Pound to Australian Dollar Week Ahead Forecast: Breaking Down

- Written by: Gary Howes

Image © Adobe Images

The Pound to Australian Dollar exchange rate (GBP/AUD) risks breaking into a downtrend.

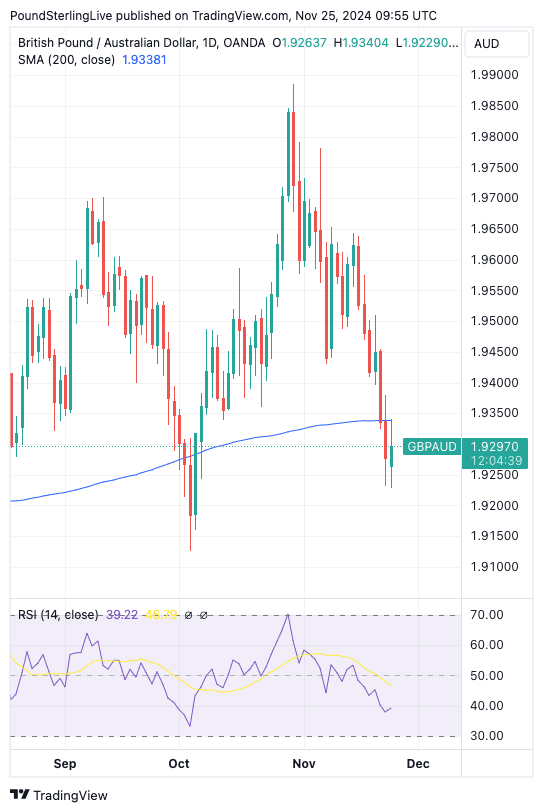

Last week, we saw GBP/AUD slip below the 200-day moving average, which can be considered a technical signal that the exchange rate has moved into a downtrend.

Indeed, GBP/AUD is now below all the key moving averages we monitor, and other momentum signals are advocating for lower levels. For instance, the RSI is at 41 and is pointing lower, consistent with the softening outlook.

This all raises the odds that the coming weeks will see lower GBP/AUD levels, with the October 04 low at 1.9124 being the first target.

GBP/AUD starts the new week with a slight gain, but we would need to see it break back above the 200 DMA (currently at 1.9338) for the setup to stabilise.

As the above chart shows, already an attempt to retake the 200 DMA has been rejected, suggesting the level now acts as a resistance point to any strength.

If the Pound can claw its way back above this resistance line then the near-term outlook stabilises somewhat in favour of a potential GBP/AUD rebound.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

This is what we will be looking for in the early stages of the week, but the initial failure leaves us wary of such an outcome.

GBP/AUD's recent breakdown came after Friday's UK PMI release revealed a sharp deterioration in UK business sentiment following the government's tax-grabbing budget.

Businesses have started to lower headcounts as the government's tax on jobs (national insurance) makes hiring and retaining staff more expensive.

"Underneath the hood, we are seeing stress on hiring plans. Both the manufacturing and services sectors reported falls in hiring plans. And (input) prices – particularly for services – have started to firm – as businesses digest the Budget tax implications," says Sanjay Raja, Deutsche Bank's Chief UK Economist.

🎯 GBP/AUD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

A rise in unemployment levels could encourage the Bank of England to cut interest rates faster, which would weigh on the Pound.

Growing economic headwinds in the UK contrast poorly with Australia, where the economy continues to run at full employment with now warnings blipping on the Reserve Bank of Australia's radar.

The RBA will be amongst the last central banks to cut interest rates, bestowing the AUD with some interest rate support into year-end.

In addition, the election of Donald Trump on November 05 has not turned out to be the AUD-negative development that some analysts had feared.

This all leaves GBP/AUD without any near-term disruptors, leaving the balance of risks look pointed to the downside, in our view.