Pound-to-Australian Dollar Rate Eyes May 2016 High as RBA Rate Cut Looms

- Written by: James Skinner

- AUD down across board after unemployment spikes in Jan.

- But AUD may have further to fall as market prices RBA cut.

- Data challenges the RBA idea that jobs market is improving.

- Westpac, CBA say April RBA rate cut is likely, AUD losses.

- GBP/AUD rate could hit May 2016 high on AUD weakness.

Image © ArchivesACT, Reproduced under CC Licensing, Editorial, Non-Commercial

- GBP/AUD Spot Rate: 1.9587, up 0.55% today

- Indicative bank rates for transfers: 1.8904-1.9041

- Indicative broker rates for transfers: 1.9296-1.9414 >> find out more about this rate.

Australia's Dollar was down for the week Friday and could fall further up ahead, potentially lifting the Pound-to-Australian Dollar rate to its highest since May 2016, as financial markets price-in an interest rate cut from the Reserve Bank of Australia (RBA) in response to a dire January jobs report.

The Aussie is down against most major rivals including Sterling following a larger-than-anticipated spike in the unemployment rate for January, which has arrested an earlier decline in the Pound-to-Australian Dollar rate and could now put the British currency at its highest since May 2016 in the coming weeks.

Unemployment rose from 5.1% to 5.3% in January when markets were looking for an increase to only 5.2%, even though the economy created more jobs than was anticipated that month. There were 13.5k new jobs created last month, down from 28.7k previously but above the 10.0k consensus.

Thursday’s data completes has put the jobless rate back at levels which had not been seen since August 2018, well before the RBA began to cut its interest rate in 2019 in the hope of stoking further growth in the labour market and broader economy so the bank could one day meet its 2%-to-3% inflation target.

“A rising unemployment rate, given a lift in the participation rate and despite stronger than expected employment growth, is consistent with more monetary policy easing. Our house view is for the next 25bp rate cut in April 2020. Futures markets are pricing a 25% chance of a 25bp rate cut in April,” says Kim Mundy, a strategist at Commonwealth Bank of Australia.

Above: Pound-to-Australian Dollar rate shown at 4-hour intervals.

Mundy and many others say the RBA may now revisit its outlook for the economy and its guidance on interest rates given the bank has consistently briefed markets in recent months that last year’s rate cuts are enough to keep the jobless rate trending lower and to get the economy growing faster. And given the market has only very recently abandoned hefty wagers that suggested another rate cut was imminent, the anticipating pricing-in of fresh stimulus could now weigh on the Australian Dollar.

Investors have recently shifted from expecting at least two rate cuts in the current year to just one but local forecasters like CBA and Westpac still project not only two cuts for 2020, coming in April and August, but they also see risks the RBA resorts to quantitative easing after its cash rate gets near to zero. Pricing in the overnight-index-swap market implied on Thursday, an April 07 cash rate of 0.67%, which is far higher than the 0.50% that would prevail if the bank does cut on that meeting date.

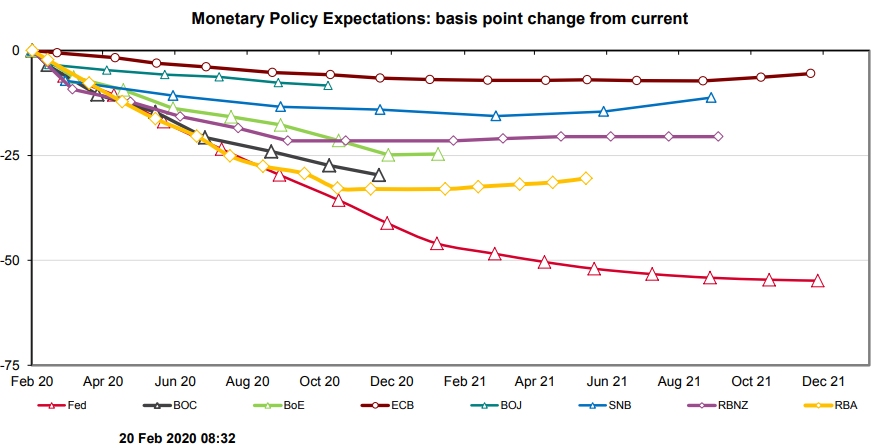

Above: Market expectations for basis point changes in major interest rates. Source: Westpac.

“The bounce in Australia’s unemployment rate in Jan may have mattered less if the RBA hadn’t taken the Q4 fall from 5.3% to 5.1% so literally: Governor Lowe on 5 Feb said the “unemployment data…show things moving in the right direction,” says Sean Callow, a strategist at Westpac. “Pricing for another rate cut remains <50% by May but if the incoming data from across Asia continues to reveal deepening economic damage, the drumbeat for easing should pick up.”

Callow says the AUD/USD rate could fall toward the 0.65 level over the coming days, which would be the lowest level for the exchange rate since March 2009. The Aussie already fell to a fresh decade low of 0.6629 Thursday but if it was to hit 0.65 at the same time as the Pound remained around 1.29 against the U.S. Dollar then price action would put the Pound-to-Australian Dollar rate at 1.9846.

Above: Pound-to-Australian Dollar rate shown at weekly intervals. Snapshot taken on Thursday.

The Pound-to-Australian Dollar rate has recently reversed its post-referendum loss but the 1.9846 threshold has not been seen since May 2016.

“The ABS saying that bushfires did not have “a notable impact on key headline statistics” – adds to the case for AUD/USD rallies to be very fragile. With 78% of Australia’s exports headed for Asia, we need to be braced for further news of disruptions to manufacturing supply chains and extended weakness in education, tourism and business travel,” Callow says. “Central bankers with an eye on where their economies might be in 1 to 2 years’ time can be forgiven for remaining cautious on the COVID-19 impact at this stage. But markets will continue to price in a greater risk of looser monetary policy.”

Above: AUD/USD rate shown at monthly intervals. Snapshot taken on Thursday.