The Pound-to-Australian-Dollar Rate in the Week Ahead: Bullish Short-term Outlook

Image © Desiree Caplas, Adobe Stock

- GBP/AUD within trend channel, short-term outlook bullish

- But loudspeaker patterns signal possible obstacles ahead

- GBP eyes Brexit as AUD looks to U.S.-China trade talks

The Pound-to-Australian-Dollar rate is set to beging trading around 1.8648 Sunday after falling more than one percent in the previous week, although studies of the charts suggest the outlook for the days ahead is a bullish one.

The GBP/AUD pair fell at the start of last week after it the government requested from Brussels only a very short delay to the Brexit process. It recovered later, however, after the EU left the door open to a much longer extension of the Article 50 negotiating window, and potentially an indefinite one if Prime Minister Theresa May fails again to get the EU Withdrawal Agreement through parliament.

Pundits are still suggesting she will struggle to win enough votes for her deal to be approved next week so there is at least one fundamental reason for why the Pound could rise during the week ahead as a third failure of the Withdrawal Bill to clear parliament might see the market fixate on the odds of Brexit being abandoned by the government or prevented through a second referendum.

Speculation over the future of Prime Minister Theresa May and government in the UK will also be an important driver of the Pound in the week ahead.

Above: Pound-to-Australian-Dollar rate shown at weekly intervals.

The technical outlook remains mixe given that charts suggest gains are likely in the short-term, but that the longer-term outlook is a challenging one. The pair is in an established short-term uptrend but is vulnerable to weakness due to the evolution of a ‘broadening formation’ or ‘loudspeaker’ patterns, which is a bearish indicator.

These patterns are usually composed of 5 waves, labeled A-E. So far only 4 waves have formed, suggesting a wave E down could be next to unfold. This move is far from confirmed since the pair remains in an intact uptrending channel and also formed a bullish hammer candlestick last week, which is evidence of a bullish short-term bias.

Above: Pound-to-Australian-Dollar rate shown at daily intervals.

The intact rising channel has further to run, likely up to the upper boundary line of the broadening formation at 1.8850. However, at that level, the market would be vulnerable to declines and the start of a long move lower.

A break below the 1.8200 level would amount to confirmation of a new bear trend evolving, with a downside target around 1.74 threshold. A long-term trendline provides major support at about 1.7200 but if this is broken, losses could easily accelerate.

Above: Pound-to-Australian-Dollar rate trend.

AA

The Australian Dollar: What to Watch

The main event for the Australian Dollar in the week ahead is likely to be geopolitical in nature since the domestic data releases in the calendar are fairly low key.

U.S.-China trade talks are scheduled to kick off again on Thursday, 28 March. Any positive opening statements may support the Chinese Renmimbi and Australian Dollar although markets could soon begin to grow impatient with a lack of detail on the final shape of the trade deal.

President Donald Trump has tweeted that tariffs on Chinese imports will remain even after a deal is done, which is likely to cost the Chinese economy and could complicate the process of reaching a durable agreement.

Markets are hoping a deal will be done in the next few weeks so that Trump and President Xi Jingping can sign it off when they meet at the end of April. This outcome is already priced-in to financial markets so the risks for the Aussie, which is strongly correlated with the Renmimbi, are all one way. This means the Aussie might not have a lot left to gain from a deal being done, but that it could easily lose out if the talks start to fall apart.

“We still see a very high likelihood that a deal will be closed within the next three months, despite the rising hurdles at the end of the trade talks. Trump needs a deal to set the stage for his election campaign, where he will be able to present significant gifts to key voters in the agricultural heartland as well as strong support to stock markets and the economy,” says Allen Von Mehren, chief analyst at Danske Bank.

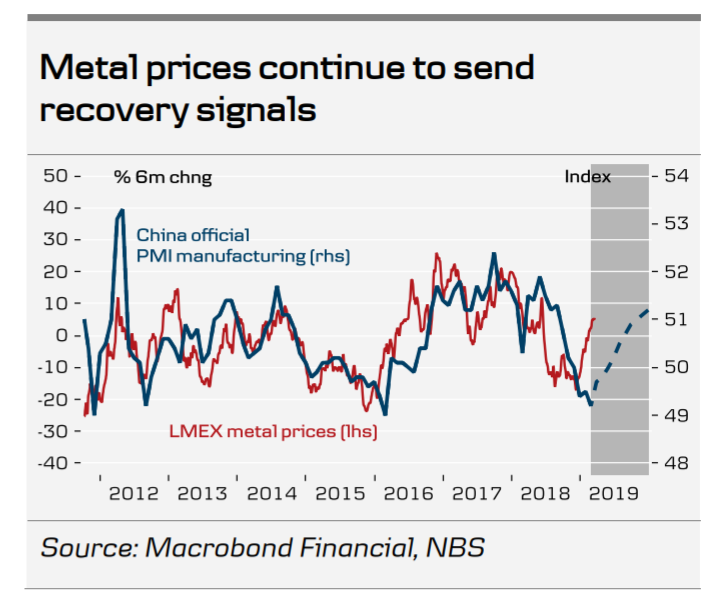

Equally as important for the Aussie are signs the Chinese economic downturn may be bottoming out. Danske notes that rising metal prices suggest a rebound in the domestic economy. Australia is a major exporter of iron ore to China so rising prices are positive for the Australian economy too.

Speeches from Reserve Bank of Australia (RBA) board members Ellis and Kent will also be scrutinised closely given the bank's current neutral interest rate stance and much speculation over the direction of policy through the rest of the year.

RBA assistant governor Luci Ellis will speak on Monday at 20:30 London time and Christopher Kent will speak at 23:00 on Wednesday.

Above: Source: Dankse Bank.

AA

The Pound: What to Watch

The main event for the Pound in the week ahead will be the third parliamentary vote on the government’s EU Withdrawal Agreement, although an exact date is yet to be set.

If Parliamentarians support the bill the UK will leave the EU on May 22 under the Withdrawal Agreement. But if MPs reject it then there the government has said it will offer a series of "indicative votes" to MPs, giving Parliament an opportunity to express its desired course.

At that point there will still be a risk that the UK leaves the EU without a deal and the key date in focus will be April 12, although this could change the moment the EU agrees to a further extension, if and when it does.

If Parliament was succesful in foisting another referendum or a general on the electorate, another much longer extension is sure to be required, alongside participation in the EU parliamentary elections.

However, and alternatively, if Parliament was to back the idea of a customs union with the EU or some other model of post-Brexit relationship it's possible that no further extension would be required as the details of such a relationship would be thrashed out in the second stage of the negotiations.

But the government must notify the EU of the path it intends to take before April 12.

“Leaving on April 12 without a deal is now the default path, and while that will most probably be avoided at the end, the mere fact this massive risk still lurks in the background is likely enough to keep sterling under pressure for now,” says XM's Hadjikyriacos.

On the data front, the next key release for the Pound is the final estimate for final quarter GDP growth, due out at 09:30 on Friday. Consensus is for growth to be confirmed at 0.2% for the final quarter and 1.4% for 2018 as a whole.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement