Pound Sterling Shows Nerves Ahead of Budget

- Written by: Gary Howes

Chancellor Rachel Reeves prepares for the Autumn Budget 2024 in her office in No 11 Downing Street. Seen behind is a portrait of Ellen Wilkinson, a former Minister for Education, taken on the 25/06/1924 by Bassano Ltd. Treasury. Picture by Kirsty O'Connor / Treasury.

The British Pound fell in the lead-up to what is expected to be a highly consequential budget statement.

Chancellor Rachel Reeves will announce significant tax rises of £35BN, which is an outright negative for the Pound, as she seeks to plug the budget deficit and guarantee fiscal discipline.

"If markets sense that the tax burden on business will be too heavy and there aren’t enough growth boosting measures, the pound is likely to fall as it would set the tone for a dovish Bank of England meeting next week," says Raffi Boyadjian, Lead Market Analyst at XM.com.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

It is reported that Reeves will fill a £22BN budget deficit by increasing the National Insurance contributions (NICs) paid by employers, meaning it will become more expensive to take on and retain staff. She will also announce that the minimum wage employers must pay will rise by an inflation-busting 6% next year.

This will heap pressure on businesses, with a report in the Times warning businesses see a "perfect storm" blowing their way.

"If employing more people is not only more expensive (NIC increases) but also more difficult and risky (Employment Rights Bill), businesses will be reluctant to hire more people, particularly those who have been out of work for a long time," says Rupert Soames, chairman of the Confederation of British Industry.

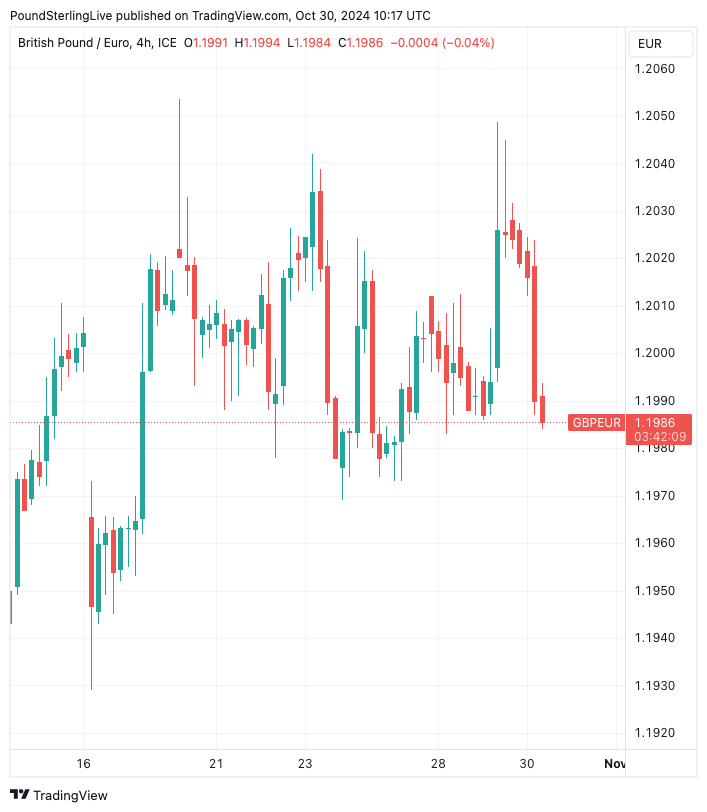

Above: GBP/EUR at four-hour intervals showing pre-budget churn.

"The crux of the matter is that such measures would increase the cost of employing, and hiring, workers in the UK. The net result would likely be that businesses either hire fewer workers due to the additional expense, or that pay grows at a slower pace. In other words, this measure would be a huge tax on both businesses, and employees," says Michael Brown, a strategist at Pepperstone.

A rise in unemployment following the budget could potentially weigh on wages, allowing the Bank of England to cut interest rates faster.

This would weigh on the Pound in the medium term.

"A negative reaction to the budget would cause Gilt yields to rise and GBP to fall," says strategist Kristina Clifton at Commonwealth Bank.

🎯 GBP/EUR year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. 📩 Request your copy.

Additional Spending Can Bolster Pound Exchange Rates

However, price action over recent days suggests the Pound is reflecting some optimism amongst market participants, likely centred on the additional spending that will be announced to fund infrastructure investments.

The Pound to Euro exchange rate spiked to 2024 highs at 1.2050 ahead of the budget but was unable to hold the gains and is back at 1.2017 at the time of writing, confirming our suspicion that the 1.20 level will remain an equilibrium level for the time being.

The Pound to Dollar exchange rate rallied to 1.30 again over the course of the past few sessions amidst Sterling strength and a selloff in the Dollar linked to weaker-than-forecast job opening numbers in the U.S.

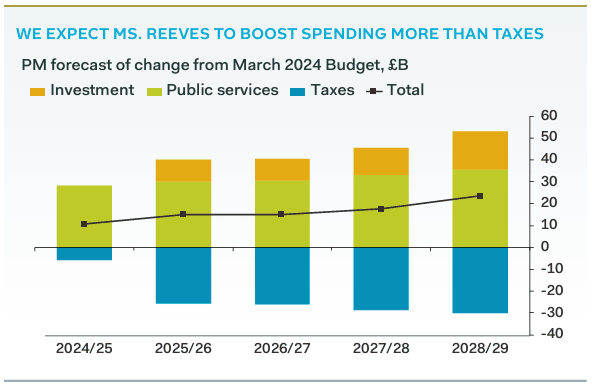

Image courtesy of Pantheon Macroeconomics.

Reeves is expected to alter the definition of the government's debt rule to allow up to around an extra £50BN in infrastructure spending.

The change is long overdue as the public sector is in dire need of investment, given this form of spending is usually the first to be cut when governments are looking for cost savings.

"A change to the measure of government debt has been flagged to allow more room to spend on infrastructure," says Clifton. "While the UK budget deficit is expected to improve over the coming years it will likely remain large. The large budget deficit may mean that the Bank of England does not need to reduce interest rates by as much as some of the other central banks."

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Analysis from Pantheon Macroeconomics suggests the government will deliver "looser fiscal policy" in the October 30 Budget, which will boost GDP by 0.5% in 2025/26.

"As a result, the MPC will need to hold Bank Rate 25-to-50bp higher than it would otherwise," says Robert Wood, Chief UK Economist at Pantheon Macroeconomics.

Pound Sterling enters the budget as one of 2024's best-performing major currencies owing to the cautious approach to interest rate cuts adopted by the Bank of England amidst better-than-expected economic data outturns in the first half of the year.

A well-received budget and a steady approach to rate cuts at the Bank can underpin Sterling's outperformance, particularly against the Euro and other European currencies.

Pantheon thinks Chancellor Reeves will raise government borrowing by an average of £17.2B per yea - 0.5% of GDP to boost tight day-to-day government spending plans.

Additional expenditure will be covered by tax hikes, but the Chancellor will borrow additional amounts to fund investments.