Pound Sterling Falls as Dollar Reigns Supreme and UK Politics Weigh

- Written by: James Skinner

- GBP slides, featuring as second biggest faller against USD.

- US-China trade war reprieve and UK politics in driving seat.

- GBP/USD facing further losses, GBP/EUR has scope to recover following soft start.

Rawpixel.com, Adobe Stock

Sterling entered the new week on the back foot Monday, falling below a key technical level against the US Dollar as the greenback advanced and markets shunned the British currency in the wake of the latest developments in UK politics.

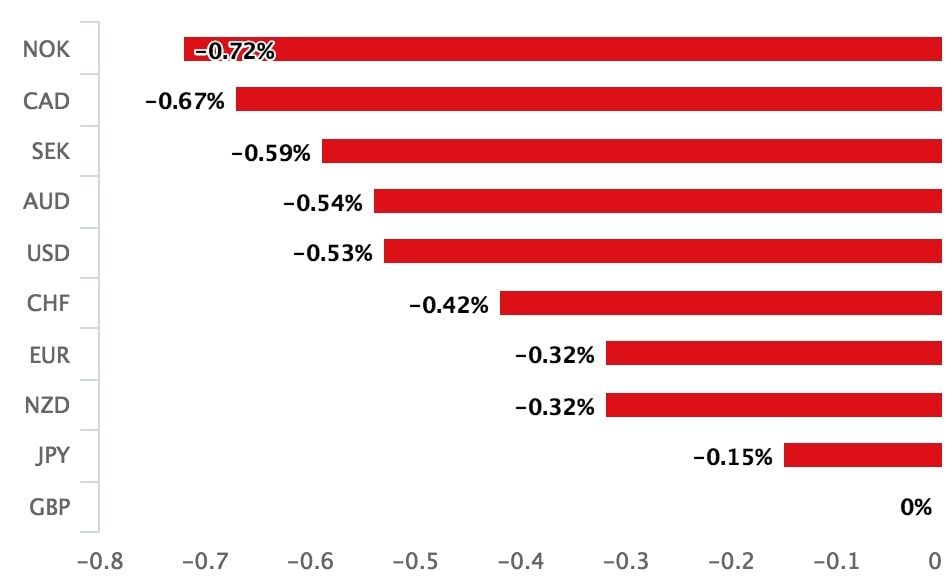

A look at the relative performance board confirms that Sterling is the laggard on global markets:

Pound Sterling was among the biggest fallers in the face of the strong greenback as markets steered away from the currency in light of reports the Scottish government is preparing a fresh push for independence and amid speculation over another possible general election in the UK this August.

"It’s worth addressing the politics head-on – as this is fast-becoming the factor that is keeping us most awake at night," says Viraj Patel, an FX strategists at ING Group. "While both remain just noise at this stage, these fresh political hits could keep sentiment for GBP dented in the near-term."

Sterling was quoted 0.34% lower at 1.3414 against the US Dollar during the morning session, making it the second biggest faller against the US currency after the safe-haven Japanese Yen, after falling below a key long term support level located around the 1.3450 area.

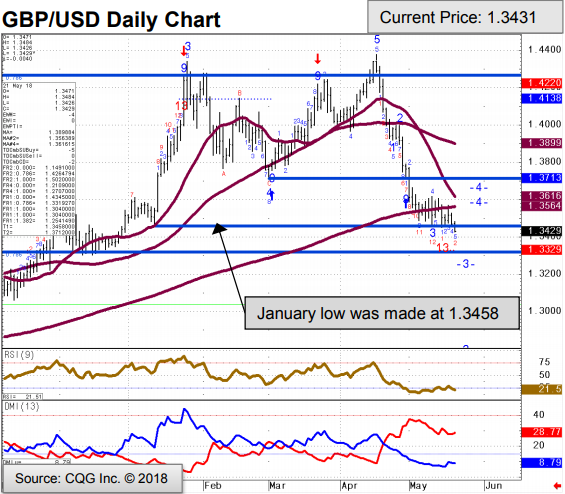

Above: Pound-to-Dollar rate shown at daily intervals.

This corresponds with the 38.2% retracement off of the October 2016 low to the April 2018 high. It is a level that has survived multiple tests throughout the month of May, before it gave way Monday morning. One analyst says the exchange rate could now see further losses during the days ahead.

"GBP/USD has eroded the 1.3458 January low and is in new lows for the year. It has ignored the divergence of the daily RSI and the 13 count on the chart and the 78.6% retracement lies at 1.3319 and we assume that is where it is heading. The 55 week ma lies at 1.3400," says Karen Jones, head of technical analysis at Commerzbank.

Above: Commerzbank graph showing Pound-to-Dollar rate technical analysis.

The Pound-to-Euro rate was 0.14% lower at 1.1420 Monday, much like all other Sterling exchange rates barring the Pound-to-Yen, as the British currency has has fallen at a faster pace against the US Dollar than all others barring the Japanese currency.

However, Jones says any weakness in the Pound-to-Euro exchange rate should not last for long:

"EUR/GBP’s outlook stays negative while capped by its downtrend from August last year at .8836 and its 200 day ma at .8863, and we maintain a negative bias while capped here. We will continue to target .8526, the 78.6% retracement of the move from 2017," Jones writes in a morning briefing, referring to a target that translates to a Pound-to-Euro rate of 1.1728.

Above: Pound-to-Euro rate shown at daily intervals.

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.

Monday's price action comes at the start of what is an important week for the Pound in terms of economic data. This is because Wednesday will see the latest batch of UK inflation figures released to the market while Thursday brings April retail sales and Friday offers the second estimate of first-quarter GDP.

The inflation data will be crucial to the narrative around Pound Sterling as it is key to Bank of England monetary policy. After all, it is rising inflation that central banks are attempting to head off when they raise interest rates and vice versa.

Until late April currency traders had spent months bidding Sterling higher in anticipation of an interest rate rise in May, which was expected to be the first of two or three in the 2018 year. But March inflation data, released in April, showed UK inflation falling by much faster than was expected, from 2.7% to 2.5%.

This prompted the Bank of England to abandon its May interest rate rise and cut its inflation forecasts, the latest of which suggest the consumer price index will fall back to the BoE's 2% target before the end of its forecast period in 2021.

The fall in inflation dented market hopes for UK interest rates and saw Sterling punished as traders priced in a steady and stable 0.5% Bank Rate until well into the first quarter of 2019.

Wednesday's inflation figures would offer the market some hope that a change in policy could come sooner rather than later if consumer prices post a surprise increase.

Likewise, April retail sales data and the second look at first quarter economic growth may also provide reasons for cheer if those figures show the slowdown experienced during the first three months of the year was just a seasonal blip.

"The perfect week for GBP bulls would be signs of sustained underlying inflationary pressures (core CPI at 2.2% YoY), a bounce back in ex-auto consumer spending (ING: +0.2% MoM; consensus: +0.5%) and a slight upward revision to 1Q UK GDP (prior unexpected to change)," says ING's Patel.

Dollar in Control, Euro Another Laggard Alongside Sterling

The US Dollar was the biggest driver of price action Monday after both US and Chinese trade delegations agreed to suspend a series of protectionist and retaliatory tariff measures announced in March, which had previously led markets to fear a so called trade war between the world's two largest economies.

US Treasury Secretary Steven Mnuchin told Fox News the tariffs would be suspended after representatives agreed on a framework for reducing the US-China trade deficit and while boosting bilateral investment between the two nations. This has addressed a major source of risk facing the Dollar, helping it to sweep the board against its international rivals Monday.

"The China agreement is a big win for USD, because if we look at the various uncertainties that the US faces, trade was far and away the number 1 question," says Marshall Gittler, an analyst with ACLS Global.

The Euro was meanwhile seen to be another underperformer alongside Sterling. "Both currencies are in a contest to see who is the worst performer today, and right now the pound is edging out the euro by just a tad bit," says Justin Low, an analyst with ForexLive. "The Euro is being weighed down by the government planning in Italy and the selloff in Italian bonds, equities also haven't really helped with that regard."

News reports suggest a new Italian Prime Minister might be installed on Monday, with Guiseppe Conte, a 53-year old law professor with no political experience being tipped to take the reins. For markets, proposed policies that go against European Union and Eurozone rules, particularly on the question of debt, are of concern and there are fears that the new Italian government will inevitably find itself on a collission course with Brussels.

Concerning the outlook for the EUR/GBP exchange rate, Low says: "the pair is a little higher on the day after holding on to support at 0.8720 since last week and earlier today as well. The key support level for the pair will be the 61.8 retracement level at 0.8693 but for now the race to the bottom appears to be favouring the Sterling so EUR/GBP buyers can take some comfort that we're yet to test said key level."

EUR/GBP at 0.8720 gives us a 1.1467 and 0.8693 gives us a key resistance in GBP/EUR at 1.1503.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.