Pound-to-Australian Dollar Rate 5-Day Forecast: Golden Cross and Rising Channel Suggestive Further Gains, Trump's China Tariff Tweet sends AUD Higher

Image © Robyn Mac, Adobe Stock

- GBP/AUD still moving higher in rising channel

- Rare golden cross a further bullish signal

- Sterling to be impacted by key Brexit votes; Aussie Dollar by multiple factors

The Australian Dollar got the week off to a decent start after U.S. President Trump tweeted that he will be delaying additional China tariffs originally scheduled to start on March 01, and that if everything goes well in China trade talks, there will be "very big news over the next week or two" and reports of “one of the strongest agreements ever on currency".

"Predictably, it was risk on in response to this news - the commodity currencies outperformed," says Sue Trinh, a foreign exchange strategist with RBC Capital Markets.

The Australian Dollar rallied against the Pound and the U.S. Dollar in response to Trump's tweet, but the gains appear to be limited with the Australian Dollar giving back some of its earlier gains ahead of the London trading session.

"While the news is positive, it is priced in," says John Noonan, an analyst on the Thomson Reuters currency desk, pointing out this outcome was read by markets before it happened. "Risk assets rallied on Friday when it became clear the U.S. and China were moving closer to a trade deal that would be agreed when Trump meets China's President Xi in late March. It was obvious too that March 1 was no longer a deadline and the U.S. wouldn't raise tariffs on Chinese imports before that meeting."

It will take 'new' news on the matter to materially shift the dial on the Australian Dollar. "Nothing has been confirmed and we think it will be impossible for China to conform to US demands on substantive core issues. But that’s for another day. Risk pared gains on Xinhua commentary that the final stages of talks could herald new uncertainties," says RBC Capital's Trinh.

Turning to GBP/AUD, Pound Sterling is poised for further gains against the Australian Dollar on a technical basis we believe, but geopolitical risks could impact the Aussie while a set of key votes on Brexit could induce volatility in Sterling.

The Pound-to-Australian Dollar exchange rate is trading at 1.8278 on Monday, after falling 1.45% in the previous week. Sterling rose on expectations Theresa May might have a better chance of getting any future deal she brokers through Parliament, and on rumours of a three month extension to the Brexit March 29 deadline, thus avoiding the possibility of a cliff-edge, no-deal outcome.

While the Pound rose, the Australian Dollar fell after the news China banned Australian coal imports in a suspected tit-for-tat for Australia’s Huawei ban.

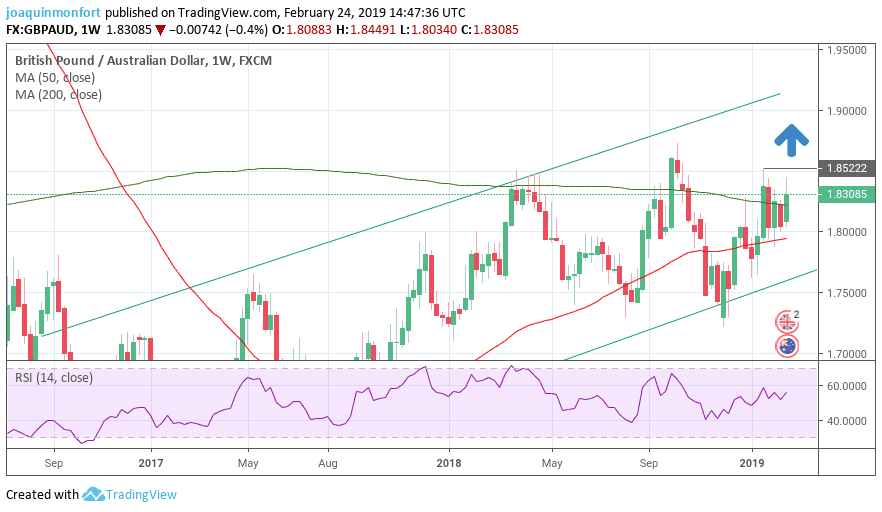

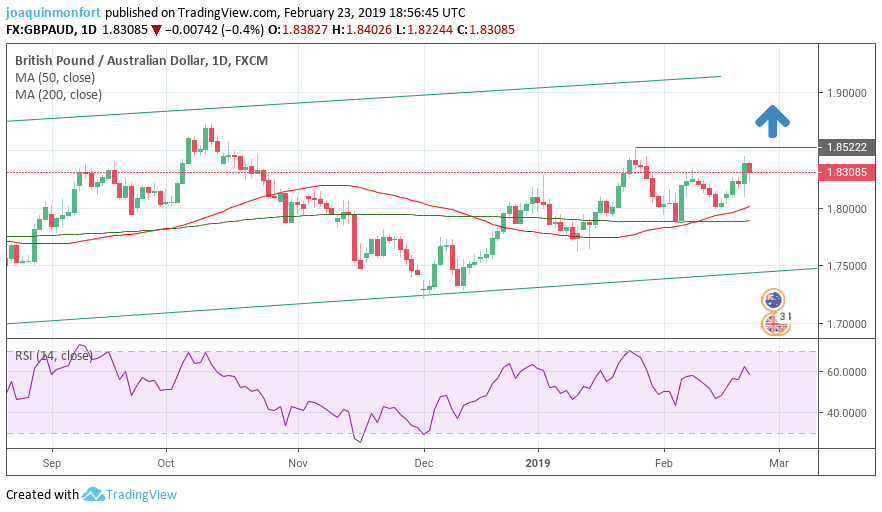

From a technical point-of-view, the outlook for the pair is still bullish; GBP/AUD continues trading higher within a rising channel and if it can break above the 1.8522 highs it will confirm a continuation higher to the next target at 1.8725, as we stipulated in our last week ahead analysis.

The pair has recently fallen to and bounced from a key level at a trendline drawn from the December lows and the level of the 50 and 200-day moving averages (MA). The three levels combined provided a tough support level for the pair and became the base from which the pair launched a recovery higher.

Added to this is the fact that the 50-day moving average (MA) has just broken above the 200-day MA in what analysts call a 'golden cross’ - a rare bullish configuration which augurs substantial upside for the pair. The golden cross is further enhanced by the shallow nature of the crossover which tends to further increase the probabilities of the signal. More ‘right-angled’ crossovers tend to be less reliable.

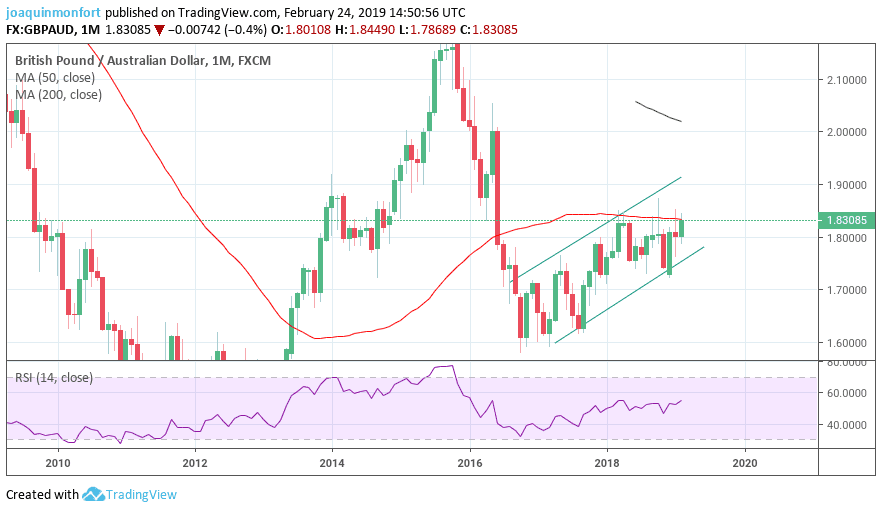

The outlook is less clear-cut on the longer-term weekly and monthly charts. Here the large moving averages are pinning the exchange rate down - the 200-week and 50-month MA - and it is unclear whether these have been broken cleanly or remain a depressing factor; the latter case more likely true.

The 50-month MA is capping gains on the monthly chart at 1.8329 and has repeatedly rejected attempts by the exchange rate to break above it, and whilst these repeated attempts at breaking higher can presage an eventual successful break, they are on balance a bearish indicator.

Yet despite the ambiguity of the longer-term charts the daily chart and the compelling golden cross suggests an overall bullish tenor to charts, with confirmation supplied by a break above the 1.8522 highs, opening the way to a continuation of the rising channel higher to the next target at 1.8725.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement

The Australian Dollar: What to Watch in the Week Ahead

The Australian Dollar fell sharply at the end of last week on news coal from Australia had been banned from 5 Chinese ports, confirming geopolitics are a major source of risk for the currency at the present time, and we will remain wary of headlines on the matter over coming days. There were reports out ahead of the weekend that Chinese ports had in fact not banned coal imports from Australia, and if this view gains traction the Aussie could knee-jerk back higher. We will be watching for further developments in order to clarity into the matter.

We are also wary of headlines concerning U.S.-Chinese trade talks, noting they have been on balance positive of late and have therefore been supportive of the Australian Dollar, but with a deal still some way off we would not be surprised to see further negative headlines emerge as either side tries to put pressure on those sitting on the other side of the negotiating table.

"We have disliked the AUD for a while, as we expect China spill-overs to continue for longer than most people anticipate. The recent negative developments in the mutual relationship between Australia and China have only worked to strengthen that negative tilt on Australia in general," says Andreas Steno Larsen, a foreign exchange strategist with Nordea Markets

Recent domestic data has been mixed with a positive employment report overshadowed by weak housing data and concerns about a slowdown in consumer spending.

“Despite the encouraging employment news the RBA remains firmly on hold for now. Earlier this month the central bank moved to a neutral outlook, with Governor Lowe saying that the probability of the next interest rate move being up or down was more evenly balanced, a view he reiterated at Parliamentary testimony this week,” says Wells Fargo in its weekly review.

The pressure is unlikely to let up in the week ahead when data watchers will have the opportunity to model growth using key data including construction work done for the fourth quarter on Wednesday (1.30 GMT), Thursday’s Q4 capital expenditure figures (also at 1.30), private sector credit numbers for January (also at 1.30 on Thursday) and AIG manufacturing index for February, at 22.30 on Thursday.

“Construction constitutes a sizeable portion of Australian GDP so the data will be a guide for Q4 growth figures due in the following week. Another clue will come from Thursday’s Q4 capital expenditure figures,” says Raffi Boyadjian, a currency analyst at broker XM.com.

“After hitting a bump this week, the Australian Dollar could be sailing through more choppy waters in the coming days as some important data releases will be looked at for signs the Australian economy could be entering troubled times,” adds the analyst.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement