Australian Dollar Softens Ahead of Weekend, but Remains Locked in Short-term Recovery Trend

- AUD follows markets lower

- Sentiment hit by news of Gilead covid-19 trial results

- But short-term trend remains constructive for AUD

Image © Robyn Mac, Adobe Stock

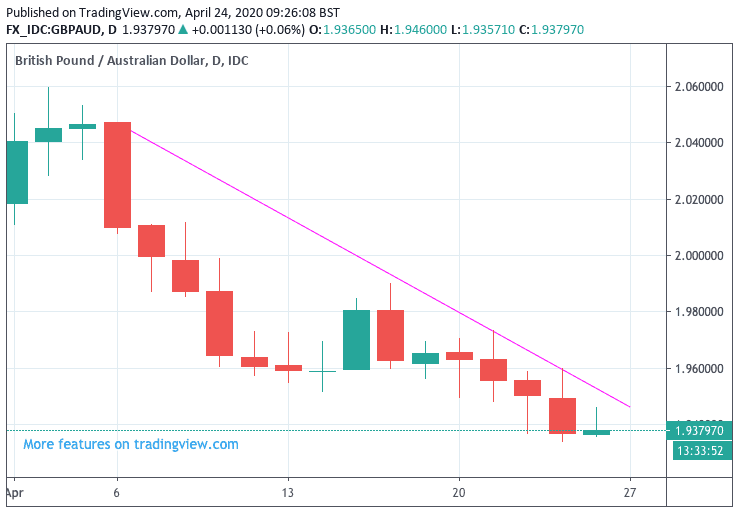

- GBP/AUD spot rate at time of writing: 1.9375

- Bank transfer rates (indicative): 1.8697-1.8833

- FX specialist rates (indicative): 1.8939-1.9200 >> more information

A risk-off end to the week looks set to trim some of this week's advances by the Australian Dollar, with analysts saying disappointing news about what was once a promising covid-19 treatment is one factor behind the more sombre investment environment.

Risk-on / risk-off sentiment amongst the broader investor community remains the key driver of FX, and the soft conditions seen on Friday are feeding into lower Aussie Dollar valuations given the currency's sensitivity to negative risk conditions.

The Australian Dollar lost 0.25% against the U.S. Dollar and 0.10% against the Pound and Euro ahead of the weekend in line with a broader risk-off tone to markets that was reflected in a 1.3% loss in the UK's FTSE 100, a 2.0% loss in Germany's DAX and futures data that suggested Wall Street was headed for a 0.5% decline at the open.

"A risk negative tone has taken hold through major markets as we approach the end of another momentous week. The U.S. pharmaceutical company, Gilead, which had a prospect COVID-19 treatment drug reported that clinical trials had flopped, causing Wall Street to fall back into the close," says Richard Perry, analyst with Hantec Markets.

A potential antiviral drug to treat coronavirus has flopped in its first randomised clinical trial, according to the Financial Times who have been privy to draft documents published accidentally by the World Health Organization.

The Chinese trial showed remdesivir - developed by Gilead Sciences - did not improve patients' condition or reduce the pathogen’s presence in the bloodstream.

Researchers studied 237 patients, giving the drug to 158 and comparing their progress with the remaining 79.

The drug also showed significant side effects in some, which meant 18 patients were taken off it.

The news comes one week after markets rallied on news remdesivir was showing great promise in treading covid-19 symptoms, confirming that there remains no easy medical fix to the crisis and as long as this remains the case we would expect markets rallies to remain subdued and the big recovery to remain elusive.

While the remdesivir news is one trigger of the softer investor sentiment impacting on Australian Dollar values, markets are also said to be disappointed by a lack of progress by the EU on reaching a joined-up approach to financing a rescue package for the Eurozone economy.

"Disappointment has come through the EU leaders being unable to agree on a major recovery package for joint fiscal support. Getting 27 countries to agree and ratify a way forward seems to be a difficult task, especially with continued opposition in some quarters to the prospect of debt mutualisation," says Perry.

While markets are softer at the time of writing we would not necessarily write them off as a more positive tone could be adopted through the course of the day, which could allow the Aussie to maintain its newfound strength.

The Australian Dollar has been appreciating for three weeks now amidst the steadying of market sentiment, and as long as this trend continues we would expect the currency to extend gains.

Above: GBP/AUD has been trending lower this April