Pound Sterling Maintains Gains against Euro and U.S. Dollar, Johnson Hints at Lockdown Exit Measures "In Coming Days"

- Johnson says no relaxation of lockdown yet

- But announcement expected soon

- UK at moment of "maximum risk"

- GBP starts new week on strong footing

- GBP could come under pressure on extended lockdown period

27/04/2020. London, United Kingdom. The Prime Minister Returns to No10 .The Prime Minister Boris Johnson walks through the door of No10 Downing Street as he returns to work after recovering from the Coronavirus. Picture by Andrew Parsons / No 10 Downing Street

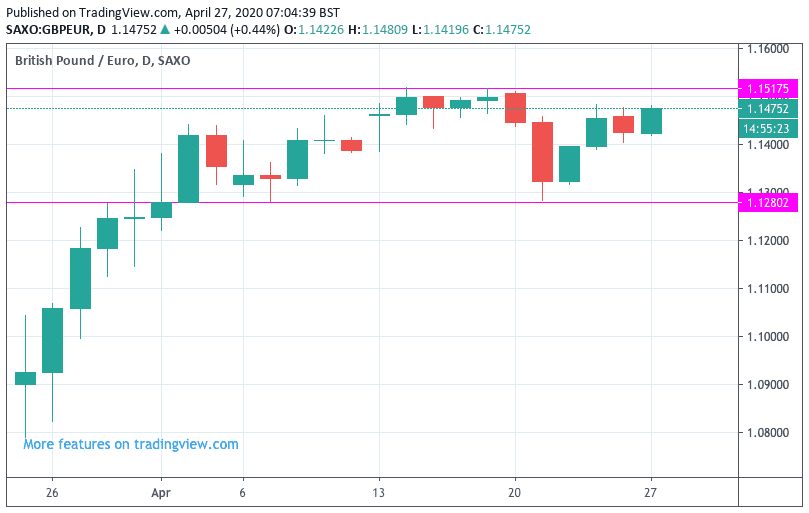

![]() - Spot GBP/EUR rate at time of writing: 1.1459

- Spot GBP/EUR rate at time of writing: 1.1459

- Bank transfer rates (indicative): 1.1191-1.1271

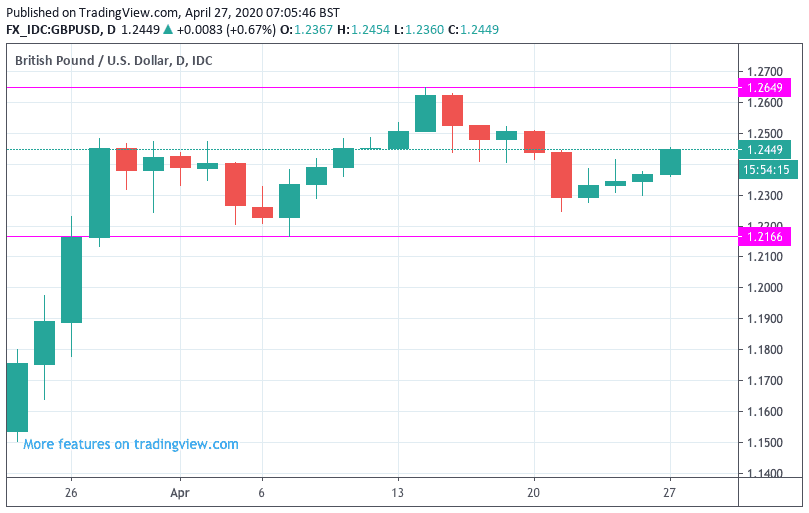

- FX specialist rates (indicative): 1.1322-1.1390 >> More information![]() - Spot GBP/USD rate at time of writing: 1.2432

- Spot GBP/USD rate at time of writing: 1.2432

- Bank transfer rates (indicative): 1.2068-1.2155

- FX specialist rates (indicative): 1.2146-1.2290 >> More information

The British Pound started the new week on the front-foot thanks to a broad-based rally in global stock markets, while a speech by Prime Minister Boris Johnson on the 10 Downing Street hinted that measures to ease lockdown measures could be announced soon.

The Pound could become increasingly sensitive to developments on the UK's lockdown exit strategy, and that Johnson hinted that in coming days the government could announce the lifting of restrictions is significant as the country and currency risk being left behind by peers that are already returning to normal.

Foreign exchange analysts suggest that those countries who successfully lift lockdown sooner, and see their economies recover, could ultimately see their currencies outperform. Therefore, Sterling could be at risk if the UK is left behind by its peers when it comes to the easing of lockdown measures.

But for Johnson, it is more important that the UK avoids a second wave of covid-19 infections than rush into a lifting of restrictions, as this could be far more damaging.

A second peak of the outbreak could lead to "economic disaster," said Johnson on his first day back at work after a short absence due to his covid-19 illness. "I ask you to contain your impatience".

He said there were "real signs now that we are passing through the peak", including with fewer hospital admissions and fewer Covid-19 patients in intensive care.

However, the Government will say "in the coming days" how it plans to end the lockdown, he said.

The ConservativeHome website believe that the Prime Minister would announce some easing after next week’s May Bank Holiday, "our reading of his statement this morning is that he wants to get on with it before then," says Paul Goodman, Editor at ConservativeHome.

The developments will underpin Sterling's solid start to the week: the Pound-to-Euro exchange rate maintains a healthy gain on the Euro at the time of writing with the pair quoted at 1.1456 while the Pound-to-Dollar exchange rate is up at 1.2484.

In his speech, Johnson also said:

"If this virus were a physical assailant, an unexpected and invisible mugger - which I can tell you from personal experience, it is - then this is the moment when we have begun together to wrestle it to the floor.

"And so it follows that this is the moment of opportunity, this is the moment when we can press home our advantage, it is also the moment of maximum risk.

"I know there will be many people looking at our apparent success, and beginning to wonder whether now is the time to go easy on those social distancing measures."

The Exit Matters for Sterling

Restrictions will therefore remain in place for the foreseeable future, with the need to prioritise the physical health of the nation and its healthcare service trumping the needs of the economy, which has undergone a spectacular collapse since lockdown restrictions were put in place a month ago.

We reported last week of concerns that Pound Sterling would struggle in the event that the UK was unable to deliver a credible and timely exit strategy, as this would disadvantage the economy relative to peers.

But the longer the restrictions last, the more capacity the economy loses and the greater the effort required to recover, which in turn could see foreign exchange markets asking questions of Sterling over coming weeks.

This will contrast significantly to economies such as New Zealand and Australia where authorities have all but declared the covid-19 outbreak defeated, allowing them to ease restrictions and resuscitate their gasping economies.

Under such scenarios, it is possible to imagine the New Zealand and Australian Dollars outperform Sterling.

In Europe, Italy has announced a set of measures to ease restrictions, confirming Europe's hardest-hit economy is coming out the other side of a dark chapter in its post-war history.

In the U.S. the Governor of the country's hardest hit state - New York - has set a date for the easing of some restrictions.

"A broad improvement in risk tone has swept across most major asset classes this morning, led by optimism of an easing in lockdowns around the world. New York Governor Cuomo announced a phased plan to reopen the state – possibly as early as 15 May. Meanwhile across Europe, Italian PM Conte said that the country would begin easing lockdown measures from 4 May, while Spain is expected to follow suit and announce some relaxation from 2 May," says Nikesh Sawjani, an economist at Lloyds Bank.

Over the course of the coming week we believe the global - and domestic focus - will be on lockdown exits, with foreign exchange analysts saying the speed with which a country's economy recovers could have a direct impact on its currency.

The currencies of those countries that make a rapid recovery from the 'corona crunch' relative to peers that will likely be rewarded.

However, a potential source of support for Sterling going forward are the strong measures put in place by the government to soften the economic impact of the lockdowns, with the country committing the equivalent of about 13% of its GDP to fighting the negative economic effects.

This contrasts to the EU where piecemeal response and an inability to settle on a Euro-wide fiscal response remains a concern for markets.

"From a fiscal policy perspective, Britain has an advantage over the EU, i.e. the UK economy may well recover much faster in the coming months. However, the resurgence of political risks (Brexit deadline) might limit the GBP's upside potential for the time being," says Marc-André Fongern at Fongern FX.

The UK Has an Exit Plan

The message from the Government is clear: the lockdown must continue, but we are aware that behind the scenes plans are indeed being drawn up for an exit.

Developments out of the UK over the weekend suggest the government is working on a strategy to get the country back to work, which could lessen the downside potential of the British Pound against a host of key currencies.

It is reported that the Treasury will propose a plan to “get Britain back to work” with measures including plans to ensure that offices and workplaces are free from coronavirus.

Chancellor of the Exchequer Rishi Sunak is reported to be drawing up measures to allow non-essential businesses to reopen in a "safe and practical way".

While it does appear there are plans afoot to stage an exit from the lockdown, no timing for the measures have yet been made available.

Above: GBP/EUR has been caught in a sideways trend this April

"With market attention now turning away from the trajectory of epidemiological curves and towards exit strategies, three observations make us very worried about the UK," said Oliver Harvey, Macro Strategist at Deutsche Bank, in a client note released last week.

The three cornerstones of concern cited by Harvey were:

1) That the UK's testing ability remains extremely poor.

2) Public support for a hard lockdown in the UK is very high.

3) The UK's economy is, on a relative basis, highly exposed to the coronavirus because consumption makes up 84% of the economy

"The UK appears to be caught in a double whammy. On the one hand, a less developed exit strategy than many other developed economies and question marks over its eventual execution, and on the other an economy that is highly exposed from a sectoral perspective to lockdowns. This should ultimately translate into a relatively harder hit to growth and, on a structural basis, be bearish for GBP," says Harvey.

The British Pound could therefore be sensitive to how effectively any lockdown exit is handled and markets will be eyeing the return of Prime Minister Boris Johnson to work this week for more clarity on the matter.

"PM Boris Johnson is due to return to work today, after having contracted Covid-19 earlier this month. The UK government has faced some criticism for failing to announce its exit strategy from lockdown, which is due to be reviewed on 7 May. Other countries have been more forthcoming, providing guidance on how the government would seek to balance demands to reopen the economy with risks of a second wave of infections," says Sawjani.

According to a report in The Times, the plans being considered by government will see businesses required to put up signs telling workers to remain two metres apart from one another and instruct staff to go home if they have symptoms of Covid-19.

It is also reported that companies will also be told to close "communal spaces" such as canteens, unless people are able to socially distance, and to ensure there is a widespread supply of hand-washing facilities and hand gel.

Furthermore, train companies are drawing up plans to run an almost full timetable within three weeks, with the government telling operators to prepare for an 80 per cent weekday service from May 18 in case ministers take the decision to partially lift the coronavirus lockdown.

Above: GBP/USD is caught in a range, but a shift in market focus to exit strategies could shake the exchange rate over coming weeks

Key to the UK's ability to exit lockdown will be the country's ability to test and trace cases. It is believed that the Government's scientific advisers are however suggesting that such a policy can only be credibly carried out once levels of infections have fallen to below a certain threshold. It is believed that once that threshold is met the Government will start laying out their policy for an exit from lockdown.

"The UK is lagging behind almost any medium to large economy globally when it comes to coronavirus tests. This will materially impact the government's ability to pursue a 'test and trace' approach when it comes to easing the lockdown," says Harvey.

However, the UK has been steadily increasing its testing capacity, with the Government last week announcing the biggest widening of access to coronavirus testing made possible due to substantially increased testing capacity.

Essential workers with coronavirus symptoms can now get tested, helping them return to work if test is negative.

A broad range of testing methods being rolled-out to increase accessibility, including home testing kits, mobile testing sites and satellite testing kits.