Pound Sterling Firms, Aided by News of Substantive Lockdown Exit

- Strong start to week for GBP

- UK drawing up lockdown exit strategy

- Credible exit strategy key to GBP outlook

Above: Chancellor Rishi Sunak delivers the Government's daily covid-19 response press conference. Picture by Pippa Fowles / No 10 Downing Street.

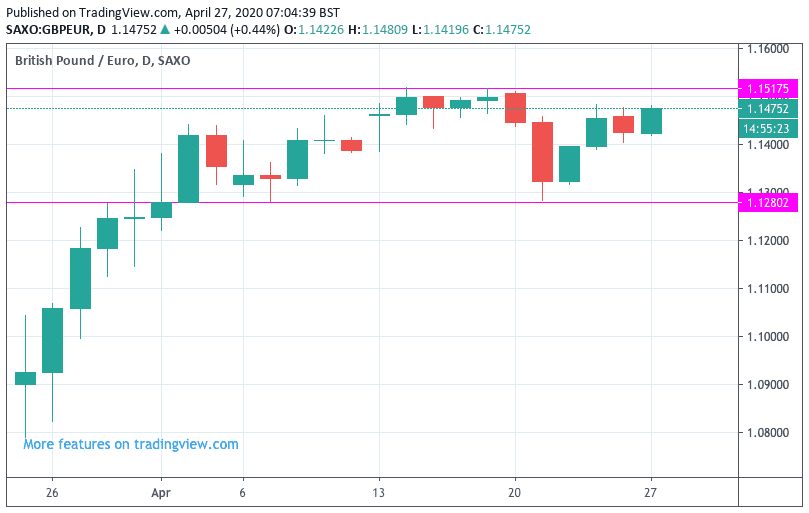

![]() - Spot GBP/EUR rate at time of writing: 1.1470

- Spot GBP/EUR rate at time of writing: 1.1470

- Bank transfer rates (indicative): 1.1169-1.1250

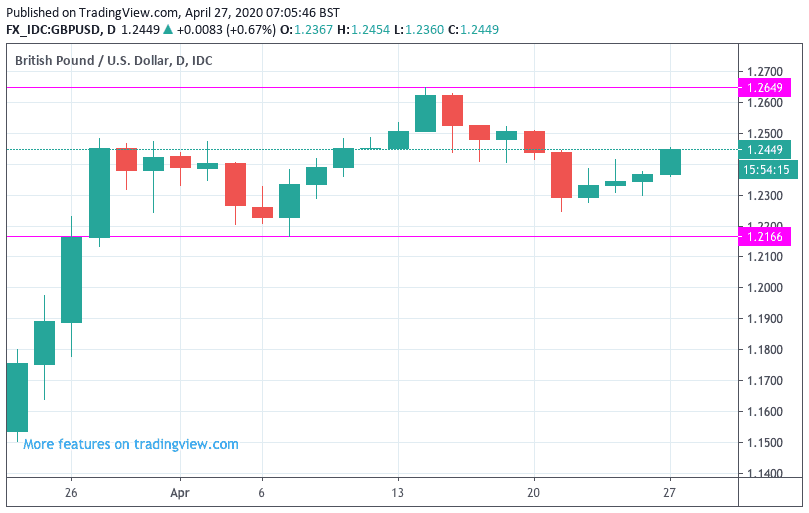

- FX specialist rates (indicative): 1.1233-1.1367 >> More information![]() - Spot GBP/USD rate at time of writing: 1.2440

- Spot GBP/USD rate at time of writing: 1.2440

- Bank transfer rates (indicative): 1.2105-1.2192

- FX specialist rates (indicative): 1.2180-1.23280 >> More information

The British Pound starts the new week on a positive note, rising against the Euro, Dollar, Yen and other 'risk off' currencies amidst a firm start to the work for global stock markets as the currency ultimately remains beholden to global investor sentiment, tending to rise when markets are rising and fall when they are in retreat.

With the global rate of coronavirus infections and deaths continuing to decline, the market narrative has increasingly become one of how countries exit their various lockdown strategies and return to growth.

"A broad improvement in risk tone has swept across most major asset classes this morning, led by optimism of an easing in lockdowns around the world. New York Governor Cuomo announced a phased plan to reopen the state – possibly as early as 15 May. Meanwhile across Europe, Italian PM Conte said that the country would begin easing lockdown measures from 4 May, while Spain is expected to follow suit and announce some relaxation from 2 May," says Nikesh Sawjani, an economist at Lloyds Bank.

The Pound-to-Euro exchange rate has risen by a third of a percent in sympathy with the improved mood to quote at 1.1464 at the time of writing, the Pound-to-Dollar exchange rate is meanwhile up two-thirds of a percent at 1.2435.

Over the course of the coming week we believe the global - and domestic focus - will be on lockdown exits, with foreign exchange analysts saying the speed with which a country's economy recovers could have a direct impact on its currency.

The currencies of those countries that make a rapid recovery from the 'corona crunch' relative to peers that will likely be rewarded.

Developments out of the UK over the weekend suggest the government is working on a strategy to get the country back to work, which could lessen the downside potential of the British Pound against a host of key currencies. We reported last week of concerns that Pound Sterling would struggle in the event that the UK was unable to deliver a credible and timely exit strategy, as this would disadvantage the economy relative to peers.

It is reported that the Treasury will propose a plan to “get Britain back to work” with measures including plans to ensure that offices and workplaces are free from coronavirus.

Chancellor of the Exchequer Rishi Sunak is reported to be drawing up measures to allow non-essential businesses to reopen in a "safe and practical way".

While it does appear there are plans afoot to stage an exit from the lockdown, no timing for the measures have yet been made available.

Above: GBP/EUR has been caught in a sideways trend this April

"With market attention now turning away from the trajectory of epidemiological curves and towards exit strategies, three observations make us very worried about the UK," said Oliver Harvey, Macro Strategist at Deutsche Bank, in a client note released last week.

The three cornerstones of concern cited by Harvey were:

1) That the UK's testing ability remains extremely poor.

2) Public support for a hard lockdown in the UK is very high.

3) The UK's economy is, on a relative basis, highly exposed to the coronavirus because consumption makes up 84% of the economy

"The UK appears to be caught in a double whammy. On the one hand, a less developed exit strategy than many other developed economies and question marks over its eventual execution, and on the other an economy that is highly exposed from a sectoral perspective to lockdowns. This should ultimately translate into a relatively harder hit to growth and, on a structural basis, be bearish for GBP," says Harvey.

The British Pound could therefore be sensitive to how effectively any lockdown exit is handled and markets will be eyeing the return of Prime Minister Boris Johnson to work this week for more clarity on the matter.

"PM Boris Johnson is due to return to work today, after having contracted Covid-19 earlier this month. The UK government has faced some criticism for failing to announce its exit strategy from lockdown, which is due to be reviewed on 7 May. Other countries have been more forthcoming, providing guidance on how the government would seek to balance demands to reopen the economy with risks of a second wave of infections," says Sawjani.

According to a report in The Times, the plans being considered by government will see businesses required to put up signs telling workers to remain two metres apart from one another and instruct staff to go home if they have symptoms of Covid-19.

It is also reported that companies will also be told to close "communal spaces" such as canteens, unless people are able to socially distance, and to ensure there is a widespread supply of hand-washing facilities and hand gel.

Furthermore, train companies are drawing up plans to run an almost full timetable within three weeks, with the government telling operators to prepare for an 80 per cent weekday service from May 18 in case ministers take the decision to partially lift the coronavirus lockdown.

Above: GBP/USD is caught in a range, but a shift in market focus to exit strategies could shake the exchange rate over coming weeks

Key to the UK's ability to exit lockdown will be the country's ability to test and trace cases. It is believed that the Government's scientific advisers are however suggesting that such a policy can only be credibly carried out once levels of infections have fallen to below a certain threshold. It is believed that once that threshold is met the Government will start laying out their policy for an exit from lockdown.

"The UK is lagging behind almost any medium to large economy globally when it comes to coronavirus tests. This will materially impact the government's ability to pursue a 'test and trace' approach when it comes to easing the lockdown," says Harvey.

However, the UK has been steadily increasing its testing capacity, with the Government last week announcing the biggest widening of access to coronavirus testing made possible due to substantially increased testing capacity.

Essential workers with coronavirus symptoms can now get tested, helping them return to work if test is negative.

A broad range of testing methods being rolled-out to increase accessibility, including home testing kits, mobile testing sites and satellite testing kits.