The Euro-to-Dollar Rate in the Week Ahead: Poised For Further Gains

Image © Pound Sterling Live

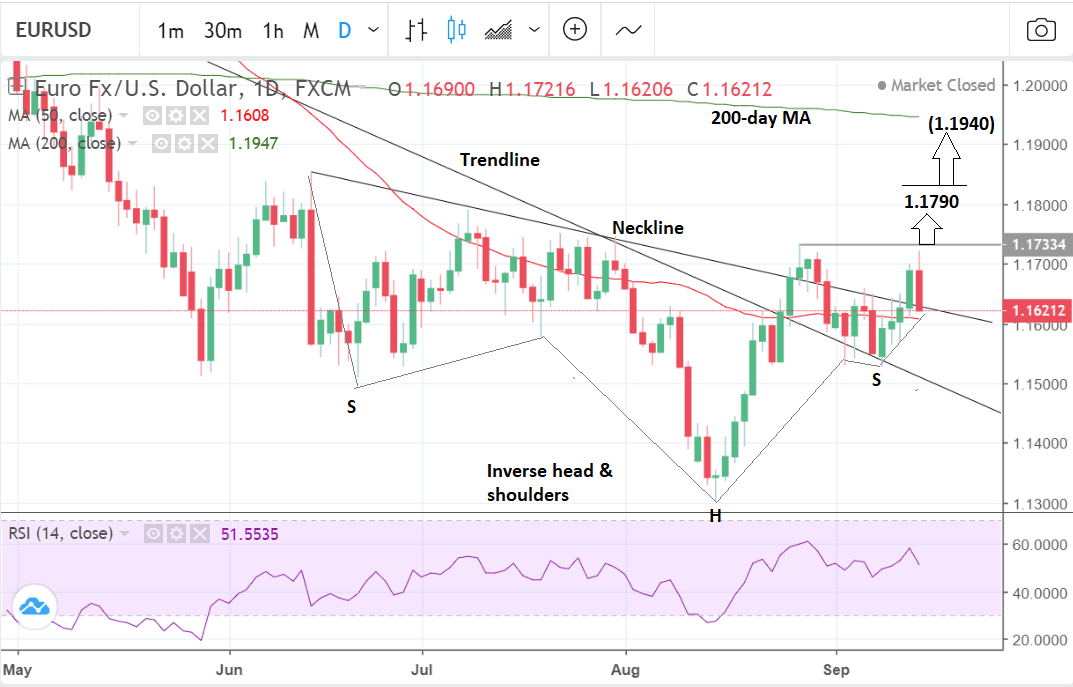

- EUR/USD has broken above the 50-day MA and a major trendline

- May have formed a bottoming pattern with breakouts higher possible

- EUR eyes PMI data this week; USD eyes tariff war

The EUR/USD exchange rate has made strong gains over recent weeks aided by a tightening in monetary policy in the region.

The European Central Bank (ECB) went ahead and cut monetary stimulus in half last week which aided the uptrend while confirming they are on track to deliver an interest rate rise in about one year from now.

The pair is now trading in the 1.16s and our technical studies observe a bias for further upside.

The pair has broken above a major trendline drawn from the January highs and this has confirmed the bull-trend. A break above the August highs at 1.1734 would add further impetus to the uptrend and probably see an extension to the next target at 1.1790 and the level of the R1 monthly pivot.

The R1 will probably resist further gains and as the name suggests could even lead to a reversal or pull-back. Short-term technical traders are likely to target it as a spot to go short in anticipation of a retracement.

Should the exchange rate manage to break above R1, signalled by a break above the 1.1815 level, we would forecast more gains up to the next target at 1.1940, just below the 200-day moving average (MA).

The pair may have formed an inverse head and shoulders (H&S) pattern at the lows, since June. This involves the formation of three trough lows, the central one of which (the head) is substantially lower than the other two (the shoulders). The pattern looks like an upside down sketch of a head and shoulders.

Confirmation of upside comes from a break above a line connecting the intervening peaks of the pattern known as the 'neckline'. This appears to already have occurred on EUR/USD and suggests further upside is now more likely.

A break above the neckline of inverse H&S's usually leads to a move higher of equal length as the height of the pattern from the trough tip of the head to the neckline extrapolated higher. Which in this case results in a move up roughly to as high as the 200-day MA.

Advertisement

Lock in a great EUR/USD rate: Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here

The Euro: What to Watch

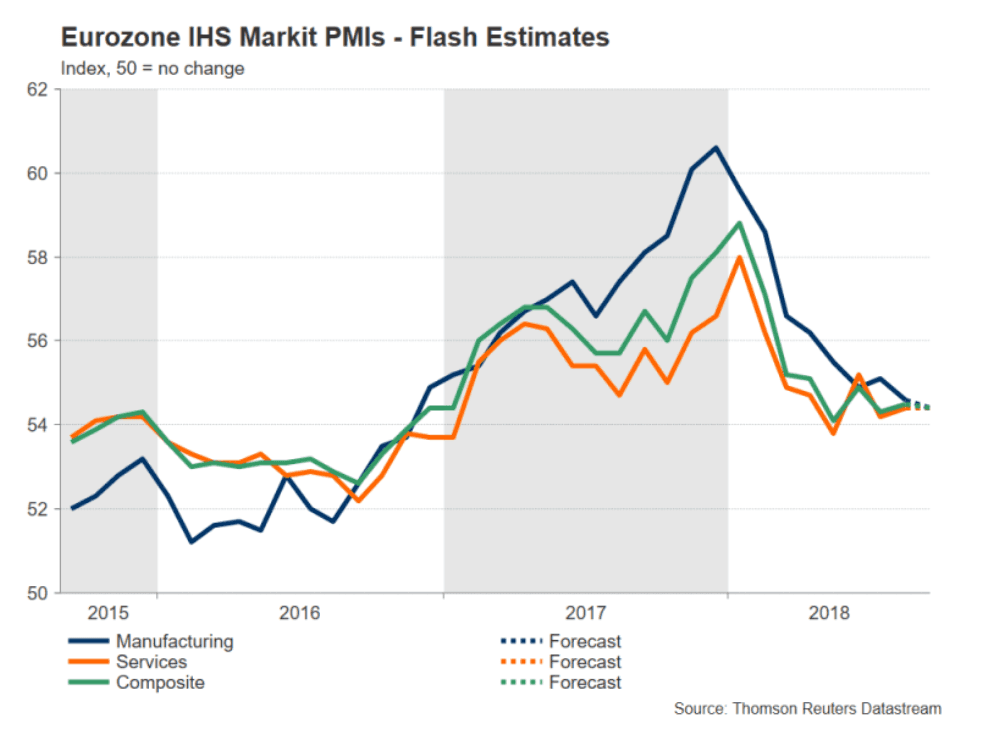

Given the continued fragility of growth in the region, the main releases for the Eurozone in the week ahead are the initial estimates for Manufacturing and Services PMIs in September, out on Friday at 9.00 B.S.T.

PMI's measure activity and Manufacturing activity in the Eurozone is expected to show a slight slowdown to 54.4 from 54.6. Services is forecast to remain unchanged at 54.4. The composite of the two is forecast to decline a basis point to 54.4 from 54.5.

A result over 50 is indicative of expansion and of under 50 of contraction. PMI's are surveys of purchasing managers conducted by data provider Markit IHS.

A higher-than-expected result is likely to support the Euro and vice versa for a lower-than-expected result.

"The composite PMI, consisting of both the manufacturing and services sectors, is forecast to decline by 0.1 points to 54.4 in September. A surprise stronger reading could be viewed as a sign that worries in the bloc over a global trade war are subsiding, indicating faster growth in the months ahead. Eurozone growth has failed to bounce back from a slowdown at the start of the year and a change in the outlook would drag the euro out of neutral mode," says forex broker XM.com.

Another key release is Consumer Confidence on Thursday, which is forecast to dip further to -2.0 from -1.9 previously, when it is released at 15.00.

CPI data out on Monday is just the final estimate for August and unlikely to change much from the previous result.

The Bundesbank monthly report on Monday as well as some speeches by ECB officials also pepper the calendar in the first half of the week.

Finally the current account surplus is out on Wednesday at 9.00 but because it is for July is considered rather backward-looking and therefore of limited consequence to the exchange rate today.

The Dollar: What to Watch

Ongoing trade-tensions could very well set the tone for the way the Dollar trades in the week ahead given data is unlikely to be significant enough to lead to major volatility.

The possibility of $200bn extra tariffs on Chinese imports to the US remains a 'sword of Damocles' hanging over markets.

Currently Beijing and Washington are still in talks but if they break down the US could announce the feared expansion of duties. The effect is likely to be positive for the US Dollar in line with previous trends as investors turn to US assets for safety.

There is also a possibility the US Dollar could suffer from political uncertainty after Trump's former campaign chairman Paul Manafort turned state's witness on Friday and agreed to help special council Robert Mueller with his investigation into links with Russia in return for a reduced sentence.

One former US attorney said this posed an "existential threat to the President."

As far as hard data goes, however, the main releases for the Dollar in the week ahead is housing related data, Fed regional activity gauges and September PMI's on Friday.

Housing data are out - both new and existing sales - and have shown marginal declines over recent months but are still not at levels deemed concerning.

The main gauge to watch is probably existing sales as these are showing some stress linked to the economy. The gauge fell by - 0.7% in July in the fourth decline in a row and the lowest level since February of 2016.

The median house price fell to $269,600 from $273,800 in June.

As the chart below shows sales are starting to break their smooth uptrend and need to be watched. That 'housing leads the economy' is an old economic adage which certainly held true in the last crisis, so this release warrants attention.

"Existing home sales remain stuck in low gear, and affordability is an increasing concern. Mortgage rates have ticked higher the past year, and continued low levels of inventory on the market have translated to home prices rising well ahead of income growth. Still, signs continue to point to economic growth remaining solid headed into the fall, which should allow existing home sales to pick up from their current pace," says a note from investment bank Wells Fargo.

Existing Home sales are scheduled for release on Thursday, September 20 at 15.00.

The leading Index is another useful gauge as it is an alloy of several economic metrics. It is expected to show a 0.5% rise compared to 0.6% previously, when it is released at the same time as Existing home sales on Thursday.

"The Leading Economic Index (LEI) increased 0.6% in the July, further evidence that economic growth should remain solid in the second half of 2018," says Wells Fargo. "The monthly gain follows a 0.5% rise in June and has now climbed 5.5% on a six-month annualised basis. July’s improvement was also comprehensive, as each of the underlying components contributed to the 0.7 point increase in the headline index."

"The largest contributor was initial jobless claims, which added 0.15 points. Meanwhile, manufacturing hours worked had the smallest impact and remained neutral to the overall index," add the bank.

The NY Empire State Manufacturing Index is out on Monday and is forecast to show a slide to 23.0 from 25.6 in September when it is released at 13.30.

It is followed by the Philadelphia Fed Manufacturing Index in September on Thursday at 13.30 which is forecast to show a rise to 16.9 from 11.5.

Finally, Friday sees the other main release for the Eurozone in the form of initial estimates for Manufacturing and Services PMIs in September, at 14.45.

PMI's measure activity and Manufacturing activity in the US is expected to show a slight rise to 55.0 from 54.7, whilst services is forecast to increase to 55.0 from 54.8.

A result over 50 is indicative of expansion and of under 50 of contraction. PMI's are surveys of purchasing managers conducted by data provider Markit IHS.

A higher-than-expected result is likely to support the Dollar and vice versa for a lower-than-expected result.

Advertisement

Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here