Pound-Dollar Rate Forecasts Point to 1985 Trough as 'Death Cross' Vandalises Charts

- Written by: James Skinner

Image © Adobe Images

- GBP/USD spot at time of writing: 1.2362

- Bank transfer rates (indicative): 1.2033-1.2120

- FX specialist rates (indicative): 1.2181-1.2255 >> More information

The Pound-Dollar rate extended this week's rebound off earlier lows Wednesday but the outlook for it appears to be darkening as a range of forecasters tip trouble ahead for the British exchange rate while a 'death cross' further vanadalises an already bearish picture on the charts.

Pound Sterling shared in a rebound of many risk currencies against the Dollar on Wednesday as American lawmakers prepared to add hundreds of billions more to a fiscal support package that's already topped the $2 trillion mark, and as investors remained hopeful that coronavirus outbreaks are close to their 'peak' in the U.S. and a number of major European economies. But the mood in the market has been fragile and some say Sterling needs to gain further momentum or face seeing its recovery reversed.

"This morning, the market mood has turned cautious, as tepid sentiment returns as a result of a spike in deaths from Covid-19 yesterday from the UK, Germany, Spain and New York. Dollar demand has thus gained traction again," says George Vessey, a UK currency strategist at Western Union. "Concerns over the economic fallout from the coronavirus pandemic might cap gains for sterling, especially if a challenge of the $1.25 doesn’t ensue this week."

Above: Pound-Dollar rate at hourly intervals.

Sterling reclaimed the 1.23 handle Wednesday as investors rewarded leaders outside of mainland Europe with a bid for risk assets, for strong and effective actions taken to not only contain the virus but also to plug the holes punctured into economic paddling pools by national shutdowns. The Dollar was stronger against the Euro currency and safe-havens like the Yen and Swiss Franc but weaker against Sterling as well as the Aussie and Kiwi Dollars.

It might not be a coincidence that this price action played out as U.S. lawmakers readied a third significant financial support package for companies and households just as economists are contemplating the mounting possibility of a peak in the spread of the coronavirus in the U.S.

"We expect today's increase, which likely will breach 30K—just—to be the peak. A week from now, we think confirmed case growth will be about 26K per day," says Ian Shepherdson, chief U.S. economist at Pantheon Macroeconomics. "Yesterday's testing data were disappointing, but these numbers are noisy and we'd be surprised to see a reversal of the favorable recent trends, with rising tests and a falling positive share.

Some European coronavirus hotspots have also reached a peak this week while a collection of smaller countries are already planning to lift 'lockdown' containment measures that helped bring the virus under control, but a lack of unity in support for companies and households has weighed on the Euro.

Above: Pantheon Macroeconomics graph showing epidemic curves in Germany, France, U.S. and UK.

The UK is seen by Pantheon as likely to experience its own peak in the coronavirus outbreak as soon as the end of this week, while Pound Sterling is benefiting from its positive 'beta' correlation with risk assets and a sizeable financial support offered to companies and households by the Treasury. As a result, it's so-far evaded the downside this week but both fundamental and technical analysts see the British currency's luck running out sooner or later.

"We see the UK economy as being at the start of a long period of economic adjustment, and we expect the government to weave its management of COVID-19 into its Brexit and economic strategies. Though an initial extension of the current Brexit transition phase beyond 2020 is looking a bit more likely, we see increasing scope for an eventual move to WTO rules. The UK's floating exchange rate is an important buffer for the economy in these extraordinary times, and we have penciled in a move to 1.15 at the 9M part of the curve," says Stephen Gallo, European head of FX strategy at BMO Capital Markets.

Gallo sees Sterling shouldering the burden of Brexit in the months ahead, a burden that may become heavier once the dust settles on the coronavirus fight. The future relationship with the European Union will come back into focus at the same time as politicians and the wider public carry out a post-mortem of the coronavirus containment process, which might complicate the pursuit of preferential trade arrangements if these are found relevant to deadly shortages of things like respirators, surgical wear, testing kits and hand sanitisers.

Above: Pound-Dollar rate shown at Monthly intervals, reaching lowest level since 1985 amid brutal March 2020 sell-off.

Such findings might raise the probability of something like a 'no deal' Brexit at year-end or beyond and weigh heavily on the Pound with or without a cantankerous or vengeful approach from the opposite side of the table, which might also be becoming more likely. The EU may need a strategic victory following its so-far limited financial contribution to the virus battle and a hard-driven Brexit bargain might seem to some like exactly the right prescription.

BMO's Gallo forecasts the prospect of a no deal Brexit and other factors will send the Pound-Dollar rate back to 1.15 by year-end, near to its lowest level since early 1985, with the bulk of losses coming in the final quarter. However, others see such declines coming back around quicker than that and are tipping levels that are also much, much lower too, although the impetus for these latter forecasts was technical and drawn from studies of the charts.

"GBP/USD is bouncing near term from the 20 day ma at 1.2124 but is currently holding below the 61.8% retracement at 1.2516, and we continue to look for this to cap the market. Failure at the 20 day ma is needed to re-target the 1.1958 September 2019 low. Failure will alleviate upside pressure and refocus attention on 1.1491, the 2016 low and last week’s low at 1.1409," says Karen Jones, head of technical analysis for currencies, commodities and bonds at Commerzbank. "Below 1.1400 lies the 1985 low at 1.0463."

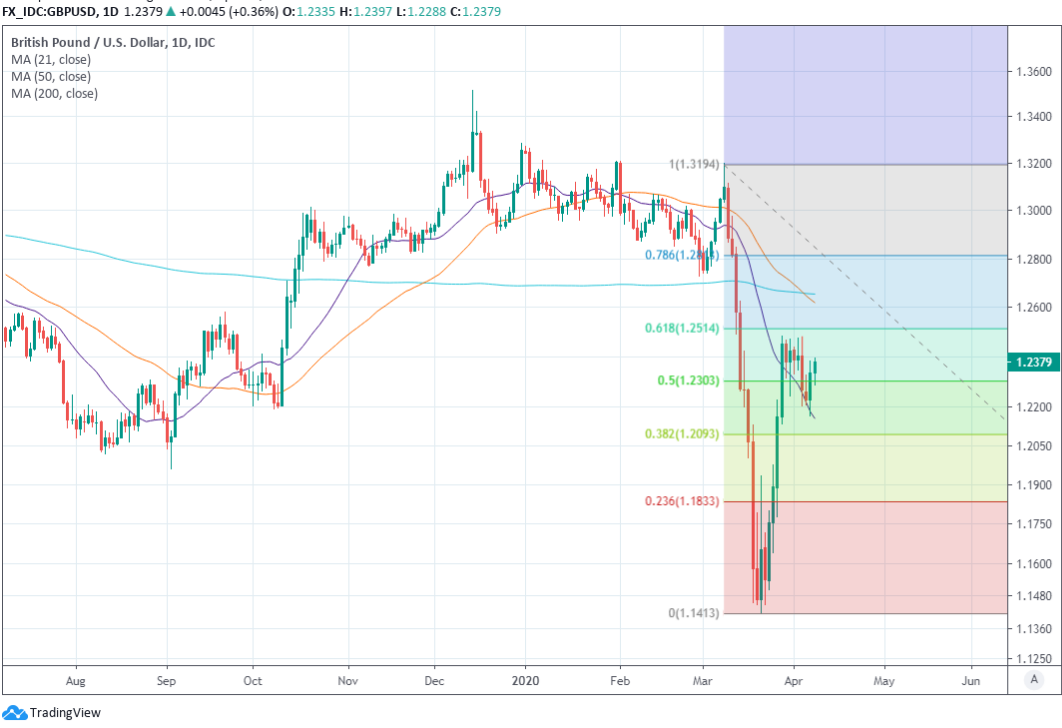

Above: Pound-Dollar rate at daily intervals, with Fibonacci retracements of 2020 downtrend marked out. 50-day

moving-average crosses over the 200-day (light blue) average, forming a death cross in the process.

The Pound-to-Dollar rate found support coming from its 21-day moving-average of prices around 1.2124 last Friday and has since attempted to recover more of the upside lost during a punishing March sell-offf that saw fall to as low as 1.1409. However, it faces a major technical road-block in the form of the 61.8% retracement of the 2020 downtrend flagged by Jones as well as the now-declining 200-day moving average that was located at 1.2655 on Wednesday.

Commerzbank's Jones is betting the Pound-to-Dollar rate will decline to a new post-1985 low of 1.0463 within the next three weeks or so and remain near to that threshold for months to come. And support for such forecasts has built this week with the appearance of a 'death cross' on the daily chart over the last few trading days, which and may now further vandalise an already-bearish technical picture for the Pound-to-Dollar rate.

A death cross is a bearish sell signal that occurs when a short-term moving average, in this case often said to be the 50-day average, crosses over a longer-term average like the 200-day en route to the downside. That happened for the Pound-to-Dollar rate on Friday, egging on earlier losses for the exchange rate, and on Wednesday the 55-day moving-average was also threatening to cross the rubicon that is the 200-day moving-average.

Above: Pound-Dollar rate at daily intervals, with 55-day moving-average threatening to cross the 22-day (light blue) rubicon.