Is Pound Sterling's Rally Against the US Dollar at an End?

The Pound to US Dollar peaked at highs of 1.3280 on Thursday, before reversing and falling steeply to a low of 1.3113, following the Bank of England (BOE) rate meeting and the publication of its quarterly inflation report.

After Thursday’s sell-off, traders are asking themselves a familiar question: has the trend changed and are we, therefore, at the start of a more lengthy decline, or is the up-trend still intact and is this just a temporary correction?

The reasons why Sterling collapsed on Thursday are important because a change in the primary trend is usually only brought about by a significant change in fundamental outlook.

It is no coincidence that Thursday was the day of the (BOE) Bank of England rate meeting as the reasons for the currency’s weakness were very much related to that event.

For a start, the voting changed as more members wanted to leave interest rates unchanged (6 versus 2) than had been the case in June when the voting was more balanced at 5-3.

Since higher interest rates tend to strengthen currencies as they attract more capital inflows from investors seeking higher returns – keeping them low has the opposite effect.

Although the change was somewhat expected as it was mainly due to BOE member Kirtsen Forbes’s leaving, who is a vocal supporter of increasing interest rates, it was still a factor, as no-one knew how her replacement would vote.

The Pound also weakened after the BOE downgraded growth forecasts and Governor Carney highlighted the problem of falling inbound investment due to Brexit uncertainty.

However, Carney did then go on to send mixed signals in the press-conference following the meeting, when he said that the market expectations of interest rates remaining lower for longer might be wrong, implying the Bank might decide to raise interest rates earlier-than-expected after all.

These mixed messages suggest a cloud of confusion about when rates will rise if ever – but they don’t completely discount the possibility.

The lack of a significant change in the fundamental landscape suggests that reasons underpinning the pull-back in Sterling are not significant enough to cause a reversal in trend at this stage, and the sell-off could just be a correction.

Another feature of Sterling’s current complex valuation is the implications of Brexit - currently unknown.

The fact that there are still fundamental analysts who are bullish the Pound also points to the possibility the pair may be just correcting, for example, Oxford Economics are maintaining their bullish forecast for GBP/USD due to expectations that Brexit will be softer than currently expected:

“Sterling’s fortunes continued to be closely tied to the prospects for Brexit. Our central forecast is for a transition arrangement to cushion the impact of the UK leaving both the single market and the EU customs union. To the extent the current Brexit negotiations are able to make good progress in this direction in the next six months, we expect sterling to recover to $1.35 by year end and then to $1.38 by end 2018,” say Oxford Economics in a briefing to clients.

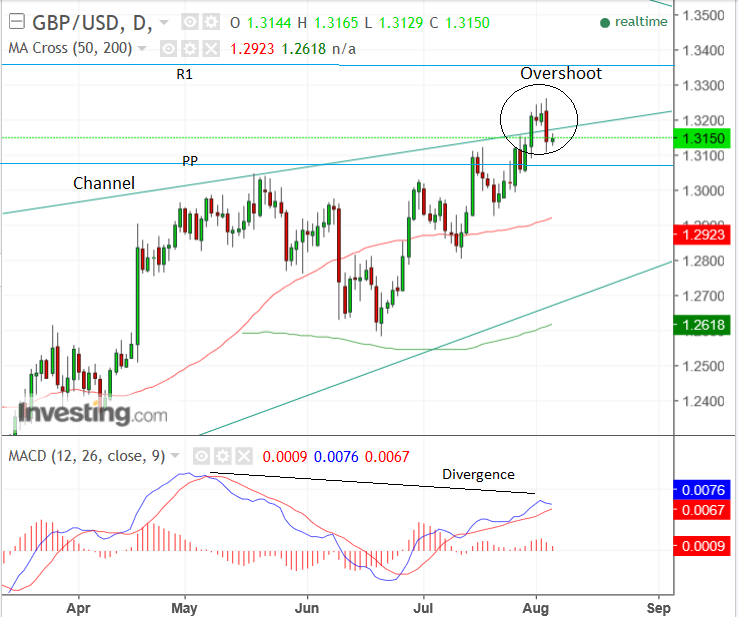

Technical Studies: Key Reversal Seen

From a technical perspective we note how there are arguments for and against Sterling weakness.

Lloyds are ambivalent as yet, seeing the possibility of further downside but cautious due to the current climate of Dollar weakness:

“We are now testing an important support region between 1.3110-1.3065. In a positive USD environment we can see cable slide through this support and suggest a deeper test towards 1.3000, if not back towards 1.28-1.26 support. Otherwise, in the current USD bear environment we expect to see GBP/USD get dragged around within its current range,” says Lloyds Bank’s Robin Wilkins.

Commerzbank’s Karen Jones gets off the fence, however, and is more bearish, saying that the pair formed a “key reversal” day which is a strong bearish signal in markets.

He pair also showed a Thomas Demark Indicator 13 count which is a sign of exhaustion if the uptrend, and touched the 50% Fibonacci retracement level.

“GBP/USD has reversed from the 50% retracement at 1.3255 as the 13 counts on the daily and intraday charts warned. With such a strong rejection from the Fibo resistance seen, it has left attention on the 1.3063/1.3049 band of support (uptrend, May high and 20 day ma). Failure here would imply losses to the support circa 1.2775/50 (December 2016 high).

Our own analysis suggests the possibility of a reversal but that it is too early to be confident that this is the case.

The most telling feature is the overshoot of the upper channel line of the pair’s bullish channel.

Overshoots such as this, tend to forewarn of deep declines of the reversal kind.

This, combined with the key reversal day reinforces the possibility a reversal may be about to occur, however, the pair really needs to break below 1.3000 psychological level for us to expect deeper declines, and a move below the 1.2930 higher low for confirmation.

The divergence between MACD, which measures momentum, and the exchange rate is proof of underlying weakness, although it doesn't indicate whether the weakness will lead to a reversal or not.