Pound Falls After Budget 2024 Sets Out Borrowing Binge

- Written by: Gary Howes

Chancellor Rachel Reeves delivers the Autumn Budget 2024. Picture by Lauren Hurley / DESNZ.

The Pound fell after the government announced a significant upgrade to the amounts it would need to borrow.

Chancellor Rachel Reeves set out plans to tax, borrow and spend more money over the next five years in an attempt to protect public services and boost investment.

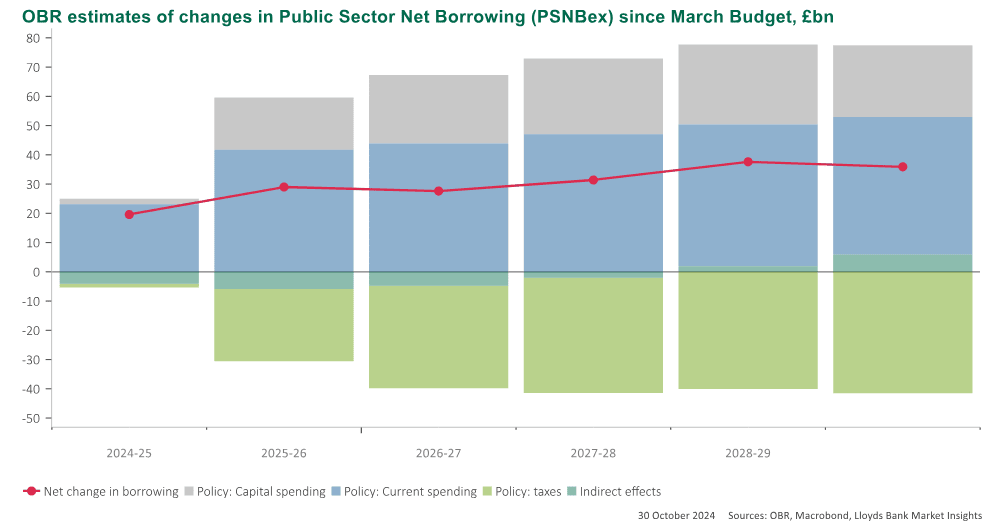

The aggregate upward revision to borrowing for the five-year period from 2024-25 to 2028-29 amounted to just over £142BN, which was a lot more than the approximate market estimate of around £80BN.

The developments triggered a selloff in UK government bonds as investors considered the increased supply of bonds that would come to market and the inflationary risks associated with the spending boost.

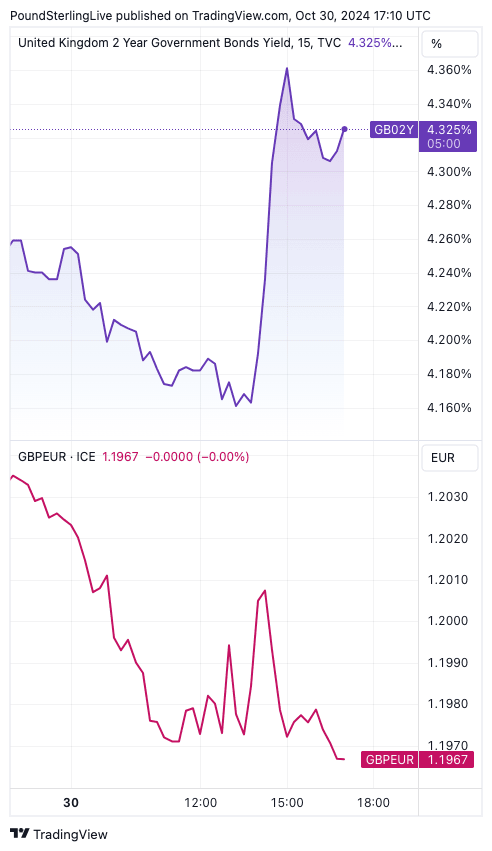

Typically, a spike in UK yields would be associated with a rise in the Pound. But, rising bond yields and a falling Pound imply a degree of nervousness.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

We saw the Pound and bond yields part direction following former Prime Minister Liz Truss' mini-budget of 2022.

To be sure, today's market is still relatively well behaved and we are not seeing any sign the market reaction is anything like it was two years ago.

Nevertheless, there is some unease creeping in.

Above: The additional amounts that will need to be borrowed over the next five years. Image courtesy of Lloyds Bank.

The government plans to increase spending by £70BN per year over the next five years, which will be funded by additional borrowing (issuing of gilts) and tax rises.

"Gilt yields are up in response to the Budget. There are at least two reasons for this, much more gilt supply than expected providing a rationale for yields at the long-end, and additional fiscal stimulus potentially stifling the Bank of England's easing cycle at the front-end," says Sam Hill, an analyst at Lloyds Bank.

The Pound to Euro exchange rate had traded as high as 1.2028 earlier in the day but was quoted at 1.1966 in subsequent hours. The Pound to Dollar exchange rate had been as high as 1.3042 before falling to 1.2992.

Above: UK 2-year bond yields (top) and GBP/EUR. Divergence in performance is rarely a good sign.

To limit the reliance on borrowing and to shrink the budget deficit in the coming years, Reeves announced tax hikes of £40BN, with the headline being a hike to the tax paid by employers when paying employee salaries.

Employer National Insurance rate was raised by 1.2 to 15% and the threshold will be cut from £9100 per annum to £5000.

"That is a £25bn tax rise, proportionally hitting harder those employing lower paid workers. Probably three quarters or so of the increase will flow through to lower pay," says Paul Johnson, Director at the Institute for Fiscal Studies.

Although the National Insurance hike is expected to weigh on wages (which is deflationary), the Office for Budget Responsibility, which assesses the spending and tax plans, said inflation won't fall back to the Bank of England's 2.0% target until the end of the decade.

The prospect of inflation remaining above target for the foreseeable future should ensure the Bank of England maintains a cautious approach to cutting interest rates, which can keep the Pound supported.

The Pound could, therefore, see downside risks remaining limited.

The OBR said Inflation will be at 2.5% in 2024 and remain above the Bank of England's 2.0% target in 2025 at 2.6%.

It is predicted to fall to 2.3% in 2026, 2.1% in 2027, 2.1% in 2028 and 2.0% in 2029.

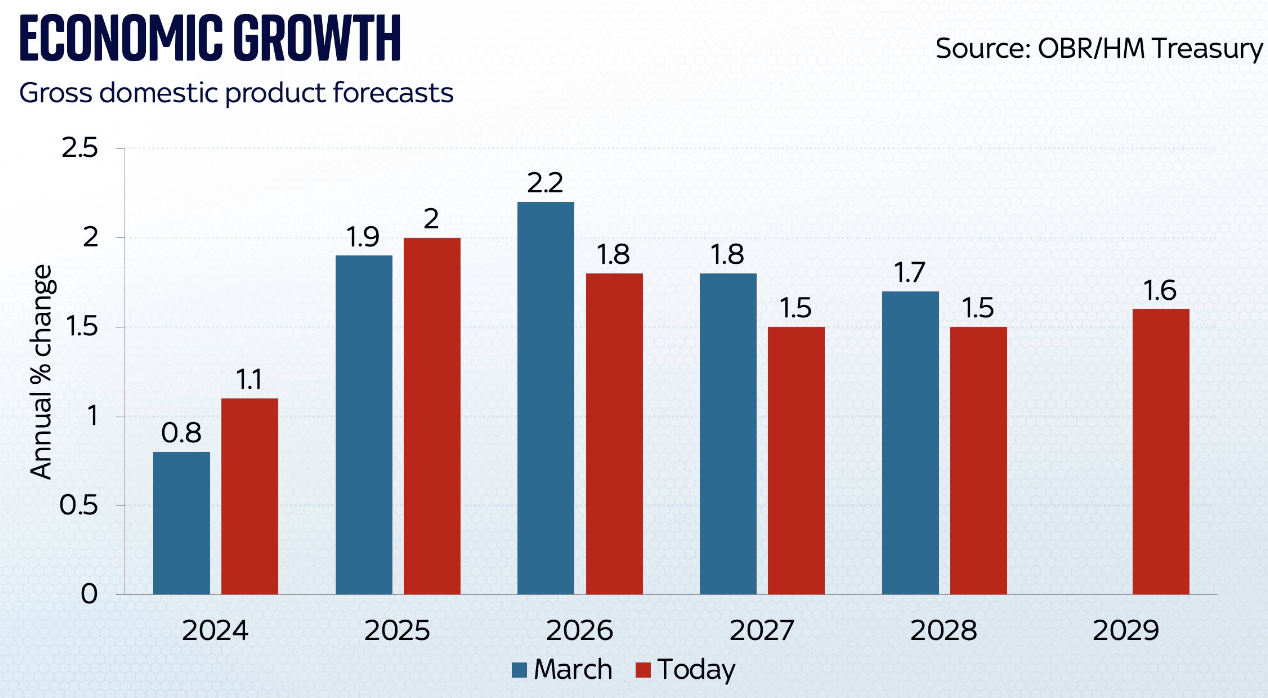

Despite the boost to spending, the OBR forecasts the economy will only grow by 1.1% in 2024, 2.0% in 2025, 1.8% in 2026, 1.5% in 2027, 1.5% in 2028 and 1.6% in 2029.

The government was able to boost spending and debt by changing its own debt rules. It will now target Public Sector Net Financial Liabilities, whereas the previous target was based on Public Sector Net Debt, excluding the Bank of England.

This simply means the government has more leeway to increase spending, with Reeves saying the additional borrowing would be spent on investments to bolster growth and not day-to-day spending.

"We will invest an additional £100bn over the next 5 years in capital spending. Only possible because of our investment rule," said Reeves.

🎯 GBP/EUR year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. 📩 Request your copy.

The increase in spending could yet bolster growth and analysts say this could strengthen the Pound's prospects over the medium term.

The government also announced day-to-day spending to rise by 1.5% per annum from this year; this compares to the 1.0% that the previous government had planned.