Pound Outlook Firms as Labour Market Delivers New Employee and Job Vacancy Records

- Written by: Gary Howes

- New employee records

- Driving wages higher

- Unfilled vacancies at new record high

- Keeps alive rate hike expectations

- Underpinning the Pound

Image © Adobe Images

Strong labour market data will keep alive expectations for a series of Bank of England rate hikes over the course of 2022 and 2023, offering a fundamental source of support for Pound Sterling valuations.

The ONS said on February 15 that the number of UK employees increased on the quarter to another record high as the UK unemployment rate decreased by 0.2 percentage points on the quarter to 4.1%

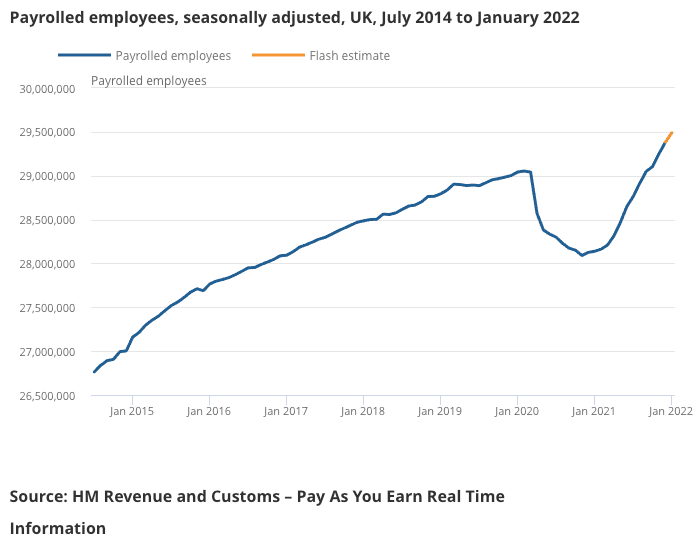

The statistical agency's most timely estimate of payrolled employees showed another monthly increase (up 108,000) in January 2022 to a record 29.5 million.

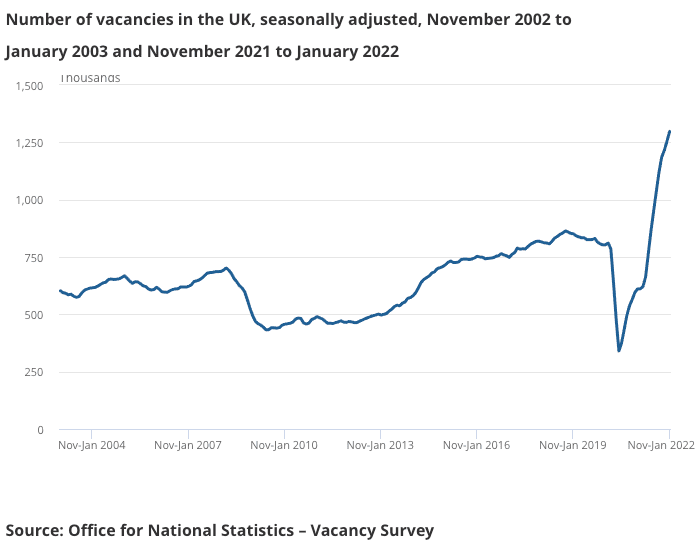

The jobs market is anticipated to remain tight as the number of job vacancies in November 2021 to January 2022 rose to a new record of 1,298,400, although the rate of growth in vacancies continued to slow down.

Above: "The number of employees declined between February and November 2020, but is now above the pre-coronavirus level" - ONS.

This tightness in the job market was reflected in pay increases, with the Average Earnings Index (+ Bonus) rising 4.3% in December, up on expectations for 3.8% and up on the 4.2% recorded in November.

Wage rises are also being driven by the "great resignation": job-to-job moves reached record numbers in October to December 2021, driven by resignations says the ONS.

The data are consistent with an expectation for further Bank of England interest rates in 2022, with markets currently pricing in another 25 basis point hike in March.

"The Bank of England has now gained a reputation for being a central bank that delivers and that provides rate support to the pound," says Marek Raczko, an analyst at Barclays.

The Bank of England has raised interest rates twice already, from 0.10% in December to 0.50% in February, citing fears of rising inflation.

Of particular concern to policy makers is that strong externally driven inflation is stoking domestic inflation expectations, which manifests via higher wage rates.

This in turn stokes further price rises.

"Employment has recouped the falls after the furlough scheme, the unemployment rate has fallen to pre-COVID levels, job vacancies are at a record high and wage growth is rising. That’s a recipe for more interest rate hikes, perhaps from 0.50% now to 1.25% this year and to 2.00% next year," says Paul Dales, Chief UK Economist at Capital Economics.

Following the inflation data release the GBP to EUR exchange rate was seen at 1.1957 while the Pound to Dollar exchange rate was at 1.3540. (The rates offered by your bank are lower than this, we would recommend getting a rate closer to the market with a specialist provider, find out more here).

The ONS did also report an increase in economic inactivity since the start of the coronavirus pandemic, diminishing the size of the labour pool.

The ONS said this was largely driven by those who are economically inactive because they are students or for "other" reasons.

Above: "Vacancies rose to a record 1,298,400 in November 2021 to January 2022" - ONS.

Those who are inactive because they are students continued to decrease, while the increase was driven by those who are inactive because of long-term sickness and "other" reasons.

Although pay is increasing it must be noted inflationary gains continue to eat into pay growth.

The ONS says in real terms (adjusted for inflation), total and regular pay fell on the year at negative 0.1% for total pay and negative 0.8% for regular pay.

"Very high inflation will mean 2022 sees the biggest squeeze on household finances for more than a decade," says Andrew Goodwin, Chief UK Economist at Oxford Economics. "while the MPC looks likely to hike interest rates aggressively in the next few months, we don’t think this response is warranted."

While the jobs market offers a supportive thesis of higher UK interest rates and a stronger Pound, the decline in consumer confidence and spending power resulting from inflation could yet prompt caution at the Bank of England later in the year.

This would in turn potentially weigh on Sterling.

But one economist says the period of falling real incomes should be limited.

"In our view, inflation will not exceed nominal wage gains for long at a time when the UK’s labour markets are historically tight. As a result, the period of falling real wages is likely to be short," says Kallum Pickering, Senior Economist at Berenberg Bank.

"Towards the latter part of 2022, we project solid gains in real wages as inflation moderates towards 3% and nominal wages continue to rise at rates of around 4-5% yoy – with risks tilted to the upside," he explains.