British Pound up on US Dollar as Carney Asks Banks to Boost Capital Buffers

The Pound to Dollar exchange rate has risen from 1.2719 to reach 1.2787 following the release of the Bank Of England’s (BOE’s) Financial Stability Report.

Sterling strengthened after the report said UK banks would have to raise the amount of capital they held in storage to protect against any shocks to the financial system.

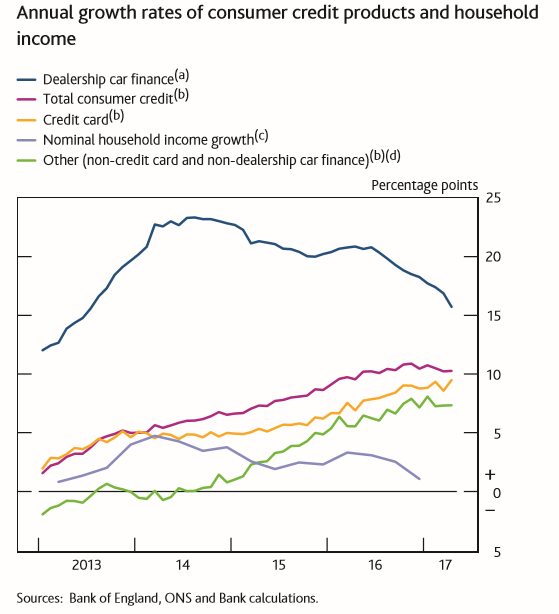

A key risk to the financial system is seen as the growth in unsecured credit, notably credit card lending and car finance.

Banks will now need to raise an additional £11.4bn as part of the Counter-Cyclical Capital Buffer to ensure they are healthy enough to withstand any potential shocks should borrowers start defaulting.

The Counter-Cyclical Capital Buffer requires commercial banks to hold a certain level of capital in reserve, in case of a crisis, as per the Basel III recommendations.

This is important as it is an effective tightening of monetary policy and would have the same impact as raising interest rates. And recall, raising interest rates tends to lead to an appreciation in the currency.

The directive means there will effectively be £11.4bn worth of currency floating around the domestic and global financial system.

Hence it explains a good part of the strength we have seen in GBP/USD.

The BOE had removed the buffer altogether in 2016 in an effort to aid growth by increasing lending, however, it reinstated it at 0.5% at today’s meeting.

The bank also raised concerns about the pace of personal lending which has grown substantially over recent years, to the point where it is a financial stability risk.

“As is often the case in a standard environment, there are pockets of risk that warrant vigilance. Consumer credit has increased rapidly. Lending conditions in the mortgage market are becoming easier. Lenders may be placing undue weight on the recent performance of loans in benign conditions,” said the FSR.

Nevertheless, overall the report was positive about conditions saying that its assessment of stability was positive.

“The Financial Policy Committee (FPC) assesses the overall risks from the domestic environment to be at a standard level: most financial stability indicators are neither particularly elevated nor subdued,” it said.

Yellen on Stage

The Dollar, meanwhile, is likely to strengthen later in the day when Janet Yellen takes to the stage, taking into account its recent track record.

“Investors expect comments from Federal Reserve Chair Janet Yellen to support the Fed's projection for one or more interest rate rises this year,” said Investing.com.

Yellen had been seen as a monetary dove – which means she was in favour of keeping interest rates low - but since unemployment fell below 5.0% and met the Bank’s mandate for ‘full employment’ she has become more hawkish.

She is likely to support the Fed’s current stance on interest rates, which stipulates a path including another 0.25% rise by the end of the year.

This may push the Dollar higher as it is out of sync with more dovish market expectations which question whether further rate hikes are needed yet given still-sluggish inflation.

Currently short rates are rising after high demand at a treasury bond auction last night, but longer-dated debt reflects low inflation, growth and interest rate expectations.

“Long-dated Treasury yields dropped to seven-month lows on Monday and the yield curve between five-year notes and 30-year bonds fell to its flattest level since 2007 after the weak U.S. durable goods orders raised concerns about tepid growth and slowing inflation,” added Investing.com.

Technical View

From a technical perspective the appears to be that the GBP/USD pair is pulling back in the midst of a downtrend.

“The recovery off the recent low at $1.2587 still seems to be a bear market rally and the very neutral, consolidation candle posted yesterday does little to dispel this,” says Richard Perry at Hantec Markets.

Momentum is also bearishly aligned:

Momentum is also bearishly aligned:

"The momentum indicators are negatively configured on a medium term basis and a failure to breach the $1.2775/$1.2817 resistance band will see the corrective pressure mounting once more. The hourly chart shows a mild negative divergence on the hourly RSI and MACD lines which suggests waning upside momentum,” said Hantec's Perry.