"Dinosaur" Comeback & Weaker Pound Drives FTSE 100 to Record

- Written by: Gary Howes

Image © Adobe Images

The fall in the value of the Pound in early 2025 lowers the valuation of UK-listed stocks. International investors are buying as a result.

It's bad news for Brits looking to buy foreign investments, but the weakening of the Pound has stoked global investor demand for UK assets.

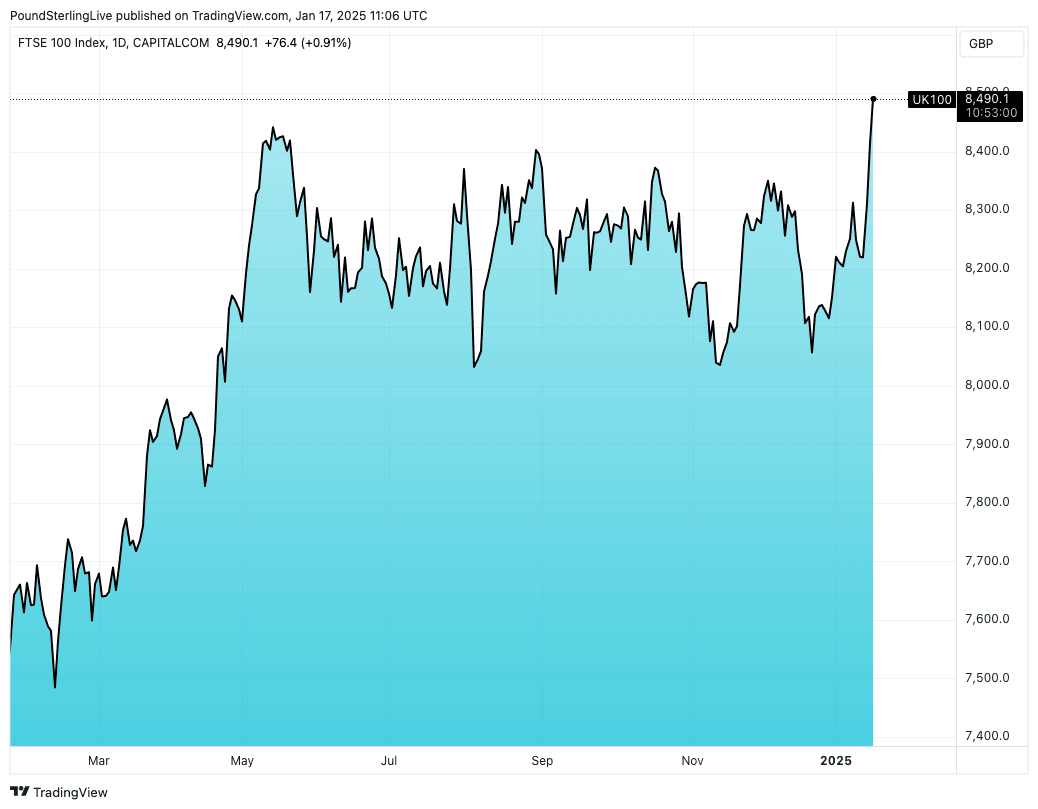

The FTSE 100 powered to 8462 on Friday, which is an all-time record for the UK's flagship index, which is outperforming its North American and European peers.

The Pound-Dollar exchange rate has fallen 4% in 2025, mechanically raising the discount of UK-based assets. GBP/USD has been falling since October 2024, but the decline of 2024 was a function of USD strength, whereas now we are seeing some genuine GBP weakness driving the move.

The latest pulse higher in the stock market has other drivers behind it: a strong GDP report out of China is helping on the day, which is driving demand for the FTSE's mining and commodity names.

"All sectors are higher on the FTSE 100 today, but the leader of the rally is the materials sector, and the top individual stock performers include oil companies and Glencore," says Kathleen Brooks, research director at XTB.

Brooks refers to the oil majors as "dinosaurs," which helps explain why they have been out of favour with global investors who have been captured by the excitement of the U.S. technology and AI boom.

"The energy sector globally, is leading stock markets higher. The US energy sector is the top performer on the S&P 500 so far this year, followed by metals and utilities. Tech is a laggard as we move through January. This is good news for the FTSE 100, as the dinosaur stocks make a comeback," says Brooks.

Metal prices are tracking higher too, helping the FTSE's big miners.

"Copper has climbed over 5% ytd, after sinking to eight-month lows in December," says John Meyer, analyst at SP Angel. "Reports that China’s 2024 GDP grew at its fastest pace in six quarters boosted sentiment. Retail sales and industrial production data from China also supported sentiment."

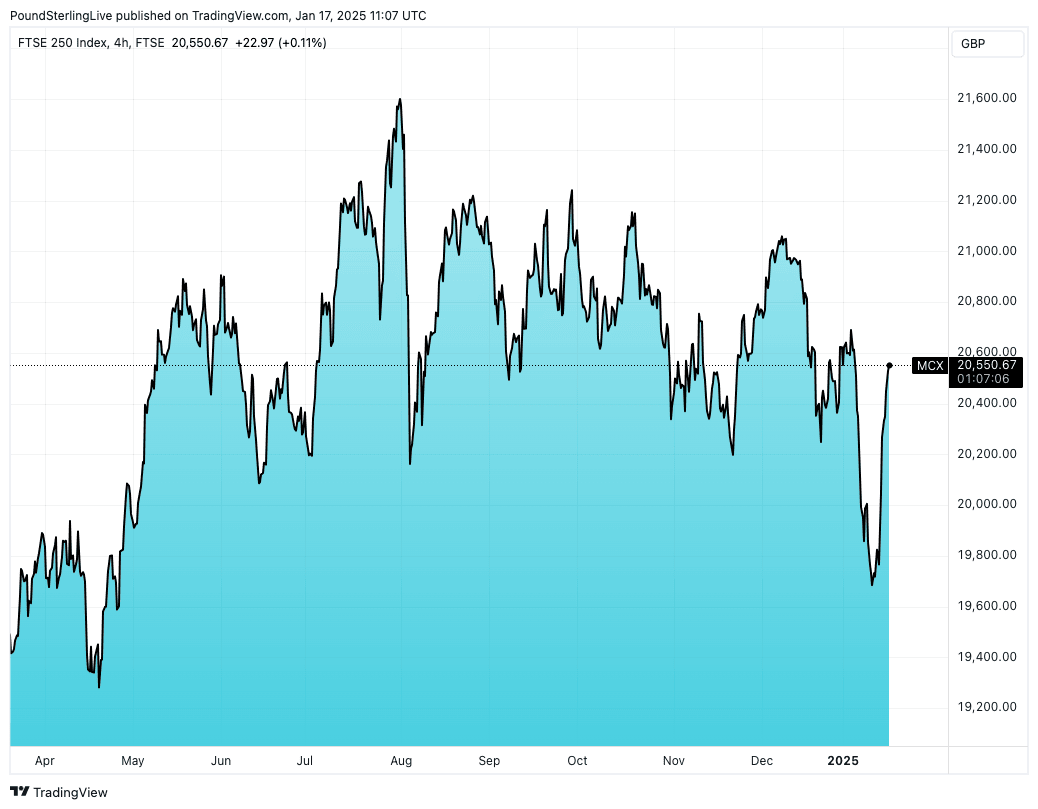

FTSE 250 Boosted by Rate Cut Bets

The falling pound and rising stocks come amid rising bets for the number of Bank of England interest rate cuts due over the course of 2025 following a slew of poor economic data prints.

Markets now see between three and four cuts, which points to the prospect of better conditions for UK companies and consumers.

Lower rates meanwhile spell a more prolonged period of underperformance of the Pound, potentially enticing more value hunters into buying UK stocks than was the case in 2024.

The domestic-orientated FTSE 250 offers a better reflection of changing interest rate views. It fell alongside the pound and UK bonds last week amidst nervousness over the trajectory of the UK economy but has since recovered from those jitters, albeit well below last year's highs.

The more attractive outlook for interest rates has helped stir demand for stocks that make up the FTSE 250.

Brooks says the FTSE 250 is having "a stunning week".

"The index is on track to rise more than 4%, as rate cut hopes spur a major recovery rally in UK mid cap stocks. The market is now predicting a 91% chance of a rate cut from the BOE next month, there was only a 73% chance at the start of the week. The interest rate futures market is also on the way to pricing in nearly 3 rate cuts from the BOE this year, earlier this week there had been less than two cuts priced in. As we mentioned, the market appears to be moving closer to the BOE’s expectation of four rate cuts in 2025," she explains.