Pound Sterling Weakness Extends against Euro and Dollar

- Written by: Gary Howes

Image © Adobe Images

The British Pound's bout of weakness threatens to extend through the final trading sessions of 2022 as traders look ahead to what economists across the spectrum say will be another difficult year for the UK.

There is no domestic data or news of consequence, ensuring the negative momentum experienced in the run-up to the Christmas period lingered in holiday-thinned markets.

The Pound joined the New Zealand Dollar at the bottom of the performance table in pre-Christmas trade even as global equity markets made gains, which proved something of a surprise given these two 'high beta' currencies tend to outperform in such conditions.

Therefore, even a 'Santa rally' for global equities ahead of the New Year might not be enough to prompt a sharp rebound in the value of the Pound.

"GBP continued to drift lower, in line with our caution for pullback play lower in the near term," says Christopher Wong, an analyst at OCBC Bank.

"Bearish momentum on daily chart intact while RSI fell," he adds. "We retained our slight cautious outlook on GBP amid stagflation concerns."

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

UK GDP data released ahead of Christmas revealed the UK was the only G7 economy in which GDP for the third quarter was still below its pre-Covid level.

"The U.K. likely will continue to underperform; we expect Britain to suffer the deepest recession among major advanced economies in 2023, due to the severity of the headwinds from both monetary and fiscal policy," says Samuel Tombs, chief UK economist at Pantheon Macroeconomics.

Bank of England forecasts suggest the downturn could last for up to two years while Pantheon Macroeconomics projects a 2.5% peak-to-trough fall in GDP and a 2023 decline of 1.5% with each of these also aided by cutbacks in government spending and increases in the Bank of England (BoE) Bank Rate.

Analysis from KPMG shows the UK economy will shrink by 1.3% in 2023, amidst a relatively shallow but protracted recession.

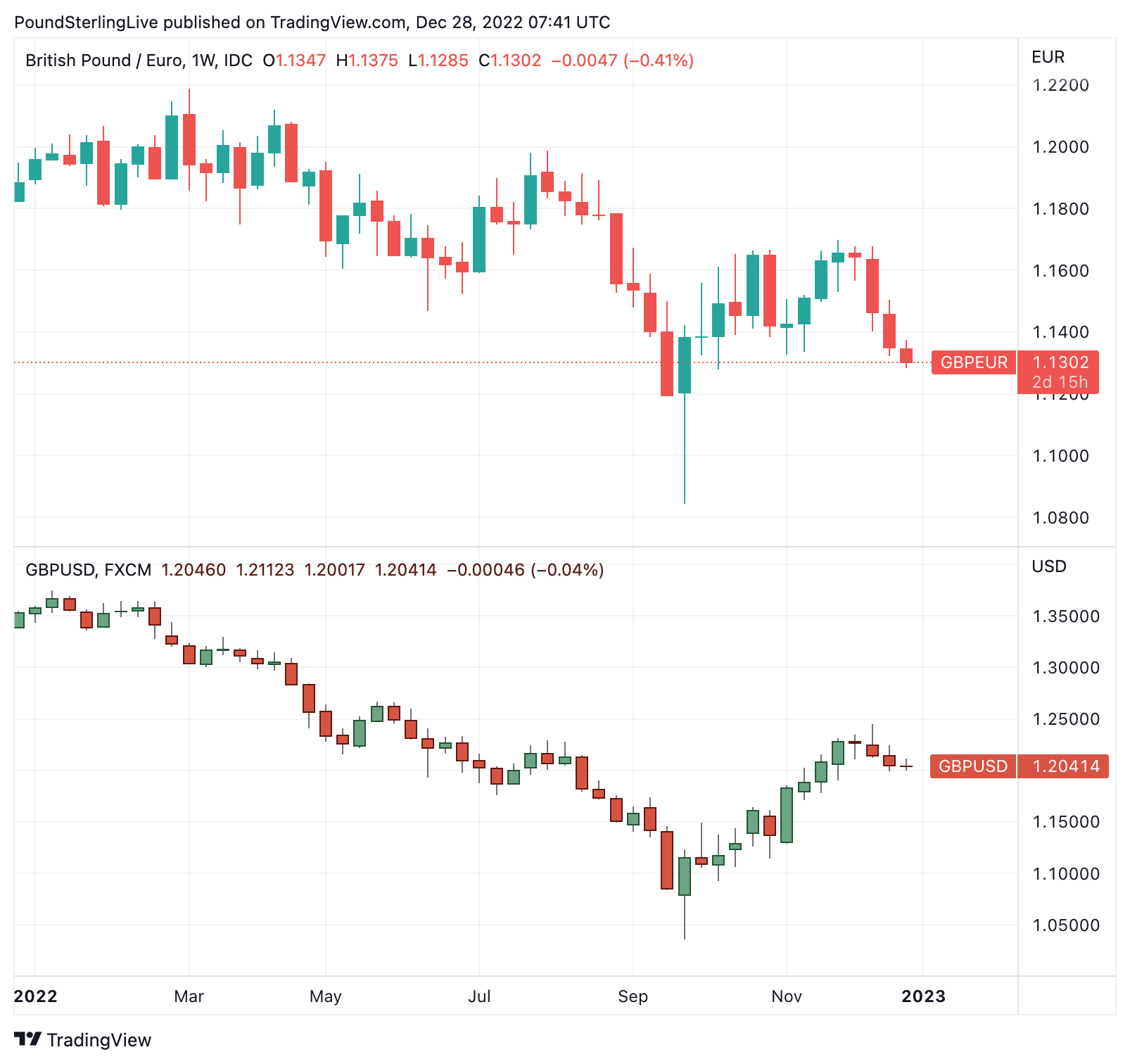

Above: GBP/EUR (top) and GBP/USD at weekly intervals showing 2022 trade. If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.

According to KPMG's latest UK Economic Outlook, this decline will be followed by a partial recovery in 2024, which could see GDP rise by 0.2%.

"Sterling's outlook remains muted on the back of cyclical weakness and Balance of Payments sustainability concerns," says Claudio Wewel, FX Strategist at J. Safra Sarasin. "According to our projections, the UK economy will contract throughout the coming year and the first half of 2024 – longer than other developed economies."

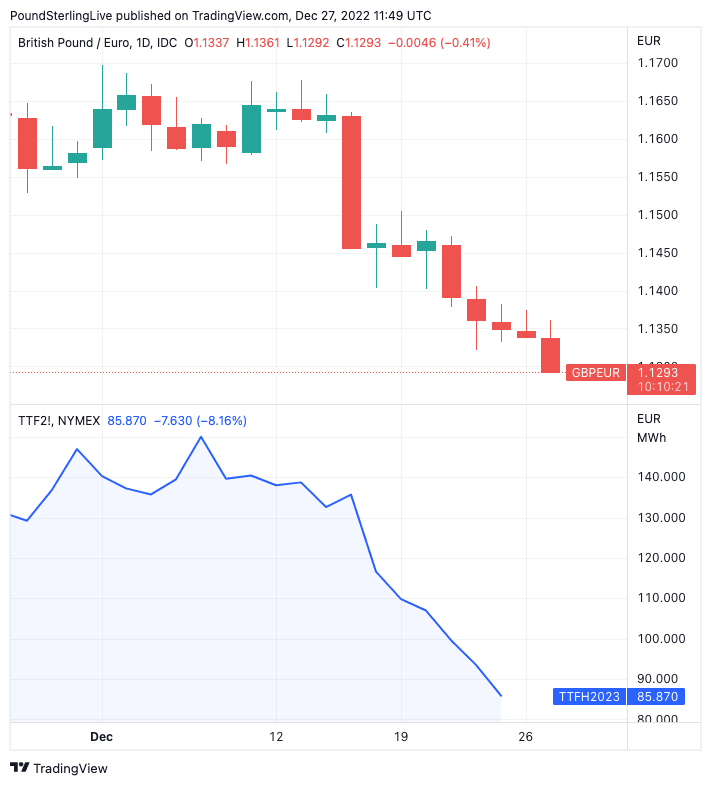

The Euro meanwhile remains on the front foot against the Pound and Dollar amidst further declines in European gas prices.

European benchmark prices fell as much as 30% last week and were a further 3.5% lower on December 27 as weather forecasts showed northern Europe would experience above-average temperatures in the first part of January 2023.

Above: GBP/EUR (top) and TTF gas prices for the next month's delivery. Shown at daily intervals. Consider setting a free FX rate alert here to better time your payment requirements.

Moscow also said is ready to resume gas supplies to Europe through the Yamal-Europe Pipeline, Russian Deputy Prime Minister Alexander Novak told state TASS news agency.

"The European market remains relevant, as the gas shortage persists, and we have every opportunity to resume supplies," TASS cited Novak as saying in remarks published by the agency on Sunday.

The TTF benchmark gas contract for January delivery dropped 0.6% to €82.50 a megawatt-hour in early trade on Tuesday.

The Euro rose 0.10% against both the Dollar and Pound as a month-long period of strength looked to extend into the new year.

The Euro's rise reflects an easing in concerns regarding the region's economic outlook; concerns spiked with Russia's invasion of Ukraine and the subsequent surge in energy prices through the summer months that threatened a deep and protracted recession.

"We are neutral-to-mild-constructive on EUR's outlook. Recession fears in Euro-area, energy woes and geopolitical concerns remain. Further deterioration would warrant a downward revision in forecasts but, for now we believe the bulk of the risks have been baked into the price," says Christopher Wong, an analyst at OCBC Bank.

The continued easing in European gas prices provides further impetus to the Euro recovery trade.

The Pound to Euro exchange rate has now retreated to 1.13, its lowest level since October.

In addition to warmer weather and supportive headlines regarding Russian supply, liquefied natural gas (LNG) shipments into Europe remain strong, allowing for storage levels to be at higher-than-typical levels for this time of year.

Lower demand amongst consumers and industry is also contributing to the lower prices.

Further impetus for the Euro comes amidst signs Eurozone interest rates are to rise further than previously expected as the European Central Bank (ECB) pursues a policy of interest rate increases to bring inflation under control.

"Hawkish ECB rhetoric mitigates against further worsening in EU-UST yield differentials and should continue to provide some support for EUR," says Wong.

The ECB said at its December policy update that further interest rate hikes of 50 basis points were required to bring inflation lower.

The tone and guidance proved more assertive than the market was expecting, resulting in higher Eurozone bond yields which in turn aided the single-currency higher.

Analysts at ING Bank said recently the ECB appears willing to promote a stronger Euro, which acts as a deflationary force.

"The ECB would clearly like a stronger euro to help out with its battle against inflation and it was telling at last week's ECB press conference that President Christine Lagarde was keen to highlight that the ECB would be tightening longer than the Fed," writes Chris Turner, global head of markets and regional head of research for UK & CEE at ING, in a recent research briefing

"If the ECB is to be successful in getting the euro higher, then the euro will need to rally against those currencies with major weights in the trade-weighted euro index. The biggest weights in this index are the US dollar (16%), the Chinese renminbi (14%) and then the British pound (12%)," he adds.

Looking ahead, Pound Sterling will lose "notable" value against the Euro says a new analysis from global investment bank MUFG, although other analysts say the UK currency can advance in value during 2023.

The call by MUFG's currency strategists comes in the wake of December's round of central bank policy decisions that included a notably more 'hawkish' European Central Bank policy update that increased market volatility in its wake.

"Gains for the euro versus the higher key further higher beta G10 currencies seems more likely," says Derek Halpenny, Head of Research for Global Markets EMEA at MUFG.

Global stocks were lower across the board after the ECB raised interest rates by 50 basis points but President Christine Lagarde warned numerous 50bp hikes were still required to bring inflation back down to the 2.0% target.

"That would be consistent with market conditions turning more volatile which could be the consequence of some of these central bank meetings this week," says Halpenny. "Higher EUR/GBP is also consistent with worsening risk sentiment and higher volatility when EUR tends to outperform GBP."

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes