to jump above 950 yuan per tonne and hit a new high since December 2013.

Iron ore swaps quoted in U.S. Dollars surged to $US146 per ton (futures up to $US150 per ton).

At the start of the month, iron ore swaps were $US125 per ton; at the start of the year they were around $US90 per ton.

Iron is Australia's main export earner meaning that rising prices improve the country's terms of trade and increases the demand for Australian Dollars relative to other currencies.

Above: Iron ore prices quoted on the IG platform.

Further extensions higher in iron ore prices would therefore likely benefit the currency.

The rally in the Aussie and iron ore prices means foreign exchange traders are willing to look through the latest negative developments in relations with China.

According to media reports, the Chinese government may restrict imports of Australian honey, fruit and pharmaceuticals.

{wbamp-hide start} {wbamp-hide end}{wbamp-show start}{wbamp-show end}