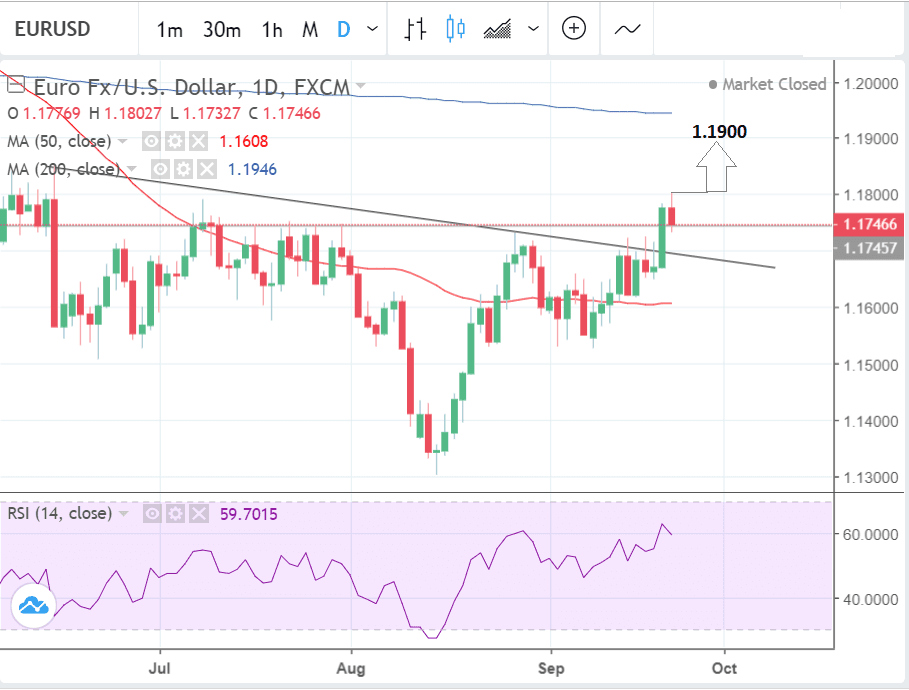

EUR/USD Week Ahead Forecast: Uptrend Forecast to Continue as 'Neckline' Breached, 1.19 Possible

Image © European Central Bank

- EUR/USD has reached new highs above 1.1800

- The short-term uptrend is likely to extend in the week ahead

- Eurozone inflation key for Euro; for Dollar, all eyes will be on the Fed

The Euro rose versus the U.S. Dollar in the previous week, reaching a peak of 1.1803 as the Dollar eased back and the Euro rose on continued faith in the European Central Bank (ECB) unwinding their monetary stimulus programme and eventually increasing interest rates.

The promise of less stimulus or quantitative easing (QE) has helped the Euro rise but it is conditional on inflation not falling any lower, so next week's inflation data should be an important deciding factor for the pair.

The U.S. Dollar, meanwhile, could be impacted by the economic predictions released by the Federal Reserve (Fed) at their monetary policy meeting on Wednesday. If the Fed forecasts continued strong growth USD will probably rise; if not most of the 'good news' may already be priced in and the Dollar could weaken allowing the Euro to push even higher.

From a technical standpoint, the pair is still in a short-term uptrend which is forecast to rise further assuming the exchange rate can re-break above the 1.1803 highs. Such a break would confirm a bullish extension to the next target at 1.1900 initially, followed by 1.1947.

EUR/USD looks like it may have formed a bottoming reversal pattern at the complex lows formed since June.

If it has indeed formed such a pattern the neckline has probably now also been broken by the last rally higher. A break above the neckline would be a very bullish indicator for the pair and probably forecast a move higher of a similar length as the height of the pattern. In this case, it could suggest an eventual move all the way up to the 200-day moving average (MA) at 1.1946.

At the 200-day it is increasingly likely to stall and pull-back as it encounters increasing selling pressure. Major moving averages such as the 200-day MA present obstacles to the trend and often lead to reversals.

Short-term technical traders exacerbate the resistant effect by entering the market at the MA and selling the pair in anticipation of downside, which often leads to further pressure lower.

Advertisement

Lock in the Euro's gains: Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here

The Euro: What to Watch this Week

September inflation data is the main release in the week ahead for the Euro given ongoing concerns about whether the European Central Banking (ECB) will stick to their plans to end monetary stimulus.

The data is out on Friday, September 28 at 10:00 B.S.T. The consensus forecast is for headline inflation to rise to 2.1% (from 2.0%) and core inflation to rise to 1.1% (from 1.0%).

A lower-than-expected inflation result will lead to further speculation that the ECB could delay plans to remove stimulus and may weigh on the Euro.

Inflation was weaker-than-expected in August and there is a risk the same could happen in September.

A result more in line with these figures could, actually, see the Euro rise instead.

For further guidance on ECB policy keep an eye on the speeches of Mario Draghi - he is scheduled to speak twice in the coming week, on Monday and Thursday. The Monday speech is scheduled for 14:00 B.S.T., the Thursday speech is scheduled for 14:30 B.S.T.

The Dollar: What to Watch

The main release in the week ahead for the Dollar is the meeting of the U.S. Federal Reserve (Fed) on Wednesday at 19.00 B.S.T.

Everyone expects the Fed to raise interest rates by 0.25% at the meeting, with a circa 100% probability expectations according to Fed funds futures.

Given the expectation is so high an affirmative decision is now probably already priced into the Dollar so only a deviation from the expected is likely to lead to a major move in the exchange rate.

The Fed will release its economic forecasts at the same time and these too may impact on the Dollar if they are different from the previous meeting.

"The real focus will be the FOMC’s updated economic forecasts, in particular, committee members’ projections on how many times they expect to lift interest rates in 2019. In June, the FOMC’s dot plot chart pointed to three more rate rises in 2019. Any change to that forecast would likely trigger significant moves for the dollar. A downward revision is possible if FOMC members cite increased trade risks, whereas an upward revision could come if policymakers become more concerned about higher wage growth," says a report covering the coming week from brokers XM.com.

Another major release is Conference Board (CB) consumer confidence which is forecast to show a slight fall to 132.0 from 133.4, when it is released on Tuesday at 15.00. Given the vast contribution of US consumers to the US economy the metric is an important gauge of growth.

New Home Sales is forecast to rise 3k to 630k from 627k previously in August when it is released at 15.00 B.S.T. on Wednesday.

Pending Home Sales are also out in the week ahead and are expected to show a -0.1% fall when they are released at 15.00 on Thursday.

The Fed's favoured gauge of inflation, Personal Consumption Expenditure (PCE) is forecast to show a 0.1% rise in August and 2.0% rise compared to a year ago when it is released at 13.30 on Friday.

Advertisement

Lock in the Euro's gains: Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here