Australian Dollar Draws Buyers Even as Jobs Market Creaks

- Written by: James Skinner

Image © Adobe Stock

- Retail sales disappoint and job vacancies fall in May.

- A slowdown in Aussie jobs growth is imminent says ANZ.

- Creaking jobs market may force RBA into further action.

- Rise in unemployment could undermine AUD's recovery.

- But analysts increasingly bullish, two banks say buy AUD.

The Australian Dollar was softer Thursday as its earlier rally appeared to run out of steam although the Antipodean currency's fledgling recovery could risk being further undermined in the weeks and months ahead now the labour market is showing more signs of strain.

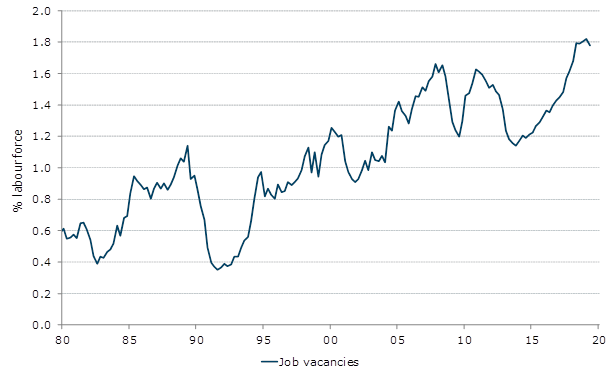

Job vacancies fell by 1.1% in seasonally adjusted terms during the quarter to the end of May, the Australian Bureau of Statistics reported Thursday, which means advertisements rose by only 1.8% during the 12 months to the end of May. Economists are concerned about what the data means for the outlook.

"This was the first decline in three years, bringing annual growth down to 1.8% from 9.9% in the previous quarter," says Catherine Birch at Australia & New Zealand Banking Group (ANZ). "Although vacancies had held up against falling ANZ job ads for some time, this decline in vacancies, along with other leading labour market indicators, suggests an imminent slowdown in employment growth."

Retail sales growth of 0.1% for May also disappointed a market that was looking for a 0.3% increase, in what was another blow to the outlook. Analysts and policymakers have long feared that consumer spending growth will suffer in the absence of meaningful wage growth for Australians and amid an ongoing downturn in house prices.

Above: ANZ graph showing trend in Australian jobs vacancies.

The figures are just the latest evidence that Australia's jobs miracle, which saw the unemployment rate fall from nearly 6% at the beginning of 2017 to 4.9% earlier this year, is now coming to an end. The unemployment rate has already risen by 30 basis points to 5.2% since February 2019.

Thursday's data is unlikely to be welcomed by the Reserve Bank of Australia (RBA), which is watching jobs market developments closely because it needs a much lower unemployment rate in order to get the wage growth it says will be necessary for inflation to rise back to within the 2%-to-3% target band.

It's an absence of sufficient inflation and wage pressures that explain why the RBA cut its interest rate to a fresh record low twice in just as many months, leaving the cash rate at 1% after this week's meeting. Speculation about those rate cuts that helped drive the Aussie into the ground in 2018 and early 2019.

"The recent rise in the unemployment rate has come despite an acceleration in employment growth, so weaker jobs growth is a concern. The labour market data for June will be released in a fortnight and will be too early to reflect the RBA’s rate cuts," Birch says.

Above: Pound-to-Australian-Dollar rate at daily intervals. Shows strengthening AUD and weaker GBP.

Australia's Dollar has now been the best performing G10 currency for two consecutive sessions despite an interest rate cut that could typically be expected to drive the Aussie lower. In a sign of how well accustomed markets now are to the idea that Aussie interest rates are only going in one direction, the Antipodean currency actually rose after the RBA cut its interest rate this week.

Analysts have said this week's Aussie strength is due to global factors and because markets already expected the rate cut. Financial markets are also anticipating one more cut from the RBA this year, which could explain the limited fallout for the Aussie from Thursday's dire economic data, although this wouldn't necessarily shield the currency from renewed losses if it begins to look as if the creaking jobs market requires even more stimulus.

However, and for now, analysts are taking the view that the Australian Dollar has already overpaid for policy changes that have not yet been fully delivered. Some are even suggesting that clients bet on an increase in Australian exchange rates over the coming months, with both Societe Generale and Commerzbank being just the latest to do so on Thursday.

"The RBA cut rates to 1% in June as widely expected, but the statement was somewhat less dovish. Further cuts will now be implemented only “if needed”. The market therefore sees about an 80% probability of no rate change at the next meeting," says Oliver Korber at Societe Generale. "Since the start of 2018, the AUD/USD fell with 10y relative yields, which have probably bottomed out."

Above: AUD/USD at daily intervals, alongside AU-U.S. 10-year bond yield spread (black line, left axis).

Societe Generale's Korber recommended clients buy the Australian Dollar at .7020 Thursday and target a move up to 0.73 over the coming weeks and months, although he also said the trade idea would be best cancelled if the market fall below 0.6950 before hitting his target. Technical analysts at Commerzbank have advocated a similar idea.

"AUD/USD is seeing a strong rebound from the 38.2% retracement at .6958 and is currently eroding the top of the cloud at .7035 and heading to the April peak at .7069. Above .7069, resistance can be spotted at the .7207 February high. A rise above the .7207 late February high would target the December 2018 high at .7394," says Karen Jones, head of technical analysis at Commerzbank.

Jones is betting on a rise in the AUD/USD rate after buying the Aussie at 0.6998 Wednesday. She's targeting a more conservative move up to 0.72 and has told clients to walk away from the trade if the market touches 0.6955, which is similar to the 'stop-loss' set by Societe Generale's Korber.

"Below .6958 targets .6935, the 50% retracement and the .6910/61.8% retracement. Where are we wrong? Below .6832 will target the .6738 January 2019 low and .6725, the 2016-2019 support line (connects the lows)," she writes, in a note to clients.

Above: Commerzbank chart showing technical indicators.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement