Pound Sterling Would Suffer on a Botched Lockdown Exit Strategy: Deutsche Bank

- UK death toll from covid-19 on a downward trajectory

- Exit strategies could soon matter for currencies

- GBP could suffer if UK exits lockdown slowly

- Pressure grows on UK govt. to announce exit measures

Above: The Foreign Secretary Dominic Raab chairs the daily Press conference on Covid-19 inside No10 Downing Street with the Chief Medical Officer, Professor Chris Whitty and the Chief of the Defence Staff Nick Carter . Picture by Andrew Parsons / No 10 Downing Street

![]() - Spot GBP/EUR rate at time of writing: 1.1463

- Spot GBP/EUR rate at time of writing: 1.1463

- Bank transfer rates (indicative): 1.1162-1.1242

- FX specialist rates (indicative): 1.1229-1.1360 >> More information![]() - Spot GBP/USD rate at time of writing: 1.2344

- Spot GBP/USD rate at time of writing: 1.2344

- Bank transfer rates (indicative): 1.2012-1.2098

- FX specialist rates (indicative): 1.2095-1.2233 >> More information

The UK has announced its lowest number of week-day hospital deaths linked to coronavirus for three weeks, confirming the death rate is starting to come down and leading to increased calls by the country's media for the government to reveal its exit strategy from lockdown.

Foreign exchange market focus could soon turn to how a country exits from lockdown - and how fast its economy recovers - relative to its peers, meaning the British Pound could be sensitive to how effectively the issue is handled.

Most developed market countries have been equally hard-hit by lockdown measures aimed at slowing the spread of covid-19, ensuring there has not been any clear country-specific currency reaction to the crisis.

For instance, the Australian Dollar and Sterling have both been subject to broader market risk trends than country-specific trends in domestic covid-19 rates, deaths and prevention measures.

But, this could all soon change as market focus turns to exit strategies as it is believed that those countries that are able to exit fast and with vigour will see their currencies outperform on a relative basis.

For the UK and the British Pound, such a shift in market focus would have analysts at Deutsche Bank worried.

"With market attention now turning away from the trajectory of epidemiological curves and towards exit strategies, three observations make us very worried about the UK," says Oliver Harvey, Macro Strategist at Deutsche Bank.

The three cornerstones of concern cited by Deutsche Bank are:

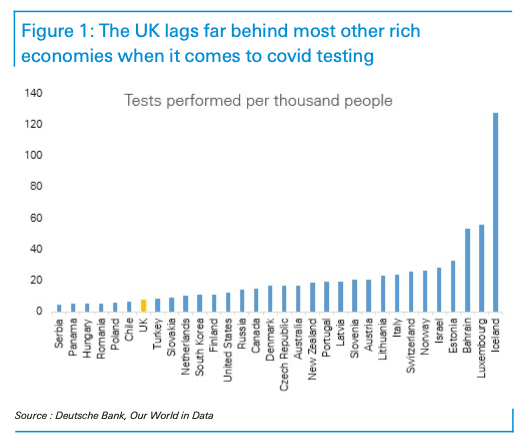

1) That the UK's testing ability remains extremely poor.

2) Public support for a hard lockdown in the UK is very high.

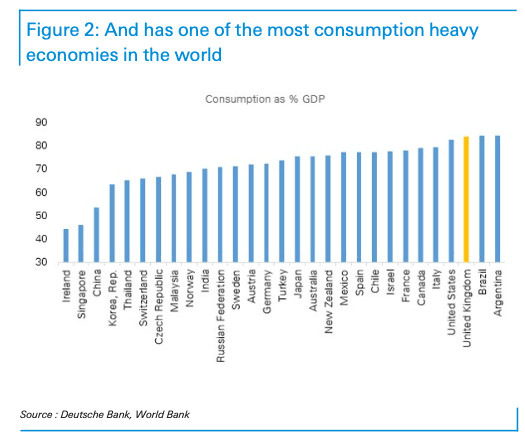

3) The UK's economy is, on a relative basis, highly exposed to the coronavirus because consumption makes up 84% of the economy

The quandary that all governments face is whether saving the economy after weeks of shutdown is worth risking more lives to coronavirus. But, from a purely foreign exchange angle it is becoming clear that those countries that get back on their feet first would likely see their currencies outperform.

An early example of this dynamic came at the start of this week when we saw the New Zealand Dollar outperform its peers after the government there announced it would be easing lockdown measures.

For many countries making an exit from coronavirus lockdowns the ability to test and trace incidences of the virus will be key to avoiding a second peak in infections. Harvey says the UK's ability to test for coronavirus still remains poor compared to other countries and, "this will materially impact the government's ability to pursue a 'test and trace' approach when it comes to easing the lockdown".

The UK government did however say on Thursday that it was substantially increasing its testing rate to extend beyond NHS workers to care workers and their families. The Health Secretary Matt Hancock told a daily coronavirus media briefing that they were well on their way to achieving the 100K a day target they would like to achieve.

Success in meeting this target would therefore prove to be a net positive for Sterling, as a sluggish an ungainly exit from lockdown could prompt foreign exchange markets to turn their fire on the currency.

The UK government does not yet appear ready to announce exit measures, despite news on Thursday that hospital deaths on Wednesday April 22 stood at their lowest weekday total in three weeks at 638.

The UK remains reluctant to spell out an exit from lockdown with Dominic Raab, deputising for Prime Minister Boris Johnson, saying on April 16 that the lockdown measures will remain in place for "at least" three more weeks.

"The worst thing that we can do right now is to ease up too soon, and allow a second peak of the virus to hit the NHS and hit the British people," said Raab. "It would be the worst outcome not just for public health but for the economy and for our country as a whole."

It is believed the government wants to see a clear and undisputable trend lower in the rate of deaths and infections before it considers lifting lockdown measures and while the death rate is falling, it has not yet met the criteria set out by the government's scientific advisers.

However, pressure on the UK government is likely to increase as a restless news cycle, observing the lifting of restrictions in other EU countries, starts to clamour for similar developments in the UK.

Recent coronavirus daily press briefings have seen journalists repeatedly accuse the government of not being clear with the public on how an exit would look. This pressure will have risen on Thursday after Scotland's First Minister Nicola Sturgeon said it was wrong to treat the public as children, as she laid out some potential exit strategies for Scotland.

Understandably, the UK government will be resistant to the idea that some parts of the country exit lockdown while other nations see no changes.

But the government's strategy is to maintain the line that they continue to be lead by the data and science on the matter and it is still too soon to announce a strategy as it could prompt the public to ease back on social distancing measures.

The longer the UK remains in lockdown, the greater the hit to its economy according to Deutsche Bank whose analysis shows the UK's economy is, on a relative basis, highly exposed to the coronavirus lockdowns because consumption makes up 84% of the economy, higher than any major country other than Brazil and Argentina.

Harvey explains this reliance on consumption was one reason behind the OBR's dramatic prediction of a 35% drop in GDP during Q2 last week, more than three times larger than some equivalent estimates for Germany.

"Far more worrying than the short term effect, however, is the prospect that government restrictions on many forms of consumption, or social attitudes, persist much longer. In this scenario, the economic shock caused by structural changes to consumer spending on restaurants, retail, hotels, transportation, culture, education and possibly even housing, will be more acutely felt by the UK where they make up a relatively large share of the economy," says Harvey.

Media reports suggest some social distancing and lockdown measures would continue throughout much of the year, which would have direct consequences for the UK's services economy, which makes up over 80% of UK economic activity.

The Scientific Pandemic Influenza Group on Modelling, which feeds into the Scientific Advisory Group for Emergencies (Sage), has proposed that parts of the country could enjoy greater freedoms for six months at a time, before returning to lockdown.

Based on the UK's unique position, Deutsche Bank are bearish on the outlook for the Pound.

"The UK appears to be caught in a double whammy. On the one hand, a less developed exit strategy than many other developed economies and question marks over its eventual execution, and on the other an economy that is highly exposed from a sectoral perspective to lockdowns. This should ultimately translate into a relatively harder hit to growth and, on a structural basis, be bearish for GBP," says Harvey.

At the time of writing the Pound remains largely a slave to broader market dynamics, showing a positive correlation with markets such as equities and oil prices.

For instance, the below chart shows the Pound-to-Euro exchange rate has largely tracked the fortunes of Brent crude prices:

However, these relationships are unlikely to last and should the market's focus shift when the coronacrisis starts to fade as a concern, other drivers could start to take hold.

For Sterling the prospect of the UK and EU failing to reach a trade agreement by year-end, combined with a sluggish exit from the economic crisis caused by coronavirus, could make for a potent cocktail that advocates for weakness.