Pound Sterling Under Pressure against the Euro, Dollar and All Else

- Written by: Gary Howes

Above: GBP performance on Dec. 21.

The British Pound is experiencing notable selling pressure in midweek trade, despite a dearth of news to affix the moves to.

UK public sector borrowing data came in worse than expected but the charts reveal virtually no impact on the Pound following their release.

The UK currency was lower by three-quarters of a percent against the Dollar and two-thirds of a percent against the Euro by midday on December 21.

Losses were recorded against all its G10 peers (see above chart) which suggests a distinctly GBP-centric flavour to proceedings, despite no discernible UK data or newsflow to explain the movements.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

What is peculiar is that the losses come despite global stock markets looking perky, suggesting investor sentiment is relatively supported.

The Pound remains particularly reactive to global investor sentiment and therefore the broader context is, if anything, supportive.

Looking at bond markets shows yields are moving higher, but this is also true of yields in all other major economies.

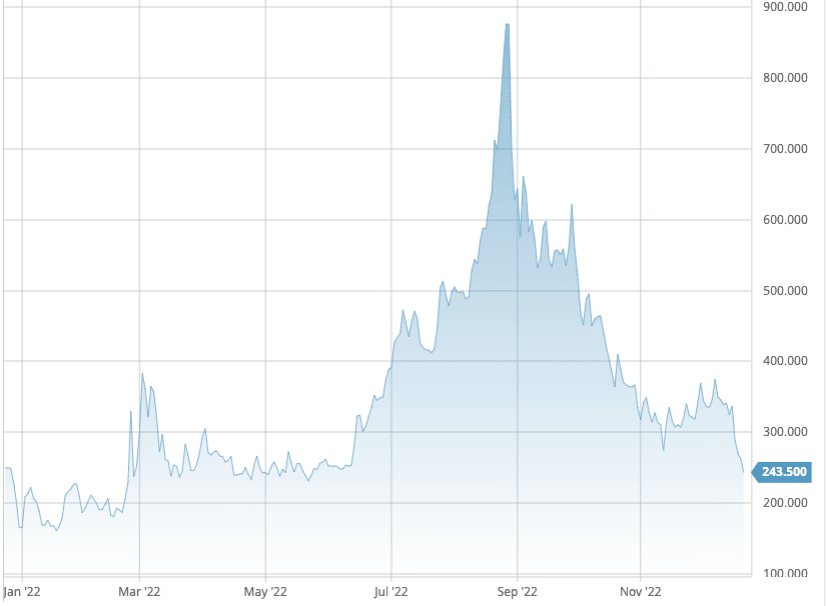

In fact, the UK news has been undeniably good with gas prices (for January delivery) falling to their lowest levels since June, meaning the impressive summer spike has been unwound.

In fact, on current short-term trends, gas prices could fall to levels seen before the Russian invasion of Ukraine, which is a clear positive for UK consumers and government finances:

Above: UK gas prices for January delivery. Source: Barchart.

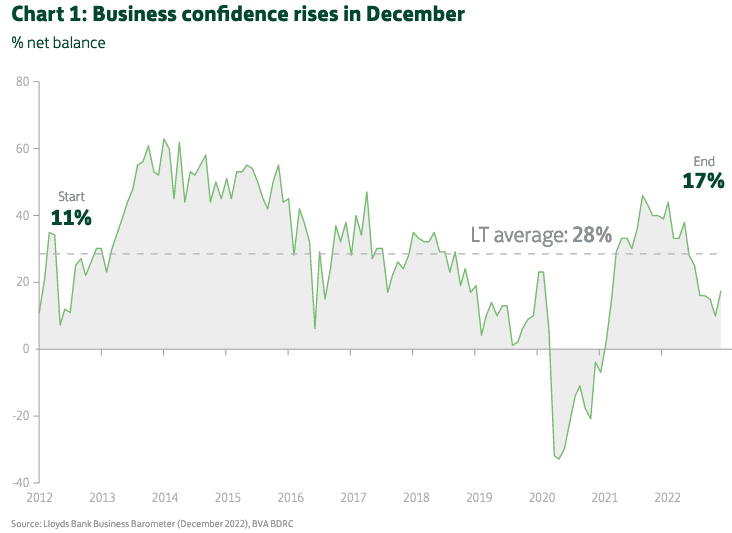

A measure of UK business confidence meanwhile reached a five-month high in December; "the revival was led by a sharp recovery in optimism about the whole economy," said Lloyds Bank in their latest Business Barometer findings.

Is the bottom in for UK business sentiment? It could be, as the net balance for economic optimism posted the biggest one-month rise since April 2021.

The Pound to Euro exchange rate has fallen to 1.1399 - its lowest in a month - at the time of writing, taking euro payment rates at high-street banks to approximately 1.1175. Competitive holiday money and cash providers are seen quoting around 1.1283 and competitive money transfer providers at 1.1369.

The Pound to Dollar exchange rate is at 1.2100, banks are offering at around 1.1861, good holiday and cash providers at 1.1979 and good payment providers at 1.2067.

Owing to a lack of clear drivers, the swings in the Pound might persist and there is potential for a reversion higher over the coming days.

However, if pressed for a directional call, it would appear the downside is currently easier to achieve than the upside.

"We continue to see mostly downside risks for the pound in the new year, as a recessionary environment and sensitivity to market instability may cause a return to the 1.15-1.18 range in cable. For this festive season, GBP/USD may hold around 1.2100-1.2250," says Francesco Pesole, FX Strategist at ING Bank.

This does however offer opportunities with near-term payment requirements, however, being reactive to movements will be important as no clear trends are likely to emerge until January.

(If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.)

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes