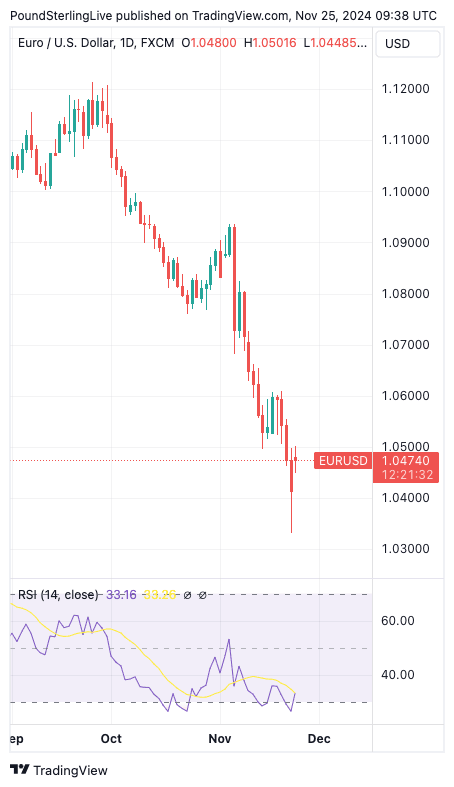

Euro to Dollar Week Ahead Forecast: Scrambling to Hold Above 1.04

- Written by: Gary Howes

Image © Adobe Images

The Euro to Dollar exchange rate could be due some relief in the coming five days.

Most momentum and technical indicators are still unambiguous in advocating for further EUR/USD weakness, and we would suggest readers have a significant bias towards anticipating further weakness.

If the selloff restarts, the Friday low of 1.0331 will be retested, followed by an eventual test of 1.02.

However, tactically, there is scope for some strength in the coming days as recent oversold conditions are corrected.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

"We maintain our view that many negatives are in the price of the EUR already," says Valentin Marinov, Head of G10 FX Strategy at Crédit Agricole. "We maintain our view that many positives related to Donald Trump’s victory at the US presidential election are already in the price of the USD."

The Euro opened the new week higher against the U.S. Dollar following the weekend news that Donald Trump had nominated Scott Bessent as his Treasury Secretary, meaning an experienced Wall Street veteran secured a role that includes delivering Trump his desired trade tariffs.

"The US dollar has weakened in the early stages of trading this week reflecting some easing concerns over the approach of the Trump administration to implementing trade tariffs following the confirmation from President-elect Trump that Scott Bessent would be his Treasury Secretary," says Derek Halpenny, Head of Research EMEA at MUFG Bank.

The Bessent pick is a clear nod to Wall Street experience, as Bessent is a well-known and successful hedge fund manager whom Elon Musk described as representing the status quo.

Musk is a disruptor and had some names he thought would be better at shaking things up at the Treasury, but it looks like the market doesn't share this appetite for risk.

The relief of Bessent's nomination is reflected in higher U.S. bonds and lower bond yields. This, in turn, is weighing on the U.S. Dollar.

🎯 EUR/USD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

"Bessent was not the choice of some prominent Trump supporters with Elon Musk suggesting he would be the 'business as usual' choice. Bessent has also in the past indicated a possible more balanced approach to the implementation of trade tariffs," says Halpenny.

Bessent has previously said he thinks tariffs would be a negotiating strategy, suggesting the policy might not be to simply implement across-the-board tariffs. This means the worst-case tariff scenario looks to be avoided.

The Dollar can give back some recent gains as the market retreats from 'max tariffs'.

However, Halpenny says perspective is required: "we would be sceptical at this stage of reading this Treasury Secretary selection as dollar bearish. It’s not and it likely means little in terms of the implementation strategy of trade tariffs going forward."

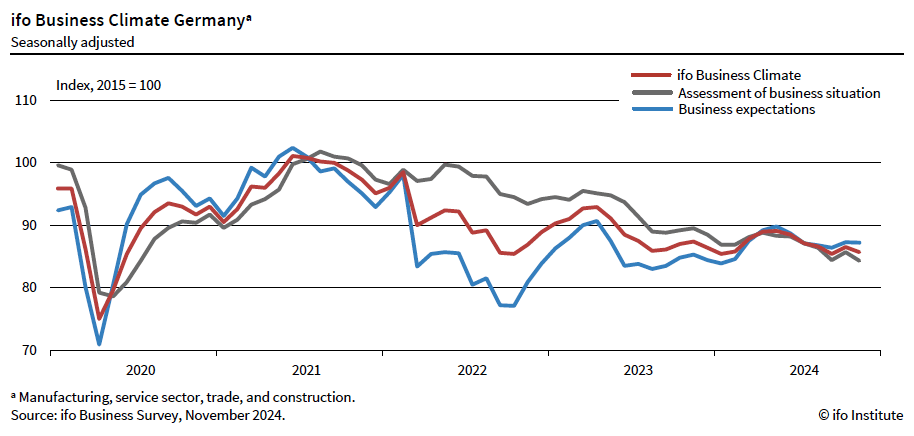

The Euro starts the new week digesting news the German Ifo Business Climate Index (BCI) survey showed a fall from 86.5 in October to 85.7 in November, which was weaker than expected (consensus 86.0).

The current conditions index fell from 85.7 to 84.3 and the expectations index fell from 87.3 to 87.2.

"The reading confirms that the German economy remains in the doldrums," says Franziska Palmas, Senior Europe Economist at Capital Economics. "The outlook for 2025 is also poor as a loss of competitiveness in industry and adverse demographics are likely to offset any boost from a recovery in real household incomes and monetary easing."

The BCI is consistent with German GDP contracting sharply, as is last week's PMI survey for November. The Composite PMI also fell further into recessionary territory in November.

The next major release will be Eurozone inflation figures, as they could determine whether the European Central Bank (ECB) cuts interest rates by a sizeable 50 basis points at next month's interest rate decision.

Thursday morning, Germany's states will release inflation numbers ahead of the official German inflation release later in the day. Spain also releases inflation numbers on the day.

The German and Spanish releases often serve as a good guide as to where the Eurozone inflation release - due on Friday - will land, and because of this, the impact on the Euro can be notable if there are some surprising deviations from expectation.

Eurozone inflation is forecast to have risen to 2.4% from 2.0% in October, which should ensure the ECB sticks to a 25 basis point cut next month.

However, if the inflation data undershoots, then the ECB could consider cutting rates by more, particularly given last week's disappointing PMI data.

If this is the case then the Euro could come under pressure.