Euro-to-Dollar Week Ahead Forecast: Looking to Extend Above 1.05

- Written by: Gary Howes

Above: The AfD's Alice Weidel. The party did not secure enough votes to prevent the formation of a centrist coalition. Image: DW, Pound Sterling Live.

The Euro-to-Dollar exchange rate can extend above 1.05 in the coming week, helped by hopes for a speedy resolution to German coalition talks and expectations for further U.S. equity underperformance.

The Euro is outperforming its peers following the conclusion of German elections, confirming there were some fears heading into the vote that the right-wing AfD would outperform expectations and complicate the formation of a centrist government.

The AfD has recorded an astonishing result, but it's in line with pre-vote polling. The relief took Euro-Dollar as high as 1.0527 at one point, but it has since retraced these gains to quote at 1.0483.

"The fact that the German election result did not throw up a surprise outperformance for the far-right AfD party has been met with relief in the financial markets and the euro is the best performing G10 currency this morning," says Lee Hardman, Senior Currency Analyst at MUFG Bank Ltd.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

The Euro's post-election rally is nevertheless relatively tepid and suggests that the outcome is not necessarily a game-changer for the single currency. The market sees weeks of negotiations between Friedrich Merz's CDU/CSU and the SDP that will ultimately result in a government with a thin majority.

The centre-right CDU/CSU emerged victorious with 28.5% of the vote. The far-right Alternative für Deutschland (AfD) achieved a historic second place, securing 20.8%. The ruling Social Democratic Party (SPD), under Chancellor Olaf Scholz, experienced its worst performance since World War II, obtaining only 16.4%. The Greens received 11.6%, while the Left Party (Die Linke) saw a resurgence with 8.8%.

A CDU/SDP coalition could be a relatively straightforward affair, which markets would welcome, as the government would not require the complicating support of a third party.

"The euro has advanced in part on the hope of a relatively quick negotiation period to form a government," says Hardman.

🎯 EUR/USD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

Investors will be watching to see whether the new government alters the debt brake rule, which constrains German spending and government investment. For now, an easing of the rule is considered to support the Euro.

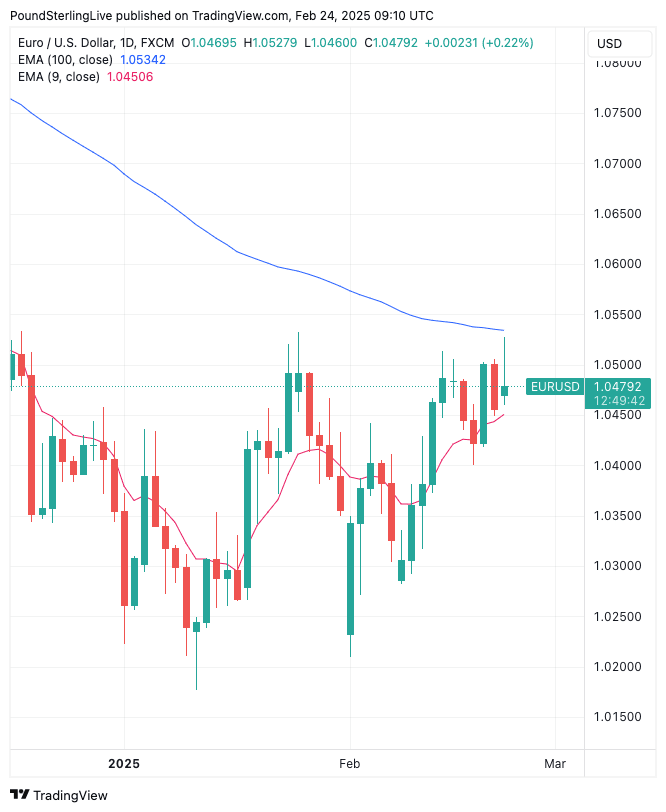

Euro-Dollar is in a short-term uptrend and trades above the nine-day exponential moving average (EMA), which advocates for gains in the early part of the week.

However, the rally runs into the 100-day EMA at 1.0534, and this could provide some near-term resistance and limit any post-election gains. Indeed, already on Monday, we see the pair being rejected here:

Above: EURUSD at daily intervals.

For now, weakness will be shallow and restricted to levels above 1.04, and the eventual move above 1.05 is preferred on a multi-day timeframe.

EUR/USD gains are largely a function of the Dollar's weakness, and although Germany offers some interest, the exchange rate's direction ultimately depends on whether the dollar will weaken further.

Investors have lowered the odds of damaging tariffs under President Donald Trump and are starting to see signs that U.S. economic outperformance is waning, which opens the door to more rate cuts at the Federal Reserve.

The risks of rising unemployment and increased economic uncertainty relating to Elon Musk's DOGE programme are also emerging as a USD headwind that must be monitored.

Musk's mantra of 'move fast and break things' underpins DOGE's approach, which spells uncertainty for U.S. federal employees and could severely risk the smooth running of U.S. institutions. DOGE could yet be a success, but in the near term, it does pose risks that will weigh on USD.

Above: File image of Elon Musk. Photo credit: (NASA/Aubrey Gemignani).

On Saturday, DOGE emailed Federal employees asking what they accomplished in the past week and saying failure to respond would be considered a resignation.

Analysts at Pantheon Macroeconomics think the cost-cutting drive should start to reflect in labour market figures from this week. They are watching the weekly jobless claims release, due Thursday, for signs of an uptick in those claiming unemployment benefits. Should the data surprise, we could see USD soften.

For their part, Pantheon is forecasting EUR/USD to target 1.05 by the start of the second quarter of the year.

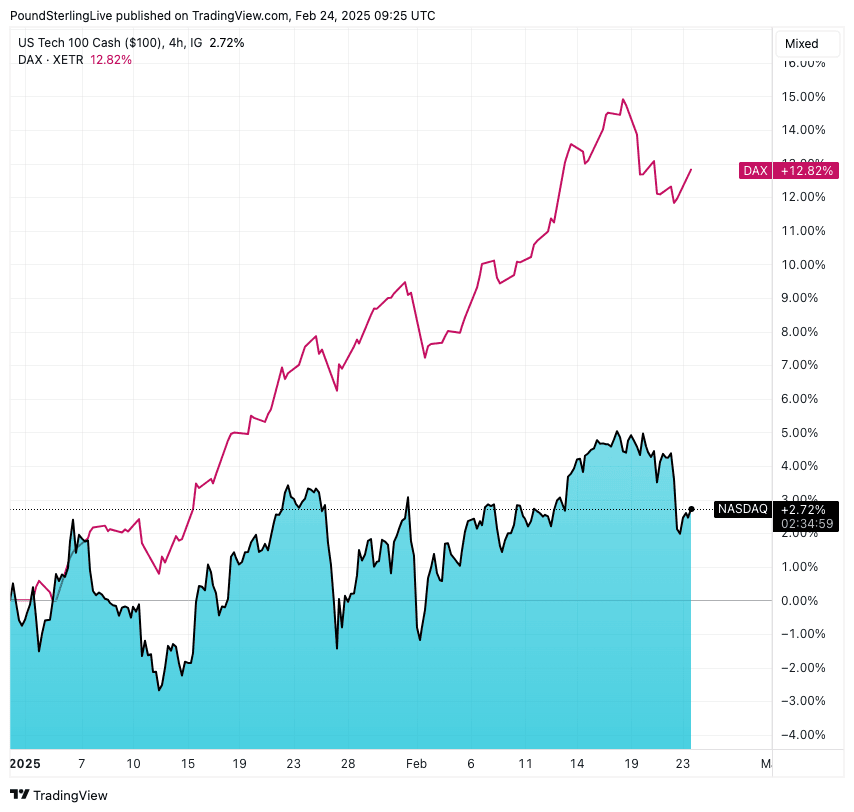

Analysts also expect the ongoing underperformance of U.S. stock markets to extend in the coming days, which has been something of a drag on the Dollar as equity flows start to prefer ex-U.S.

"A surprising trend in 2025 has been the underperformance of US equities compared to other markets. This is attributed to the high valuations of US stocks, with their price-to-earnings (PE) ratios increasing significantly over the past years, leading to a ceiling effect," says an FX strategy note from Deutsche Bank.

Above: The German DAX has outperformed the U.S. NASDAQ 100 in 2025.

"Similar to US equities, the US dollar is seen as expensive relative to other global currencies. Thematic trends in the G10 FX market indicate a preference for "cheaper" assets, which has contributed to some softening in the USD," it adds.

Second-tier releases dominate the week's calendar, but we will look for further signs of a cooling in the U.S. economy. Should this be confirmed, bets for further Federal Reserve rate cuts will rise, potentially weighing on the USD.

Tail risks would involve 'hawkish' tariff threats from President Donald Trump. The raising of tariffs on Eurozone imports is a certainty under Trump, but the timing and extent of the tariffs remains unclear.

Any USD strength on any tariff comments from the President should fade, as has been the pattern of late, suggesting that Trump's tariff agenda is not considered USD supportive as was the case at the start of the year.