Trump's Ascendency Poses Risks to Dollar Buyers

- Written by: Gary Howes

Should I buy dollars ahead of the U.S. election? Consider covering at least half your exposure, says a leading foreign exchange dealer.

Official White House Photo by Shealah Craighead

Those looking to buy significant amounts of dollars should consider covering some of their requirements before November 05.

The Pound to Dollar exchange rate has slid below 1.30 in midweek trade amidst an ongoing decline that analysts say is linked to rising odds of a second Donald Trump presidency.

Trump is now the firm favourite amongst betting markets, which have a strong track record of picking the winner of the presidential race.

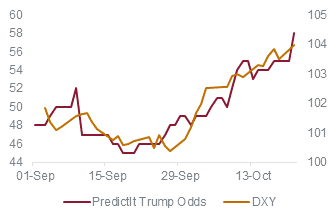

Image courtesy of CIBC.

Analysts say his policy agenda is more radical than that of his Democrat rival Kamala Harris, putting a number of USD-positive policies and scenarios in play.

Those with payments due in USD in the coming two weeks should cover at least half of that exposure, if that payment is significant or important, consider covering more, says Louisa Ballard, a dealer at Horizon Currency.

Ballard can be contacted directly on WhatsApp and is ready to assist those seeking assistance with large payments.

Why Should You Cover Some USD Exposure Ahead of the Vote?

When approaching international payments, always consider how to limit losses as opposed to maximising gains. This is a risk-averse approach to your money that rests on a 'least-regrets' outcome.

There is significant upside potential for the Dollar under a Trump and 'red sweep' outcome.

"We see the most bullish dollar outcome as a red sweep and the most bearish dollar outcome on a blue sweep, but the magnitude of the moves is likely larger in the former," says George Saravelos, an analyst at Deutsche Bank.

Analysts at Barclays say a Harris win would see the USD erase the Trump premium, which they think amounts to a 2% drop (i.e. 2% recovery in GBP/USD and EUR/USD).

Given this, If you are buying USD, where is the risk to your purchasing power? A Trump win, of course!

Trump continues to make modest gains in the polls, although nearly all remain well within the margin of error.

"With polling the closest in over 50 years of presidential election, a structural polling error in one direction or the other could mean either candidate sweeping all swing states," says a note from Citibank.

However, betting markets tell a different story as they show a clear lead for Trump. According to aggregates by Bookmakers Review, betting odds have accurately predicted 77% of the expected candidates winning over the last 35 years.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

"Betting markets have evolved into reasonably accurate predictors of elections - even more than some polls - but they're far from foolproof," says Thomas Gift, a political scientist who runs the Centre on U.S. Politics at University College London.

This increase in expectations is reflected in financial markets, which are themselves driven by expectations.

One such reflection is the stronger Dollar.

"We suspect Trump's proposed curbs on immigration and new tariffs would be stagflationary," says Paul Ashworth, Chief North America Economist at Capital Economics.

Currency analysts are broadly in agreement that Trump winning is supportive of the USD outlook owing to the significant import tariffs he intends to enact, which would raise domestic inflation and prevent the Federal Reserve from cutting as far and as fast as previously assumed.

"The proposed 10–20% increase in tariffs across the board has the potential to be inflationary," says Tom Kenny, Senior International Economist at ANZ Bank.