Euro-to-Dollar Week Ahead Forecast: Coming Off the Boil

- Written by: Gary Howes

Image © Adobe Images

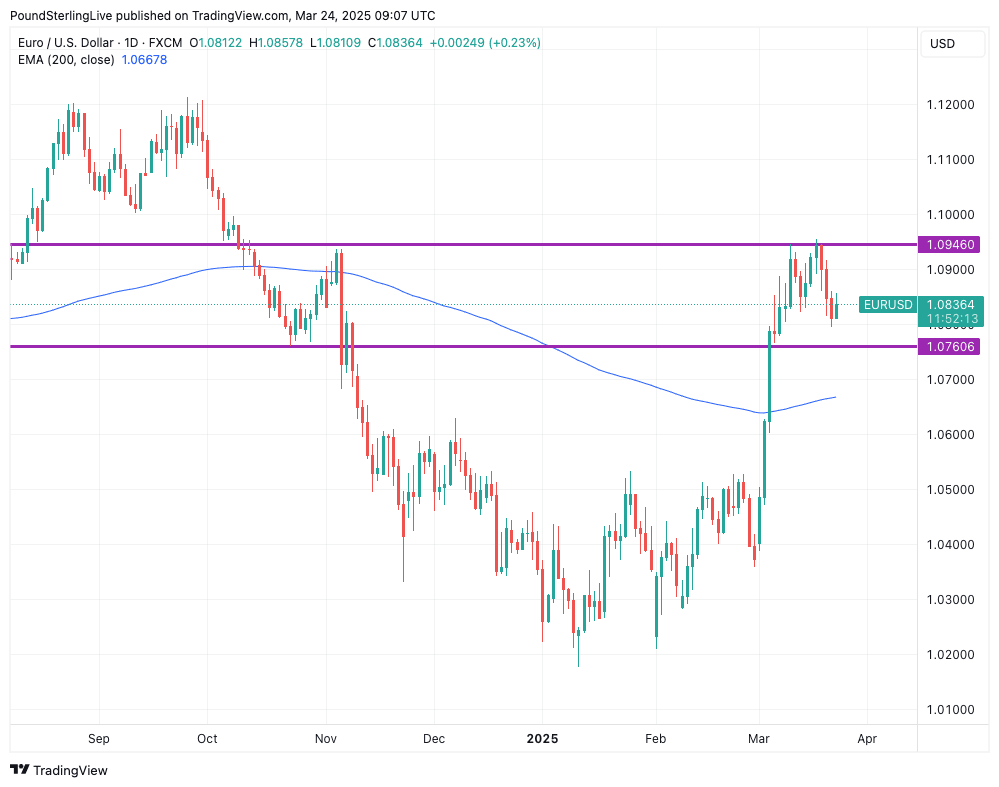

The Euro is off the highs, but the broader trend remains constructive.

The Euro-to-Dollar exchange rate trades with a slight bid on Monday morning as it looks to snap a run of three consecutive daily losses.

Those losses represent a pullback from the resistance level of 1.0946, which was tested twice last week and rejected.

🎯 EUR/USD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

The failure to break through the ceiling follows a significant selloff in the USD and a ramp-up in positive sentiment towards the Euro, linked to hopes Germany will spend the Eurozone economy into a new phase of expansion.

But, the move has reached its near-term limits, and we are seeing failures in other USD-based exchange rates, confirming a broader relief-style bid for the Dollar is returning as the market pauses the 2025 selloff ahead of the April 02 tariff announcements.

This 'cooling-off' could well be the theme for the coming week, and further losses in Euro-Dollar are possible, with markets likely to turn more nervous about the April 02 reciprocal tariff announcements due on April 02.

The first downside target is graphical support at 1.0760, which is in scope for the coming week. Should the selloff extend into next week, then the 200-day exponential moving average at 1.06678 comes into play.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

Bigger picture, while above the 200-day EMA, the exchange rate is in an uptrend and pullbacks should ultimately give way to fresh highs over a multi-week timeframe.

If the Dollar weakens again, then a retest of the 2025 high at 1.0946 becomes likely ahead of a multi-week move to 1.12.

"Even after this significant rebound, the EUR/USD still has upside potential in coming months, buoyed by a news flow that is unfavourable to the U.S dollar and favourable to the euro," says Nordine Naam, FX analyst at Natixis.

Eurozone PMIs Underwhelm

Euro-Dollar was as high as 1.0857 earlier in the day but has since retreated to 1.0829, with a Eurozone PMI report for March somewhat underwhelming.

Eurozone services PMI read at 50.4, which was below the consensus expectation for 51 and down on February's 50.6.

Manufacturing is still in contraction at 48.7, while the composite PMI read at 50.4, which was up a shade on the previous print of 50.2.

All eyes were on the German number, released half an hour prior, where there were hopes for a sentiment boost from the spending 'Bazooka' being worked on by the government. These hopes weren't quite met:

The services PMI read at 50.2, which is below expectations for a reading of 51.4 and actually down on February's 51.1.

Manufacturing recovered to 48.3 from 46.5, leaving the composite PMI at 50.9, below expectations for 51.2.

In all, this is a bit of a sobering outturn in light of the recent "EURphoria" and a reminder that the benefits of a German fiscal stimulus will play out over the longer term.

What's Coming Up

Tuesday, March 25

📌 Germany IFO Business Climate (Mar)

Business Climate Index:

Expected: 86.7 | Previous: 85.2

Expectations Component:

Expected: 87.5 | Previous: 85.4

Current Assessment:

Expected: 85.5 | Previous: 85.0

🔹 EUR Sensitivity:

A continued improvement in sentiment, especially expectations, could boost EUR by suggesting greater business confidence. A disappointment may suggest Germany’s recovery remains fragile, potentially weighing on EUR.

Thursday, March 27

📌 Eurozone M3 Money Supply (Feb, YoY)

Expected: 3.8%

Previous: 3.6%

🔹 EUR Sensitivity:

A faster M3 growth rate could suggest credit creation and monetary expansion, potentially supporting EUR modestly. Weak growth would point to tepid economic activity, likely neutral to mildly negative for EUR.

Friday, March 28

📌 Eurozone Economic Confidence (Mar)

Expected: 96.7

Previous: 96.3

🔹 EUR Sensitivity:

A rise in sentiment would reflect growing optimism, supporting EUR. A flat or weaker print could indicate sluggish confidence, softening EUR outlook.

📌 Germany Unemployment Change & Rate (Mar)

Unemployment Change: Expected: +10K | Previous: +5K

Unemployment Rate: Expected: 6.2% (unchanged)

🔹 EUR Sensitivity:

Rising unemployment could raise labour market concerns, weighing on EUR. Stable/lower unemployment may support EUR via signs of underlying strength.

📌 France & Spain – EU Harmonised CPI (Mar, Preliminary)

France CPI (YoY):

Expected: 1.1% | Previous: 0.9%

Spain CPI (YoY):

Expected: 2.6% | Previous: 2.9%

🔹 EUR Sensitivity:

Higher inflation prints in France or Spain may delay ECB rate cut expectations, supporting EUR. Lower CPI would reinforce a disinflationary narrative, potentially weakening EUR.

USD Week Ahead

Image © Adobe Images

Monday, March 24

📌 S&P Global Flash PMIs (Mar)

Manufacturing PMI:

Expected: 51.8

Previous: 52.7

Services PMI:

Expected: 51.2

Previous: 51.0

🔹 USD Sensitivity:

Above 50 signals expansion; if PMIs hold up, it supports the Fed’s soft landing narrative, boosting USD. A drop toward 50 or below could raise slowdown concerns, weighing on USD.

Tuesday, March 25

📌 Conference Board Consumer Confidence (Mar)

Expected: 94.0

Previous: 98.3

🔹 USD Sensitivity:

Confidence falling in line with expectations may reflect moderating consumer momentum. A positive surprise would boost growth expectations, supporting USD.

📌 New Home Sales (Feb, MoM)

Expected: +3.5%

Previous: -10.5%

🔹 USD Sensitivity:

Not typically a significant driver of USD.

Wednesday, March 26

📌 Durable Goods Orders (Feb, Preliminary)

Expected: -0.7%

Previous: +3.2%

🔹 USD Sensitivity:

A larger decline may signal slowing investment, which could pressure USD. If the drop is smaller or rebounds, it may support economic resilience narrative, lifting USD.

Thursday, March 27

📌 GDP (Q4, Final Estimate, Annualised)

Expected: 2.4%

Previous (Second Est.): 2.3%

🔹 USD Sensitivity:

This is unlikely to have a significant currency impact.

📌 Initial Jobless Claims (week ending Mar 22)

Expected: 225K

Previous: 223K

🔹 USD Sensitivity:

With all eyes on the U.S. labour market in light of the DOGE job cuts, a stable low number signals labour market strength, supporting USD. A sudden increase could fuel rate cut expectations, softening USD.

📌 Advance Goods Trade Balance (Feb)

Expected: -$134.5bn

Previous: -$155.6bn

🔹 USD Sensitivity:

A narrower deficit supports GDP tracking and USD. A wide deficit weakens net exports, slightly negative for USD.

📌 Pending Home Sales (Feb, MoM)

Expected: +1.5%

Previous: -4.6%

🔹 USD Sensitivity:

Rebound in-home sales would reinforce consumer activity, which supports USD. Continued housing weakness may hurt sentiment.

Friday, March 28

📌 PCE Price Index (Feb)

Headline PCE:

Expected: +0.3% MoM (2.5% YoY)

Core PCE:

Expected: +0.3% MoM (2.7% YoY)

🔹 USD Sensitivity:

These are the Fed’s preferred inflation gauges. Sticky or stronger-than-expected PCE → fewer rate cuts expected → USD bullish. Weaker PCE → increased cut expectations → USD bearish.

📌 Personal Spending (Feb)

Expected: +0.6%

Previous: -0.2%

🔹 USD Sensitivity:

A bounce in spending signals resilient demand, supporting USD. A miss would weaken the growth outlook, pressuring USD.

📌 University of Michigan Consumer Sentiment (Mar, Final)

Expected: 57.9 (unchanged)

🔹 USD Sensitivity:

Stable confidence likely neutral; large revisions may cause short-term volatility.