Morgan Stanley: Pound Sterling Strength on its Last Legs

The British Pound could yet still deliver its best levels against major currencies for 2017, but expect a sharp reversal in fortunes towards the end of the year.

This is the view of investment bank Morgan Stanley who have released their mid-year expectations for the UK currency.

The Pound has proved remarkably resilient in the face of Brexit uncertainties as the strengthening economy has helped offset fears about Europe, but this support cannot be relied on indefinitely says Morgan Stanley’s Hans Redeker.

A major part of the reason for the Pound’s invulnerability in the face of so much political uncertainty is the continued stream of positive economic data from the UK, which has far outstripped doom-laden pre-referendum expectations.

By far the most important element in the Pound’s stubborn strength has been the consumer.

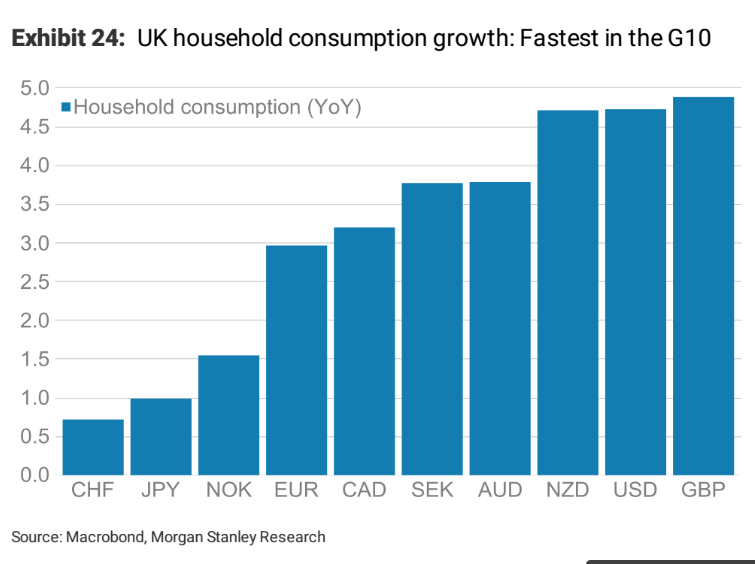

The continued resilience of UK consumer spending has supported Sterling, according to Morgan Stanley, who point out that UK Consumer spending is now the highest level in the G10.

This high is unsustainable, however.

In fact, consumer spending is probably peaking presenting a future scenario in which shoppers tighten their belts when they realise they cannot afford their current levels of spending.

The UK may have the largest consumer spending levels in the G10 but it also has the lowest savings ratio.

What will happen when consumers realise they have no savings for a rainy day, or for retirement?

“The UK consumer may now slow down after a rapid rise in the past year (due to), lower savings and weaker real income growth. UK company investment is also expected to be weak,” said Redeker.

Yet regardless of economic arguments the immediate risk event for the currency is the General Election on Thursday.

The Prime Minister needs a majority of at least 30 in order to negotiate strongly with the EU, however, opinion polls have narrowed so much recently that she is not guaranteed to have such a large majority.

Clearly, a failure to acquire a large enough majority would put Brexit negotiations in peril as it would potentially leave the government open to pressure from the far-right Brexit splinter of the party, who do not care whether the UK defaults to WTO.

Bank of England to Weigh on Sterling Longer-Term

The policies and interest rate set by the Bank of England (BOE) is normally a major driver of the currency, yet Redeker does not see it as a factor in the medium to long term as he sees little chance of the Bank raising interest rates until Brexit negotiations are completed.

If anything, this will put the currency at a disadvantage as most other central banks will not have the same headwind and assuming a general increase in global growth and a broad reflation story will see their rates rise and polciies tighten.

Money tends to flow from low wot higher interest rate currency jurisdictions, putting the Pound at risk of entering a downward spiral due to rates remaining low, weakening currency and this causing rising prices in shops which will undermine consumer spending still further.

Positioning For a Fall

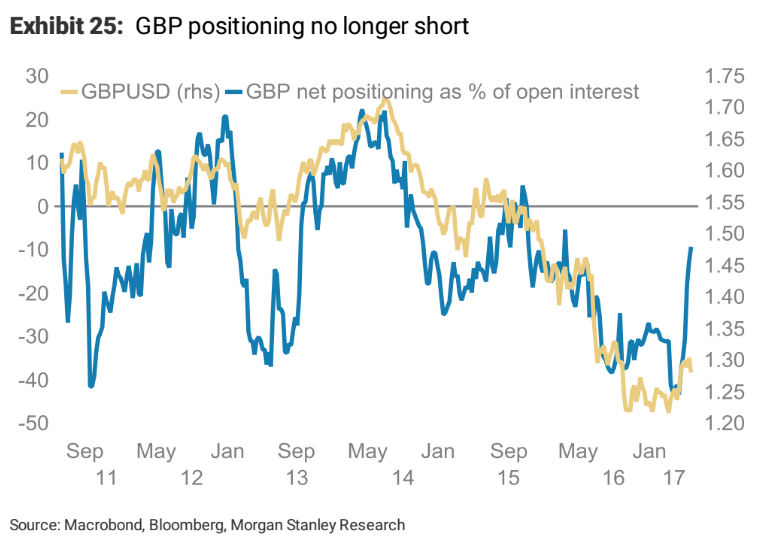

Further evidence the rally in the Pound may be on its last legs comes from positioning data from international futures exchanges.

The normal way in which the data is analysed is too highlight extremes of sentiment – either bearish or bullish.

When these extremes are reached they are a signal the opposite is about to happen, so for example an extreme surplus of bearish sell contracts on a currency is a sign the currency is cheap and may actually start to rise as buyers cautiously re-enter the market.

Positioning on GBP in the futures market shows it has already reached a bearish extreme and has risen sharply from it.

This means there is no longer a positive signal from the bearish extreme.

Forecasts for the Pound

Morgan Stanley expect GBP/USD to peak at 1.32 in Q3 of 2017 but then to steadily roll back down to 1.23 in Q2 2018.

As for EUR/GBP, the bank expects it to weaken even more as the Euro is supported by a brighter outlook.

They see EUR/GBP rising to a peak of 0.94 in Q1 of 2018 before selling off to 0.90 at the end of 2018.