Pound / Dollar Presses a Breakout above 1.36

- Written by: Gary Howes

Image © Adobe Images

February's period of consolidation in the Pound to Dollar exchange rate could be coming to an end as Sterling presses higher.

The exchange rate moved above 1.36 in the wake of Dollar weakness that followed the release of the minutes to the Fed's January meeting, with investors seeing little new hawkish developments.

"The Fed minutes showed that higher inflation warrants a rate hike in March and even a faster pace of rate hikes. But this did not tip the balance towards a 50 bp rate hike in March," says Georgette Boele, Senior FX Strategist at ABN AMRO.

"Uncertainty as to whether the Federal Reserve will kick off its interest rate tightening cycle conservatively or aggressively looks set to keep the U.S. dollar volatile into the FOMC meeting next month," says Robert Howard, a Reuters market analyst.

"The greater the perceived probability of an aggressive 50 basis point hike from the Fed in March, the better for the USD (and vice versa)," he adds. There is currently a 41% chance of a half-percentage point Fed hike on March 16, according to the latest Refinitiv measure based on interest rate futures, down from 65% earlier this week.

- GBP/USD reference rates at publication:

Spot: 1.3550 - High street bank rates (indicative band): 1.3180-1.3283

- Payment specialist rates (indicative band): 1.3440-1.3495

- Find out about specialist rates and service, here

- Set up an exchange rate alert, here

It was the release of the Fed's December minutes in January that sparked a rally in the U.S. currency as investors priced in a rapid series of interest rate rises for 2022.

The Dollar has been bid since mid-2021 as investors moved to price in interest rate hikes at the Fed in 2022, with the pace of this move accelerating alongside a series of inflation data surprises.

But for the Dollar this narrative might have limits as too many rate hikes too soon could ultimately tip the U.S. economy into recession in the future.

"Market expectations about Fed rate hikes this year are very high. Currently a total of 150 basis points of rate hikes is reflected in the US dollar. So, it will be difficult for the Fed to be more aggressive than what the market is now pricing in," says Boele. "This could dampen the upside of the dollar."

History shows the run up to Fed hiking cycles tends to be supportive of the Dollar, but once the cycle starts the Dollar can struggle.

This reaction function comes "on the back of market fears about the growth-negative impact of Fed tightening," says Valentin Marinov, Head of FX Research at Crédit Agricole.

But this fear for future growth might already be playing out for the Dollar, even before the Fed has hiked.

"Such fears are rampant at present and seem to hinder further USD gains," says Marinov.

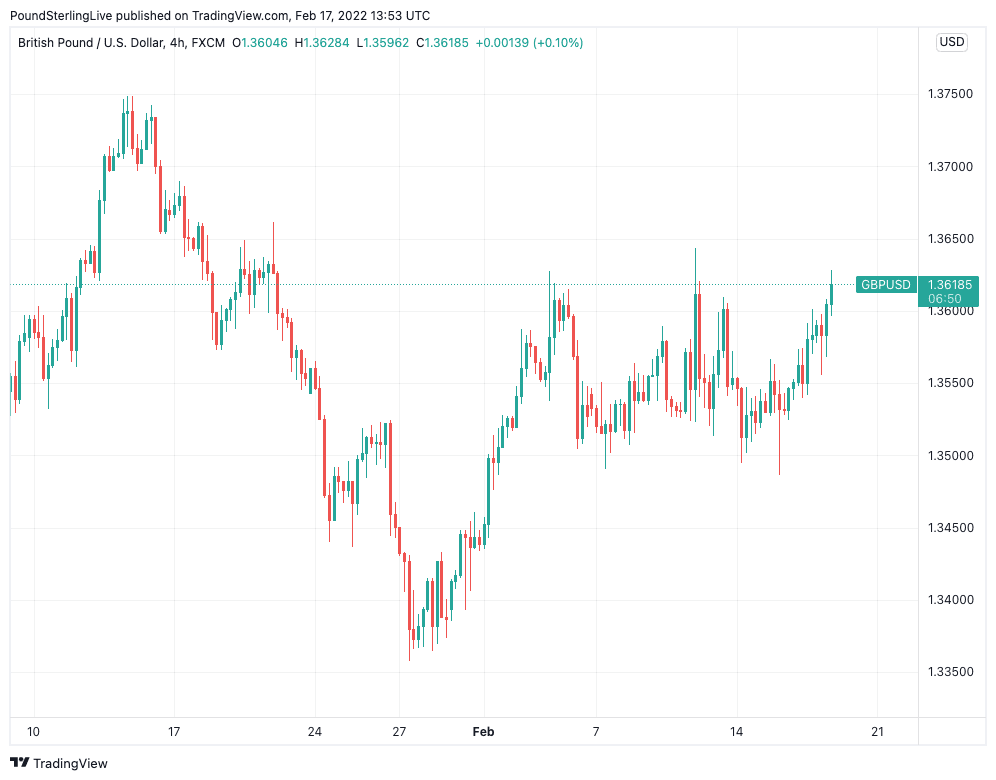

The Pound to Dollar exchange rate has pushed to 1.3620 at the time of writing which takes it towards the top of the February range:

Above: Daily GBP/USD chart.

As the chart above shows the spot market has failed to close above 1.36 since January. It would need to trade in the 1.3650 area for retail rates from competitive providers to reach 1.36, although rates offered by banks would still lag in the 1.3290-1.3420 area. (More information on this pricing can be found here.

A close above 1.36 in spot could encourage bulls to eye the January high at 1.3750 again.

The Pound is meanwhile broadly bid, aided this week by two sets of consensus beating data releases.

Job and wage figures released on Tuesday confirm the country's job market is 'tight', providing the Bank of England with the cover it requires to pursue higher rates.

Raising interest rates is of course a symptom of the economy's elevated inflation levels; which reached 30-year highs in January according to the ONS.

"British inflation data for January has once again confirmed the market in its view: the Bank of England’s next rate step is likely to follow in March," says analyst Antje Praefcke at Commerzbank.

Commerzbank currently expects three further rate steps over the course of the year, so that the key rate is likely to stand at 1.50% by year-end.

An environment of rising UK interest rates has tended to be supportive of the Pound in the past; therefore the global shift to a higher interest rate regime that is currently underway could ultimately underpin the UK currency longer-term.