Dollar Exchange Rates Betray a Market Not Yet Ready to Buy the "Blue Wave" Narrative

- Markets overestimating "Blue Wave" scenario says Saxo Bank

- Odds of contested election set at 40%

- USD churn confirms deep market uncertainty

File image of Joe Biden, image courtesy of Gage Skidmore. Accessed Flickr.

- GBP/USD spot rate at time of writing: 1.2943

- Bank transfer rate (indicative guide): 1.2590-1.2680

- FX specialist providers (indicative guide): 1.2860-1.2880

- More information on FX specialist rates here

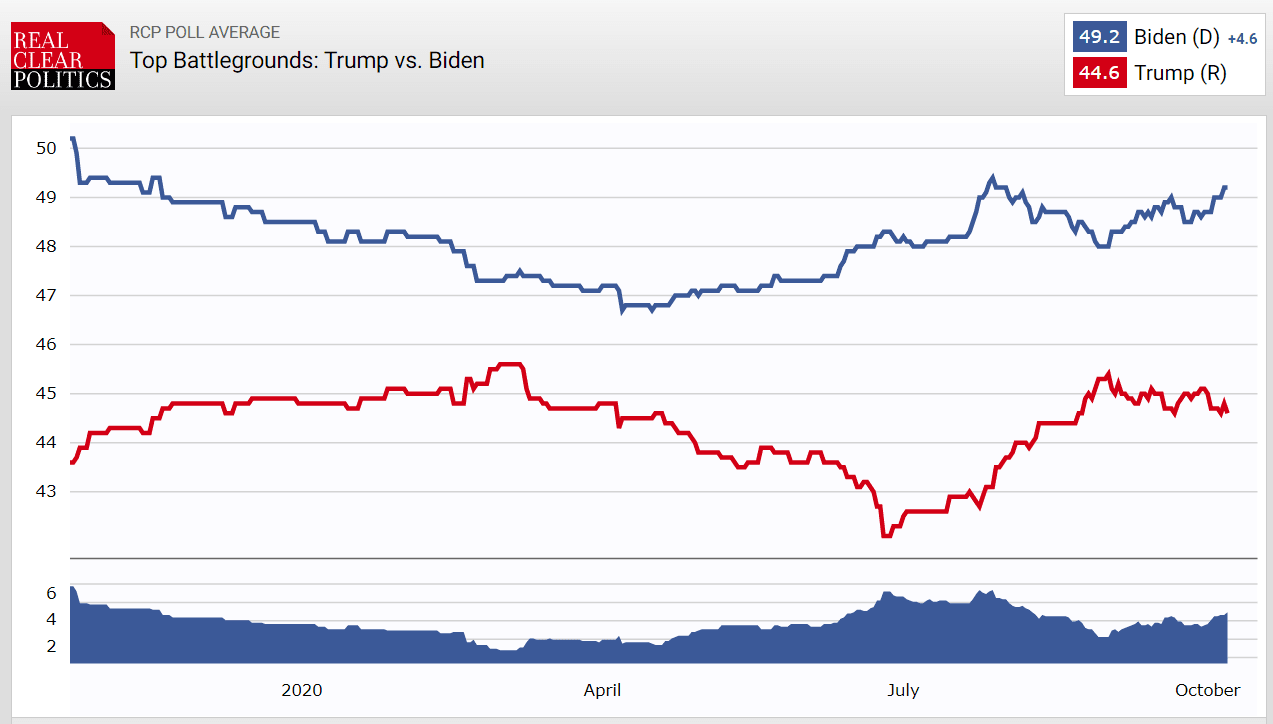

Polling and betting markets are sending a strong signal that Joe Biden and the Democrats will gain control of both congress and the executive in November, a result that is widely said to be negative for the U.S. Dollar.

However the inability of the Dollar to find a clear trend of late could be betraying a market at odds with what the pollsters are saying, and economists at Saxo Bank have told clients that there is in fact only a 40% chance of a "blue wave" outcome.

The odds of either a Trump win or a contested Democrat win amount to 60% according to Saxobank, which would be interpreted as being bullish for the U.S. Dollar which has benefited from Trump's policies and would do so again during another presidency; it would also benefit from the safe haven demand that a contested outcome would yield.

"President Trump should not be written off as he can make another comeback if he wins the critical states of Wisconsin, Pennsylvania, Florida and Michigan. Some observers say the election is so close that the ten electoral votes in Wisconsin could make all the difference," says Saxo Bank’s Chief Economist and CIO, Steen Jakobsen..

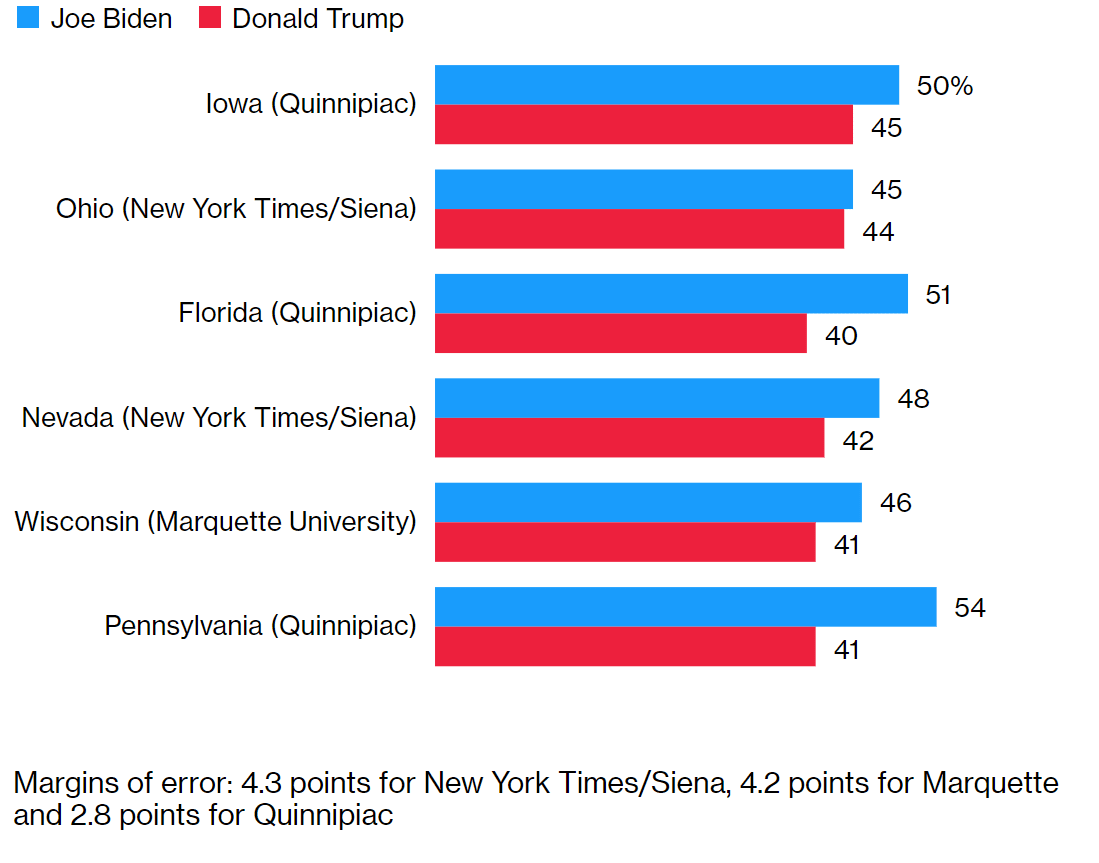

The market's expectation for a Joe Biden win was further cemented after new polling showed that he leads in six key battleground states:

"Signs are that a big lead for the Democrats is seen as reducing the risk of a contested election, supporting risk assets and gently weighing on the dollar. Any Republican comeback could reverse this trend," says Francesco Pesole, FX Strategist at ING Bank N.V.

A Biden win would likely prompt Dollar weakness, while a win for Donald Trump would likely trigger gains for the currency shows new analysis from Goldman Sachs. In addition, a Biden win combined with a Democrat win of the Senate would "pull forward" Dollar weakness, according to the Wall Street bank.

"Any change that raises the odds of a “blue wave” scenario—where former Vice President Biden wins the presidency and Democrats also take the Senate — should accelerate US Dollar weakness," says analyst Zach Pandl at Goldman Sachs in New York.

Above: Breakdown of key battleground states.

Despite the strong signals for a clear outcome to the vote, foreign exchange, equity and commodity markets continue to show some significant churn with little clear direction. Looking at key dollar pairs, there is little exceptional movement with many failing to break away from recent ranges: the Pound-to-Dollar exchange rate is seen capped by 1.30 at 1.2922 while the Euro-to-Dollar exchange rate is failing to find any fresh direction at 1.1739.

The lack of strong directionality could well signal a market that is not yet quite prepared to buy the view signalled by the polls, namely that a blue wave is about to sweep America.

"Our probabilities are at odds with both polls and bookmakers. The Biden-Harris ticket is odds-on to win the White House, and potentially even get a clean sweep by winning both the Senate and Congress. The math is seriously stacked against President Trump, even more so than it was in 2016, but when talking to investors around the world we get the feeling that a large majority continues to ‘feel’ and think President Trump will come from behind once again," says Jakobsen.

Saxo Bank sees three distinct paths and probabilities between now and the Inauguration day on January 20 2021:

1) A contested election – probability 40%

Results:

• Spike in volatility

• Sell off in equities due to uncertainty

• Weaker US Dollar

• Strong Gold

2) A clean sweep by Biden – probability 40%

Results:

• Sell off in equities, particularly in technology (tax increases, focus on monopolies)

• Rally in green stocks

• Higher interest rates as ‘power of the purse’ in controlling both houses of Congress creates fiscal bonanza

3) A win by Trump – probability 20%

Results:

• Volatility increases – four more years of disruption to global order

• Increased China vs. U.S. tension

• Relief rally

• Two houses most likely split, which will mean little fiscal stimulus ability

"We fear that the U.S. election is the biggest political risk we have seen in several decades, as the end of the economic cycle meets inequality, social unrest and a market feeding frenzy driven by the policy response to this deep economic crisis: zero interest rates, infinite government and central bank support. The massive official backstop, with guarantees for demand and jobs in a world of State Capitalism, means that markets and individual freedom have never been more under attack," says Jakobsen.