Sell the Yen into Next Week's Bank of Japan Decision: CIBC

- Written by: Sam Coventry

Image © Adobe Images

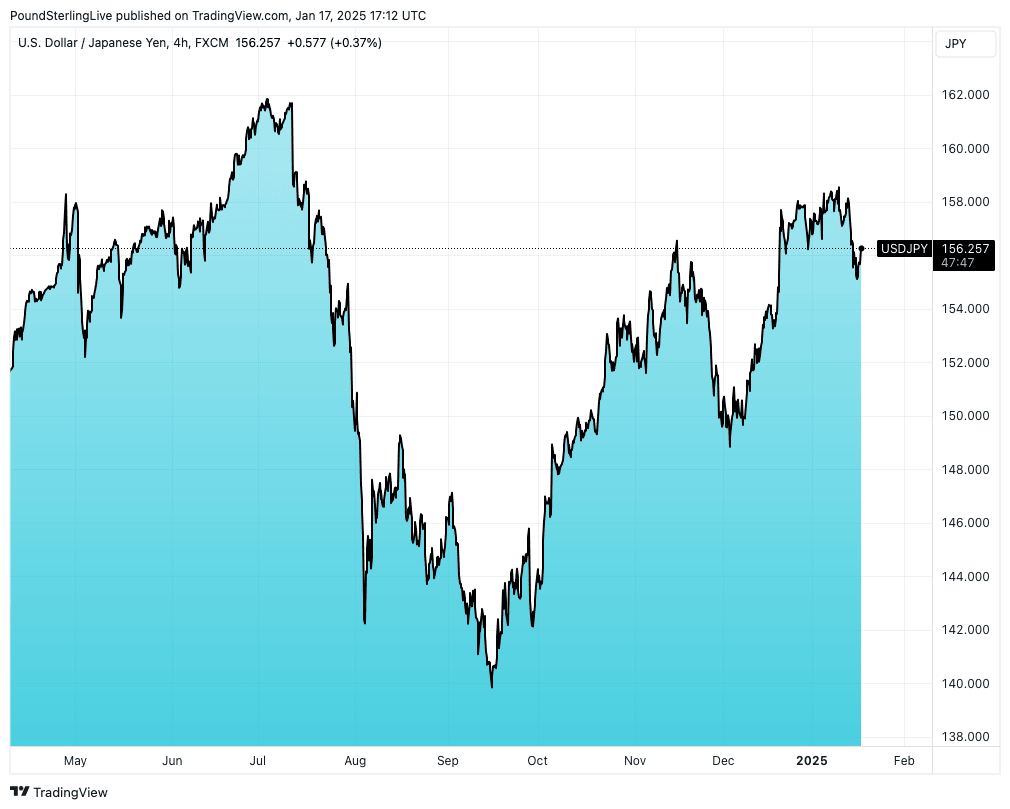

As the Bank of Japan (BoJ) prepares for its pivotal monetary policy meeting next week, the Japanese yen finds itself at a critical juncture. While the currency has recently gained strength, analysts at CIBC argue that this momentum presents a tactical opportunity to sell the yen.

With market expectations for a 25 basis point rate hike largely priced in, a dovish tone from BoJ Governor Kazuo Ueda could lead to a reversal, setting the stage for a rebound in USD/JPY.

The question for traders is not just whether the BoJ will act, but how the market will respond to what is likely to be a nuanced policy message.

The Japanese yen recorded its strongest weekly performance in over a month, appreciating 1.5% against the U.S. dollar, fueled by mounting expectations of a BoJ rate hike next week. Recent data highlighting persistent inflation and robust wage growth in Japan have bolstered speculation of a 25 basis point increase, with market participants assigning an 80% probability to such a move.

Despite this momentum, CIBC's FICC Strategy advises a tactical long USD/JPY trade, projecting the yen's strength to be short-lived.

Key Rationale

A "Buy-the-Rumor, Sell-the-Fact" Opportunity:

Although market expectations heavily favour a BoJ hike, analysts at CIBC anticipate dovish commentary from Governor Kazuo Ueda, which could temper enthusiasm for additional rate increases. This dynamic mirrors the market’s reaction following the BoJ's March 2024 hike, where USD/JPY climbed after a similarly dovish tone.

Temporary Yen Strength:

While the yen briefly strengthened to a one-month high of 155.10 against the dollar, it has since slightly weakened to 155.40. CIBC predicts this strength will wane, particularly if the BoJ signals a cautious approach to further tightening.

Fed-BoJ Divergence Narrows:

In the U.S., core inflation data has weakened, prompting speculation of potential Federal Reserve rate cuts. However, robust retail sales indicate strong consumer demand, reducing the likelihood of aggressive cuts. This limits the policy divergence between the Fed and the BoJ, undermining the yen's recent gains.

Attractive Carry Trade Environment:

USD/JPY longs benefit from a 4.1% annualized carry for a three-month holding period, making short positions costly in the current environment.

CIBC notes that yen shorts are unlikely to sustain prolonged pressure.

Reduced Risk Sensitivity:

USD/JPY's sensitivity to equity market sell-offs has diminished post-pandemic, reducing its vulnerability to risk-off events. Unless a significant equity correction occurs, the pair is expected to remain resilient.

CIBC strategists target 159.50.