Australian Dollar: AUD/USD a Sell says TD Securities

Image © Adobe Images

Advertisement: For the best Aussie Dollar exchange rates for your money transfer, please visit Global Reach.

Foreign exchange strategists at global investment bank TD Securities tell clients at the start of the new week they are not buying into the strong rally in risk assets and look to sell the Australian Dollar as an expression of this view.

Global stock markets are rallying, commodities prices are spiking while emerging market and risk-on currencies such as the Australian Dollar are appreciating in sympathy with a view that the global economy is moving towards a period of recovery.

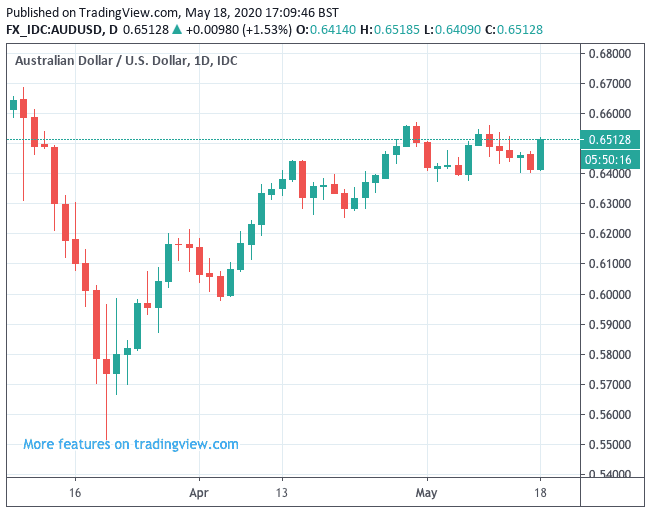

With the S&P 500 up 3.0% and oil prices up 10%, it is little wonder the Aussie Dollar is outperforming its peers, with Australian-to-U.S. Dollar exchange rate seen trading 1.30% higher on the day at 0.6510, while the Pound-to-Australian Dollar exchange rate is 0.34% lower at 1.8743.

The pro-AUD conditions come on a combination of falling covid-19 infection and death rates, while the Chairman of the U.S. Federal Reserve Jerome Powell committed to providing more further support to the U.S. economy if required.

"Powell’s comments about doing more if needed to support the US economy have provided the fuel for yet another rally in equity markets, with the Dow adding 700 points in its first hour of trading. This is just the thing to re-energise the bounce in stock markets, which has been looking rather tired of late. Q1 data such as GDP and earnings is now mostly done and dusted, but things are expected to get worse. And just as central banks moved quickly earlier in the year to support economies as the crisis worsened, so they are beginning to make the kind of noises that suggest even more support is coming," says Chris Beauchamp, Chief Market Analyst at IG.

However, strategists at TD Securities are not yet convinced the bounce in 'risk on' assets is sustainable.

"Our skeptical attitude toward this bounce in risk keeps our focus on the AUD," says Ned Rumpeltin, European Head of FX Strategy at TD Securities. We are already short AUDUSD in our model portfolio, where we are rather defensively positioned overall."

TD Securities say they remain committed sellers of AUD rallies and look to fade any further upward progress back toward a 0.65 handle.

"In line with this, we are also choosing a short AUDUSD trade as our trade of the week," says Rumpeltin. "We may live to regret it, but we simply don’t buy this rebound in risky assets."

Researchers at the Canadian bank say the Aussie Dollar's correlation with global equity markets remains "very, very high" at present.

It is also noted that a number of other major currencies are "having a hard time" against the U.S. Dollar and it is Rumpeltin's belief that the Aussie Dollar will ultimately fall in line with this trend and turn lower.

"Today may not be the day to look for it, but we think a push lower through a near-term double bottom a hair above 0.64 could see additional selling pressure emerge. From there, we’d expect to see a test of 0.6370. The real prize is a bit lower, we think. We think the 0.6260 area could emerge as the key threshold for further downside potential. Otherwise, we think we’d have to see a clear move above recent highs at 0.6570 to revisit our bearish bias," says Rumpletin.