The Euro-to-Dollar Rate Week Ahead: Charts Point Higher and Multiple Analysts Tip Fresh Gains

- Written by: James Skinner

- EUR/USD suffers worst weekly loss since Trump election at -2.07%.

- But charts point higher and multiple analysts tip EUR gains ahead.

- As European, UK and U.S. coronavirus epidemic curves steepen.

- France, Spain enter lockdown as UK & Sweden risk "pariah" status.

- Virus spread said to be most important factor for currencies ahead.

- G7 to meet on coordinated fiscal and monetary response Monday.

- Central bank and government actions, volatility expected this week.

- More Brexit-referendum-sized moves are possible in weeks ahead.

Commerzbank HQ dominates the Frakfurt skyline. Image © Andre Douque, reproduced under CC licensing conditions

- EUR/USD Spot rate: 1.1105, -2.07% last week

- Indicative bank rates for transfers: 1.0757-1.0835

- Transfer specialist indicative rates: 1.0980-1.1047 >> Find Out More About This Rate

The Euro-to-Dollar rate closed its worst week since the election of President Donald Trump on Friday after suffering a more-than 2% loss but it's tipped by multiple analysts to outperform in the week ahead as national coronavirus 'epidemic curves' rise in major economies.

All markets saw extreme volatility last week with Thursday's losses putting many stock indices on course for their worst week in history before Federal Reserve (Fed) actions and a significant announcement from President Trump saw them more-than reversing earlier losses. However, and throughout all of this, the Euro has been highly volatile, at times benefiting from financial mayhem caused by the pandemic and more recently succumbing to the overtures of a strengthening Dollar.

"Extreme volatility, VAR limits being hit and the sharp changes in collateral valuations are all contributing to large shifts in positioning. Losses are also being covered by profitable positions with the best performing G10 currencies (JPY, CHF, EUR) all suffering losses," explains Derek Halpenny, head of research, global markets EMEA and international securities at MUFG. "The EUR still appears well placed to outperform broadly in the near-term."

The Euro will enter the new week trading at 1.1105 against the Dollar as investors digest an eventful weekend in which France and Spain went into a something like 'lockdown' due to the spread of coronavirus. Both countries ordered the lockdown of citizens Saturday, forbidding all but essential travel from the home and risking unprecedented damage to their economies that will likely necessitate a combined government and central bank response like no other seen in modern history.

This is the backdrop against which the G7 meetings of central bank heads and finance ministers will play out on Monday. Expectations of coordinated action between government and central banks, as well as countries, are high but the previous meeting offered only disappointment to investors and prompted a nasty sell-off in risk assets. That sell-off benefited a Euro that was previously sold to fund bets on risk assets during better days and which continues to enjoy a bullish set-up on the charts.

"EUR/USD has spiked down to the 61.8% retracement at 1.1052 and bounced from here, we think that is it on the downside and the market should now recover. It continues to consolidate around the 200 week ma at 1.1347," says Karen Jones, head of technical analysis for currencies, commodities and bonds at Commerzbank. "A weekly close above here (i.e. Friday) would target the 1.1570 January 2019 high and then the 1.1815 September 2018 high. Our overall target is the 12 year downtrend at 1.1950."

Above: Euro-to-Dollar rate shown at daily intervals.

Commerzbank's Jones says the Euro's late February bounce has seen it lift off from the "base of a 35 year up channel" that's left it technically well positioned to challenge the 1.1950, before making an eventual return to 1.2643 and 1.2725. In the short-term, the exchange rate can be expected to find support around the 1.10 level on the charts.

“With the CoV turning into a global, and more sustained, shock, the market has started pricing the recoupling of the US with the rest of the world. Aided by the unwinding of carry trades, USD has as a result weakened against both JPY and EUR, despite strengthening against EM and high-beta G10 currencies. Going forward, we expect these forces to remain in place: we see further EUR/USD upside in most scenarios,” says Athanasios Vamvakidis, head of FX strategy at BofA Global Research.

Uber low European Central Bank (ECB) interest rates and a downbeat outlook for growth and inflation had seen the Euro borrowed and then sold repeatedly in order to fund bets on higher-yielding assets outside Europe over recent years. And the liquidation of those wagers has forced investors to buy back the single currency in recent weeks, generating a more-than 6% increase in the Euro-to-Dollar rate between February 24 and March 09.

BofA Global Research says a spike in stock market volatility precipitated a general increase in risk-aversion among investors, causing large moves in many currency exchange rates that forced the liquidation of 'carry trades' that investors had used in order to earn the higher yields paid by emerging market currencies. The bank says "an outsized short base may still exist and therefore remain a source of EUR upside". It forecasts a year-end EUR/USD rate of 1.15.

"After the collapse of Lehman Brothers in September 2008, the dollar initially fell before then rallying nearly 16% in just 2mths. We don’t expect that degree of move this time but clearly the USD gains recorded yesterday highlight the large USD demand in extreme episodes of risk-off that overwhelms the other favoured safe-haven currencies – JPY and CHF and to a lesser extent EUR," says MUFG's Halpenny. "The ECB’s policy response alone is not sufficient to weaken the EUR. However, we are not optimistic that eurozone finance ministers will provide a significant fiscal boost to encourage an even stronger EUR."

MUFG's Halpenny has urged a cautious approach toward the Euro-to-Dollar rate because the liquidation of risk asset positions swung back in favour of the Dollar last week and there remains a prospect of "tighter funding and liquidity" conditions. Tightness in those liquidity and funding conditions was seen behind a vicious swing most exchange rates last Thursday, which saw the Dollar strengthen in a rare and awe-inspiring move.

Above: Euro-to-Dollar rate shown at weekly intervals. Logarithmic scale.

The Euro and Dollar: What to Watch in the Week Ahead

There is a range of economic figures due from Europe and the U.S. in the week ahead, which would normally be important drivers of exchange rates but these all matter very, very little in the current market where the infection growth rates, death rates and the actions of authorities are the only things that matter.

Economic data will become relevant again in the months ahead but this week's figures relate primarily to the economy of January and February, which is moot at a time when authorities are facing a de facto choice between allowing their economies or their health systems to collapse. Steepening epidemic curves (increasing infection growth rates) risk overloading healthcare systems given that 10% of patients suffering from the virus require intensive hospital care.

“We have seen a very high number of ICU admissions, almost entirely due to severe hypoxic respiratory failure requiring mechanical ventilation. The surge can be important during an outbreak and cluster containment has to be in place to slow down virus transmission. We are seeing a high percentage of positive cases being admitted to our Intensive Care Units, in the range of 10% of all positive patients,” says Prof. Jozef Kesecioglu, president of the European Society for Intensive Care Medicine, in an email to colleagues dated March 04. “We wish to convey a strong message: Get ready!”

Above: French epidemic curve. Source: World Health Organization.

For now the market focus is on trends in epidemic curves and actions to stem the spread as well as provide support for economies. The European Commission announced it will spend €37bn to support member states and their businesses on Friday, and that it will also grant sweeping exemptions from its state aid rules to support efforts aimed at containing the virus and will also relax ‘stability and growth pact’ terms of the treaties. This was after a European Central Bank support package was announced Thursday.

"The ECB’s policy package this week was well designed, but less well received by a desperate market; augmentations of the ECB response could follow in the coming months. A European fiscal response seems to be taking shape, a development that will be followed closely in the coming days. However, ultimately it may take reduced uncertainty about the underlying COVID-19 pandemic itself – through higher testing rates and finally declining new infection numbers – to bring markets back on a more constructive path," says Christian Keller, an economist at Barclays.

Above: Euro-to-Dollar rate at daily intervals. Correlation with 10-yr German bond yield goes into reverse from February.

New Zealand and Australia, which have among the lowest number of cases among major economies, announced at the weekend that travellers visiting the countries will need to self-isolate for 14 days. Tourist volumes, an important source of economic growth, had already collapsed everywhere in recent weeks although these moves could ensure the antipodean countries remain effectively closed to many holidaymakers for the forseeable future.

Meanwhile, France and Spain joined Italy in ordering the lockdown of tens of millions of citizens - which forbids all but essential travel from the home - at the weekend, risking unprecedently severe damage to their economies and likely necessitating an eventual combined government and central bank response like no other seen in modern history. Europe's economy was already in trouble and the coronavirus now risks compounding all manner of problems.

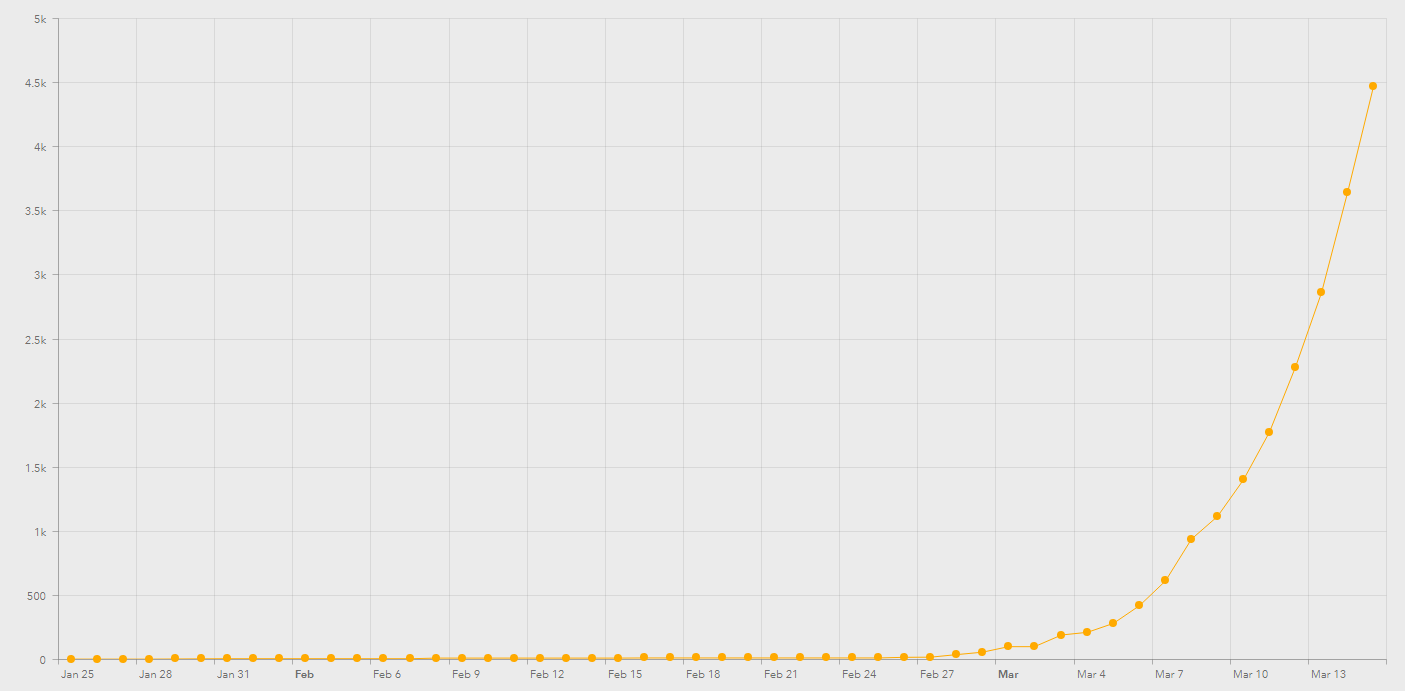

Above: Spanish daily disclosures of new infections. Source: World Health Organization.

"Testing is not universal, and testing rates per infected person fall if outbreaks become large and governments start to test only people who need medical attention. The only way we'll know for sure that the outbreak is over is when the number of deaths begins clearly to fall. The number of deaths is still rising rapidly, though; Italy's Covid-19 death rate per million people is rising faster than was Wuhan's at the same stage of their outbreak, though Italy's population is substantially older than China's and age appears to be the biggest single factor determining mortality risk," says Pantheon's Shepherdson.

This is the backdrop against which Monday's G7 meetings of central bank heads and finance ministers will take place, although Wednesday's 18:00 Fed decision will also be important. There's a risk that something is announced before Wednesday's scheduled decision to maximise the impact of any measures. The Fed has already all-but launched a fourth round of quantitative easing although, facing an unprecedented crisis, there's no telling what lengths it may eventually be compelled to go to.

Above: U.S. daily disclosures of new infections. Source: World Health Organization.

The U.S. is also grappling with its own epidemic that begun to gather pace last week, which is partly why President Donald Trump declared a national emergency on Friday, "unleashing the full force of the federal government" and unlocking around $50 bn in disaster relief funds. Congress has since reached a bipartisan agreement on measures to provide further support to U.S. companies and households as they grapple with the virus.

"Developments this week crushed remaining hopes for a containment of the COVID-19 pandemic, which continues to spread rapidly in Europe and the US, even if seemingly ebbing in Asia. As governments take drastic measures that are affecting public life, a global recession is now likely. In response, financial markets sold off radically, with signs of distress emerging, including in the pivotal US Treasury market. The Fed reacted promptly with large liquidity measures, and we expect it to lower its policy rates to zero and to increase its monthly purchases next week," says Barclays' Keller.

Above: Dollar Index at daily intervals. Correlation with 10-yr German bond yield goes into reverse from February.