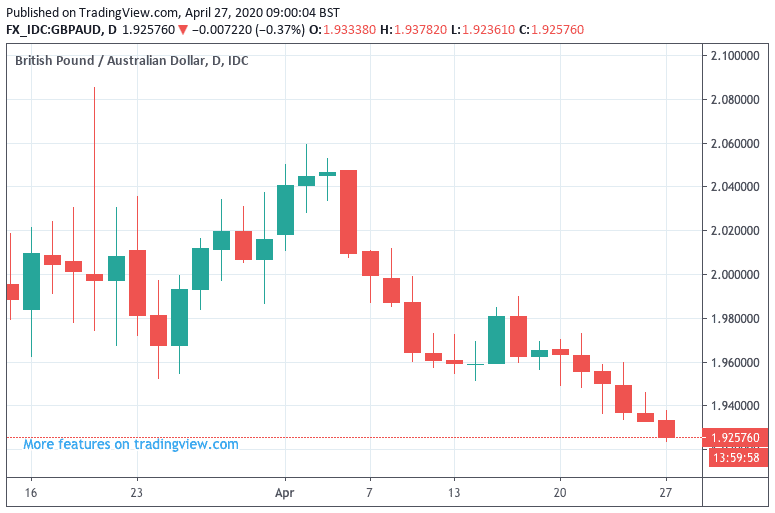

Pound-Australian Dollar Set for Sixth Consecutive Daily Decline as AUD Recovery Extends

- "Australian Dollar holds advantage" - analyst

- AUD aided by global risk sentient pick-up

- Australia starts easing lockdown conditions

Image © Adobe Images

- GBP/AUD spot rate at time of writing: 1.9268

- Bank transfer rates (indicative guide): 1.8594-1.8782

- FX specialist rates (indicative guide): 1.8834-1.9095 >> more information

The Pound-to-Australian Dollar exchange rate is looking set to register its sixth consecutive daily decline on Monday, April 26 amidst an ongoing recovery in global market sentiment which comes as investors eye the end of coronavirus lockdown measures across the world.

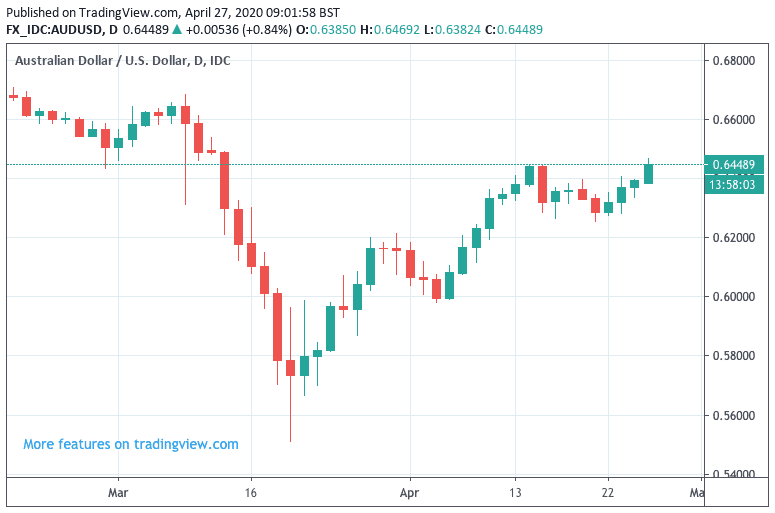

The Australian Dollar registered a further gain of 0.4% against its British counterpart and a gain of nearly a percent against the U.S. Dollar in sympathy with a broad-based rally in global stock markets and commodity prices.

"A broad improvement in risk tone has swept across most major asset classes this morning, led by optimism of an easing in lockdowns around the world. New York Governor Cuomo announced a phased plan to reopen the state – possibly as early as 15 May. Meanwhile across Europe, Italian PM Conte said that the country would begin easing lockdown measures from 4 May, while Spain is expected to follow suit and announce some relaxation from 2 May," says Nikesh Sawjani, an economist at Lloyds Bank.

The Australian Dollar tends to display a positive correlation to risk sentiment, rising when global markets are rising and falling when they are in retreat.

"AUD is outperforming as countries, including Australia, continue to slowly wind down COVID-19 constraints on economic activity," says Adam Cole, Chief Currency Strategist at RBC Capital Markets.

Above: The Australian Dollar is the best performing major currency of the past month

Australia's states have announced the partial lifting of lockdown conditions, which were put in place to curb spread of the covid-19 pandemic.

Western Australia Premier Mark McGowan said on April 26 that after "remarkable result" in the country’s fight against the deadly pathogen, he had decided to "cautiously relax" some of the "most extreme" restrictions in western Australia.

As of April 26, Australia has recorded 6,710 cases of coronavirus with at least 83 fatalities.

"The AUD was the strongest performing currency last week – even though global stock and emerging markets and key commodities lost ground," says John Noonan, Regional Director for Forex Watch in Asia, at Thomson Reuters. "This was likely due to Australia's success so far in containing the spread of the coronavirus.

Those countries that are able to get their economies back to speed in a relatively short time following the unprecedented lockdown measures will likely see their currencies outperform, and we are increasingly seeing this as a narrative behind recent AUD and NZD outperformance.

Both antipodean countries have been left relatively unscathed by the covid-19 virus, which has allowed them to seek a return to normal a lot sooner than European and North American countries, which could allow for some currency performance divergence.

The Pound-to-Australian Dollar exchange rate is quoted at 1.9253 at the time of writing, which makes for a sharp reversal from the April 02 high of 2.06 thanks to the Aussie Dollar's ongoing recovery.

The Australian-U.S. Dollar exchange rate (AUD/USD) is meanwhile quoted at 0.6452, but had been as high as 0.6469 which makes for the Aussie Dollar's best rate of exchange since March 12.

The Euro-to-Australian Dollar exchange rate (EUR/AUD) is quoted at 1.6815, placing the Euro at its weakest level since early March.

Thomson Reuters' Noonan says the Australian Dollar currently "holds the advantage" on the global foreign exchange market as investor sentiment looks set to remain a binary play on 'risk on' vs. 'risk off'.

Noonan says the optimistic market view is that the worst of the coronavirus pandemic is over and investors will continue to price in an economic recovery once the lockdowns are lifted.

But, "the pessimistic view is the full extent of the economic damage has not yet been revealed and the purging of companies and other entities with heavy debt burdens has just begun," says Noonan.

As such, expectations for a clear and uninterrupted path of recovery for the Aussie Dollar and global markets could yet be challenged.

The analyst says what will be critical to the outlook for markets in general, and the Australian Dollar in particular, will be the progress towards finding a cure and/or vaccine for COVID-19 and whether the phasing out of lockdowns can take place without sparking a second wave of infections.

Also central to the Australian Dollar's outlook will be the trajectory of China's recovery, as the world's second-largest economy remains Australia's number 1 trading partner and the engine for its exports.

"AUD/USD has good resistance at 0.6445/50, but if that level gives way, a test of the 200-day moving average around 0.6700 might follow," says Noonan.